Toward confirming the B2B deal with the GST-compliant supplier, an individual must review the below-mentioned information which would be made available on the GST portal:

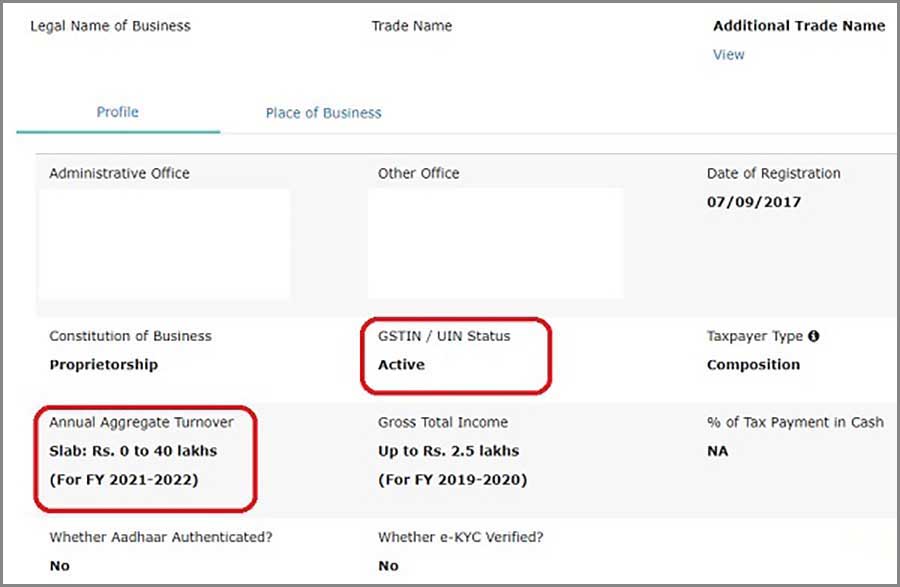

Check the Registration Activity of GST Suppliers

Doing the transaction with the registered supplier, the recipient would ensure that the supplier would be actively enrolled under GST. As there would several cases in which the supplier’s GSTIN was revoked and even the transactions performed however the tax would not be filed to the treasury of the government. Moreover, the revenue gives the notices to the bonafide recipient to recover the mentioned tax that was filed via the recipient to the supplier and the supplier defaulted in doing the payment to the exchequer.

For avoiding the same litigations, the registration status of a registered person could be verified via the GST portal beneath the Search Taxpayer tab.

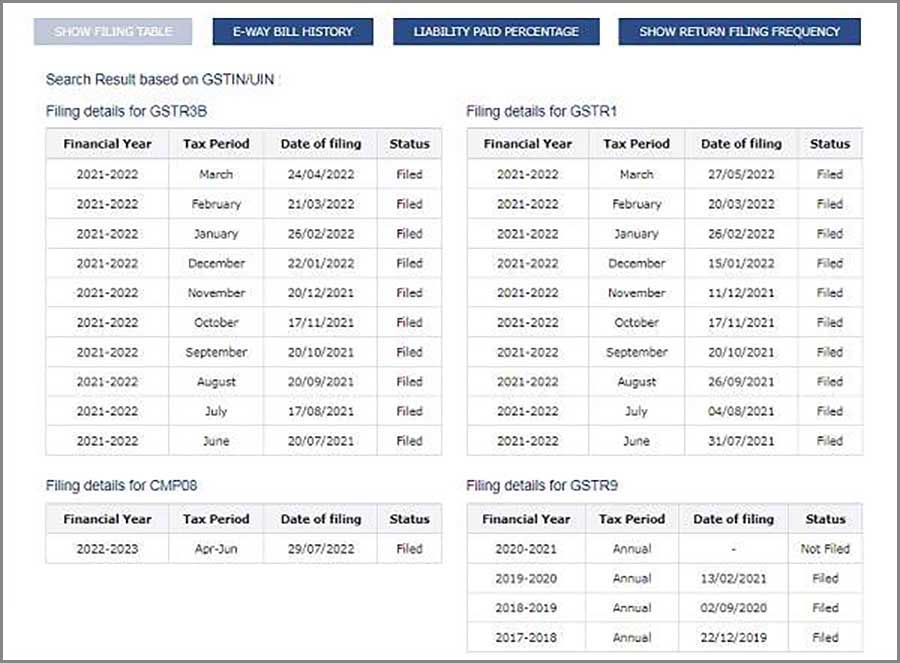

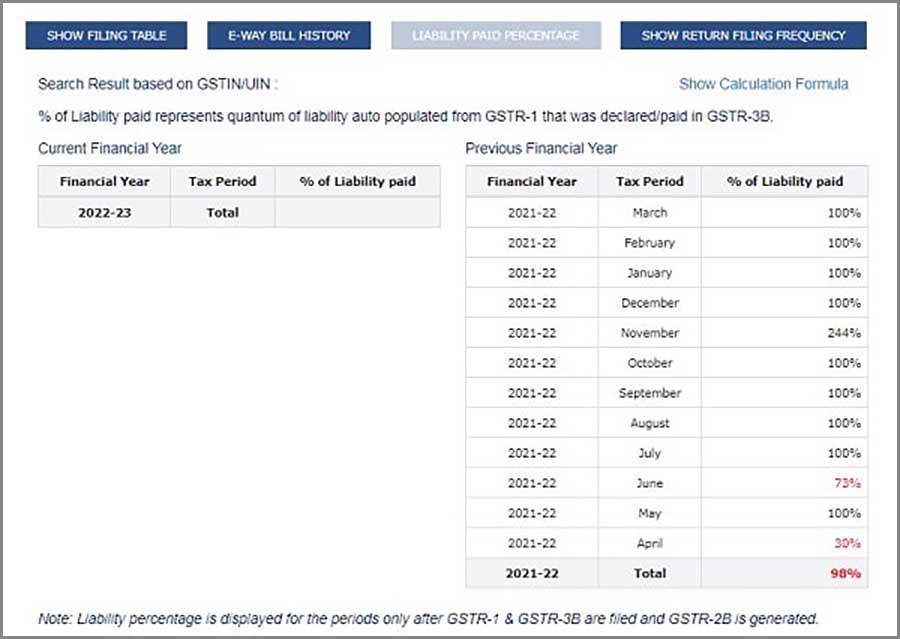

Review the Status of GST Return Filing

As the reflection of the invoices cornered to the inward supplier would be automatically notified in Form GSTR 2B on the grounds of the statement of the outward supplies in Form GSTR 1 filed via the supplier on the mentioned date that reveals the ITC availability in the recipient’s hands, the same would become essential to ensure that the supplier would furnish its Form GSTR 1 in the specified time duration, non-compliance of which directed to much more load on the recipient as the ITC availability might get late.

Since one of the major conditions to claim the ITC would be the tax should get deposited to the revenue, the supplier would be required to provide the precise GST liability related to the supplies notified in Form GSTR 1 through a summary return in Form GSTR 3B.

There would several cases in which the supplier would secure precisely notified the invoices to the outward supplies in Form GSTR 1, however, this does not reveal the specific tax via Form GSTR 3B related to the same invoices. The department would provide the notices for the tax via the bonafide recipient who would have furnished the tax previously to the supplier, and defaulted in doing the payment to the exchequer.

For preventing all the mentioned adverse implications, a person would validate the return filing status and liability percentage via a supplier in their GSTR 1 along with the related liability discharged vide Form GSTR 3B. The mentioned information could be seen post logging the GST portal in the section of search taxpayer.

GST Supplier Liability for E-Invoicing

Any enrolled individual who had an aggregate yearly turnover of more than Rs 10 Crore in any of the fiscal years from 2017-18 to 2021-22, is responsible to make an e-invoice which comes into force from 1st October 2022. This has brought various small assessee into the net of e-invoicing.

For the enrolled supplier, mandated for e-invoicing, unable to generate an e-invoice, the mentioned invoice would be treated as invalid including a void-ab-initio because of which the recipient shall be unable to claim GST ITC of the taxes furnished in place of the specified invoice.

Suppliers’ yearly turnover for the FY 2021-22 could be verified by the person on the GST portal post logging in beneath the search assessee tab.