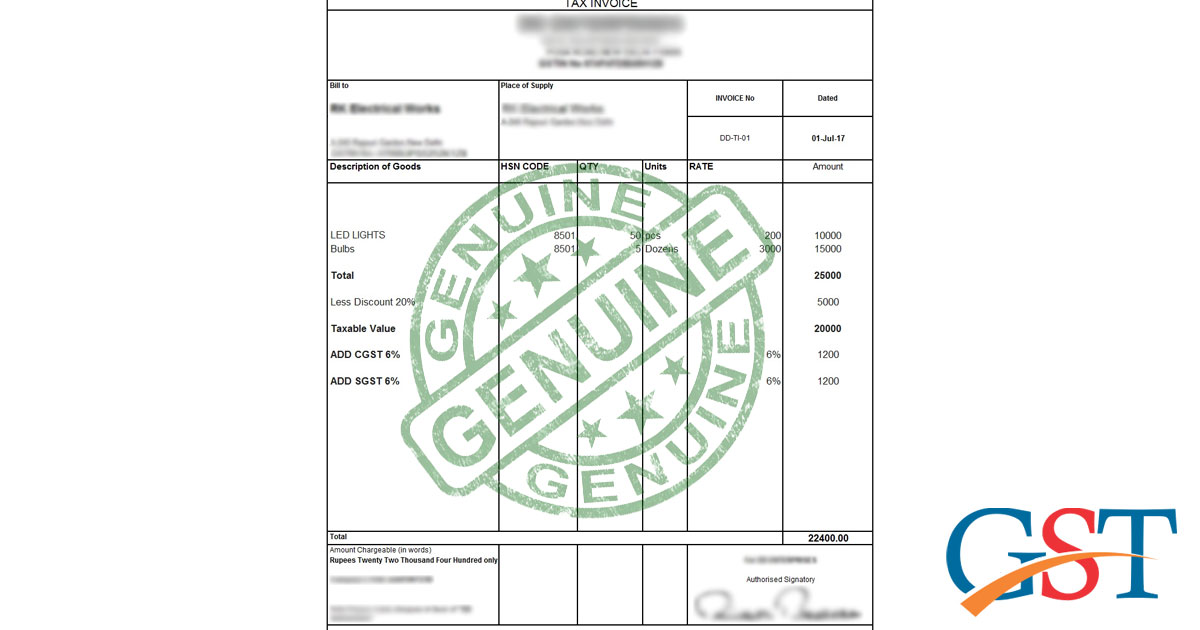

Due to lack of knowledge and unawareness of GST among customers and buyers; shopkeepers and businesses are taking advantage of it and issuing the irrelevant and unauthentic GST bills. The buyer generally doesn’t pay heed on detailing regarding GSTIN number, the tax deduction for CGST and SGST, and it becomes a favorable condition for sellers.

Understand Trading With Registered Anew helpline number 011-21400643nd Unregistered Sellers

There are two kinds of businesses, registered and unregistered; the registered business is registered under GST regime and own a GSTIN number and unregistered business neither has GSTIN number nor registered under GST.

The bill issued by registered sellers always consists GSTIN number and shows break-up of CGST and SGST. It is not necessary that every taxpayer should register under GST as the government has given relaxation for intra-state supplies to businesses having a turnover less than INR 20 lakh or INR 10 lakh if business belongs to north-eastern states.

When a registered business trade with unregistered business, the liability to pay tax is burdened on registered business. So, a registered business can avoid dealing with unregistered taxpayers. There is a choice of registration under GST for the businesses whose turnover is below the threshold limit and they can get a GSTIN number as well.

But, it can be possible that unregistered business can charge the GST and doesn’t transfer it to the government, so be aware of the GSTIN number, whoever charging GST checking the GSTIN is important.

How to Select a Fake GST Invoice?

If any essential details needed in a GST invoice are not available then the same could be the fake invoice for instance,

- If a trader provides the GST invoice without GSTIN, it would be regarded as a fake invoice.

- Under GST if a business would have not been enrolled but uses a fake GSTIN on the invoice and imposes GST then the same would be treated as a fake invoice since the tax furnished would not get deposited with the government.

How do you Validate the Supplier’s GST Rate Applies to you?

After validating the authenticity of GSTIN, a customer is obligated to validate how correct the levied GST rate is. On the CBIC portal, a customer could validate the GST rate by seeing the GST rate chart with HSN codes. Click to see

Note: Searching via product name, confirms that it comes beneath the correct HSN code since various products with identical names can secure various HSN codes, as per their details, and thus secures various tax rates.

What If Sellers Are Issuing Old Bills?

A complaint can be lodged against the practices when businesses are issuing old receipt including the VAT, TIN, and CST number instead of GSTIN number but breaking the applicable tax CSGT and SGST along with the old manner tax. It is also mandatory for the business unit to display GSTIN number on the bill and without the GSTIN number, the bill will be considered void. Various imminent tax practitioners had given comments on this issue and straight away alleged these perpetrated acts of illicit trade practices. The consumer can directly approach to the tax department and the finance ministry in case of issuing old bills and may also ask consumer forums for further discretion in this matter.

Facts and Issues Regarding GSTIN

GSTIN number is must in issuing any bill charging CGST and SGST. If the business has applied for the GSTIN, then the provisional GSTIN must be mentioned on the bill as provisional GSTIN number and final GSTIN in accordance with further issuance. The shopkeeper can trick you by charging CGST and SGST without mentioning GSTIN and saying they will pay the government back once they get the GSTIN or get verified for it. In the case of provisional GSTIN, the business can use it in issuing bills, filing returns, and for other compliances.

Know The GSTIN (GST Identification Number) Structure

The 15-digit GSTIN is a unique number and standard across the country. Here is the construction of GSTIN:

The First 2-Digit: As every state is uniquely coded under GST with a 2-digit number code, the starting digit of GSTIN holder will consist the state code of the owner or business. Here is the list of state code:

| 2-digit State Code | State Name |

|---|---|

| Jammu And Kashmir | 01 |

| Himachal Pradesh | 02 |

| Punjab | 03 |

| Chandigarh | 04 |

| Uttarakhand | 05 |

| Haryana | 06 |

| Delhi | 07 |

| Rajasthan | 08 |

| Uttar Pradesh | 09 |

| Bihar | 10 |

| Sikkim | 11 |

| Arunachal Pradesh | 12 |

| Nagaland | 13 |

| Manipur | 14 |

| Mizoram | 15 |

| Tripura | 16 |

| Meghalaya | 17 |

| Assam | 18 |

| West Bengal | 19 |

| Jharkhand | 20 |

| Odisha | 21 |

| Chattisgarh | 22 |

| Madhya Pradesh | 23 |

| Gujarat | 24 |

| Daman And Diu | 25 |

| Dadra And Nagar Haveli | 26 |

| Maharashtra | 27 |

| Andhra Pradesh | 28 |

| Karnataka | 29 |

| Goa | 30 |

| Lakshadweep Islands | 31 |

| Kerala | 32 |

| Tamil Nadu | 33 |

| Pondicherry | 34 |

| Andaman And Nicobar Islands | 35 |

| Telangana | 36 |

| Andhra Pradesh (New) | 37 |

Next 10-Digit: It consists of the 10-digit PAN number of business or taxpayer.

13th Digit: It is based on the total registrations in the particular state, the number is assigned in respect of all registrations in a particular state.

14th Digit: It takes Z by default.

15th Digit: It is assigned for checksum digit for the tax department’s use. Generally, the number is an alphabet or a number.

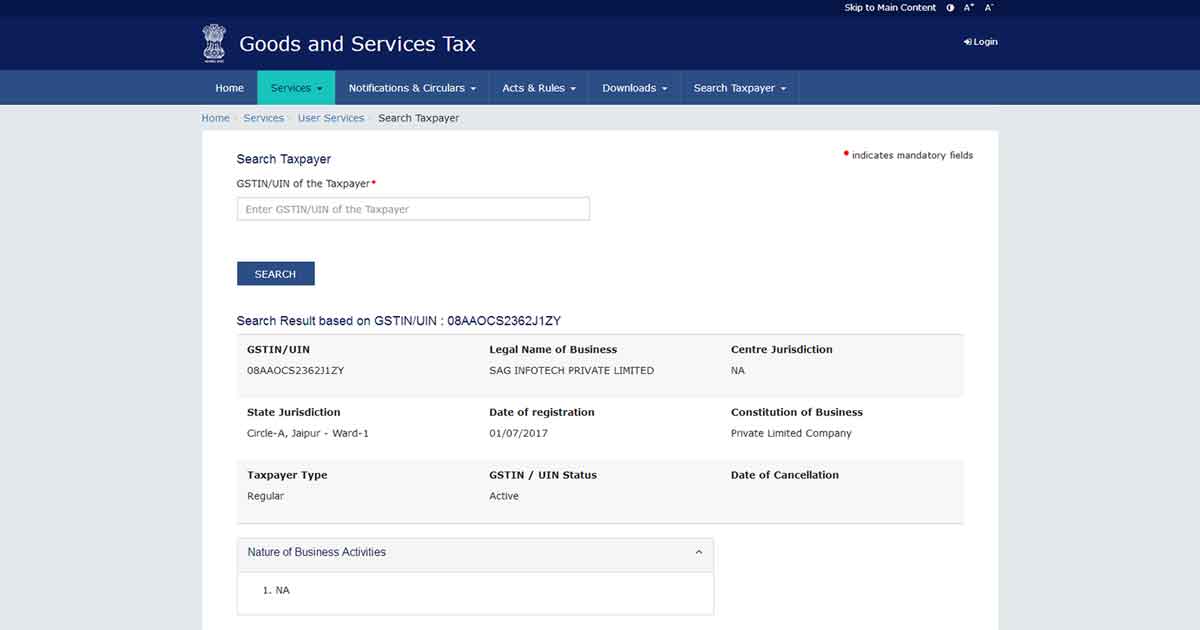

Check The Authenticity Of GST Bills on Indian Government GST Portal

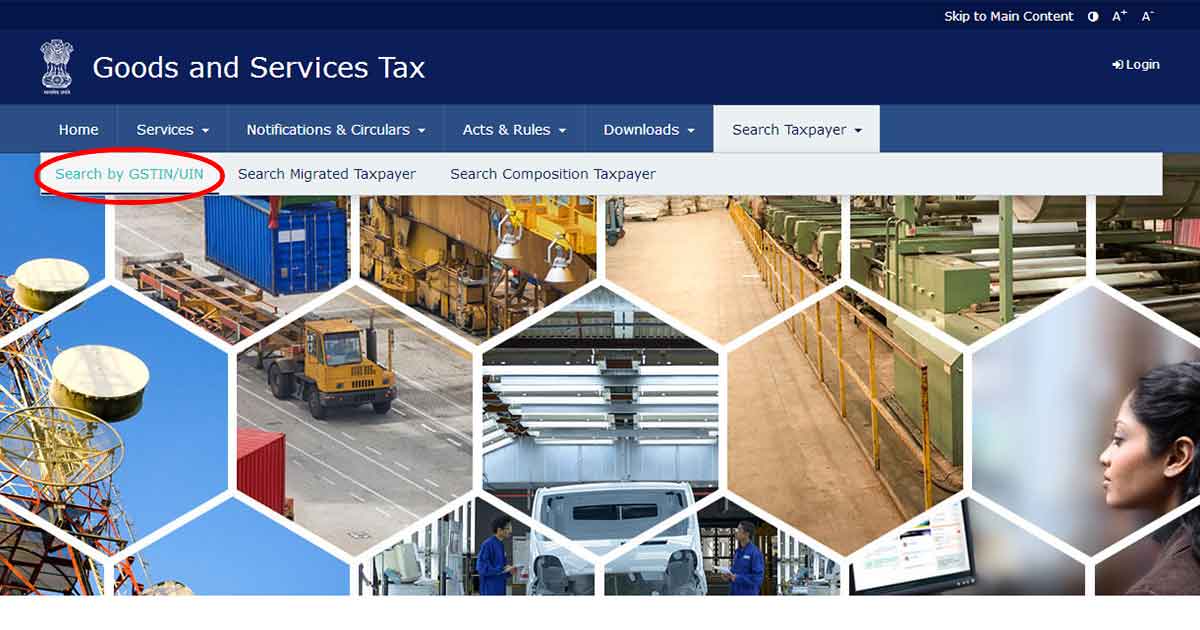

Here is the step-by-step procedure to check the authenticity of a bill:

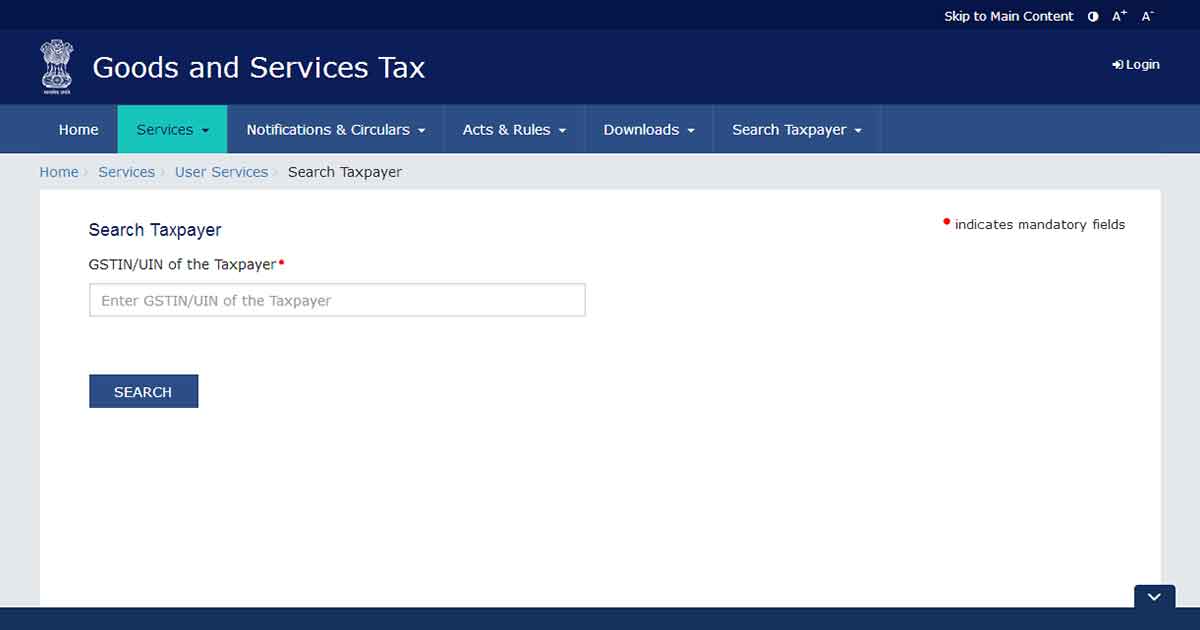

Step 1: Open https://gst.gov.in Portal and Click on Search by GSTIN/UIN

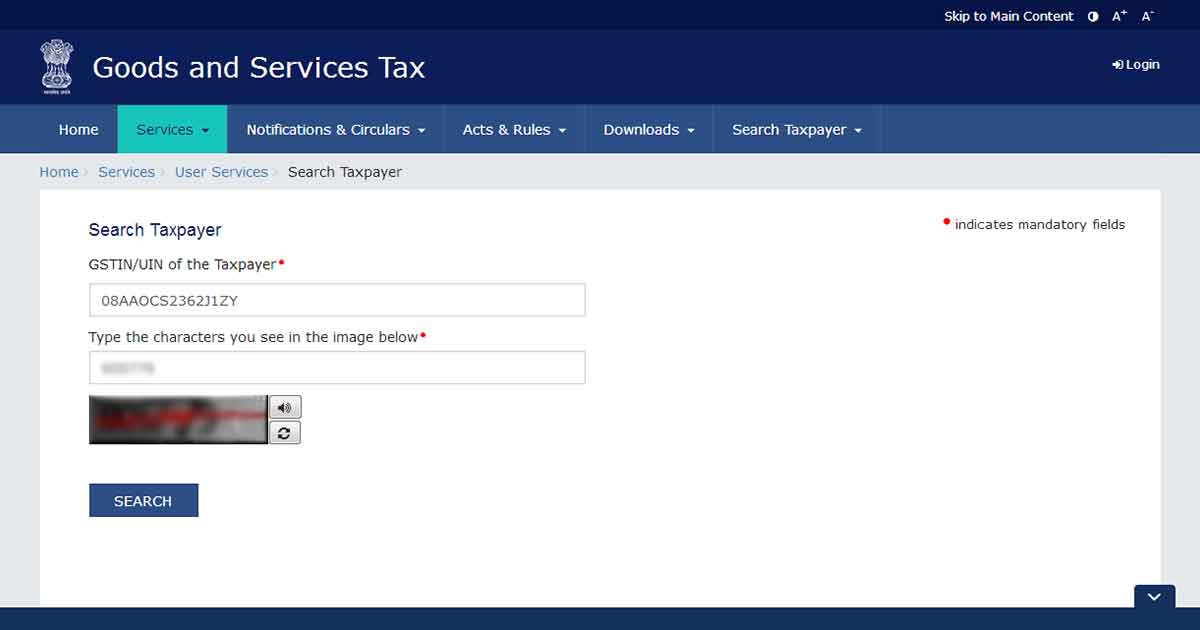

Step 2: Enter the GSTIN in the box and click the search tab

Step 3: Fill out the Captcha and Press the Search Button

Step 4: As soon as the search tab clicked, the page will display all the registration details of a company along with the relevant details of location, a status of registration and type of registration.

Meaning of the Message Displayed after Searching by GSTIN number:

| Message Displayed after Search Button Selection | Valid/Invalid GSTIN |

|---|---|

| The GSTIN/UIN that you have entered is invalid. Please choose a valid GSTIN/UIN. | Invalid GSTIN |

| If the Legal name of a business, state, date of registration, private or public ltd company, partnership or sole-proprietor are shown | Valid GSTIN |

| Active pending verification | Valid GSTIN (Provisional GSTIN Issued To The Business) |

| Taxpayer Type | Regular, Composition, UIN Holder, TDS Deductor, etc. |

Note: If a taxpayer type shows composition then shop owner is not eligible to charge GST from the customers in any case.

To see if the chargeable GST is correct or not, one can check the applied GST Rates on CBEC portal. To check the GST rates follow this: Go to https://cbec-gst.gov.in On the main page, hovering the mouse on ‘Services’ will give an option of ‘GST Rates’, click on ‘GST Rates’.

Buyers can also call at 011-21400643 or write on helpdesk@gst.gov.in if there are any discrepancies regarding the format of issued bills by sellers.