The Chandigarh Bench of the Income Tax Appellate Tribunal (ITAT) rejected the Revenue’s request because the tax amount of ₹56,31,819 was below the ₹60 lakh limit established by the Central Board of Direct Taxes (CBDT) in Circular No. 09/2024.

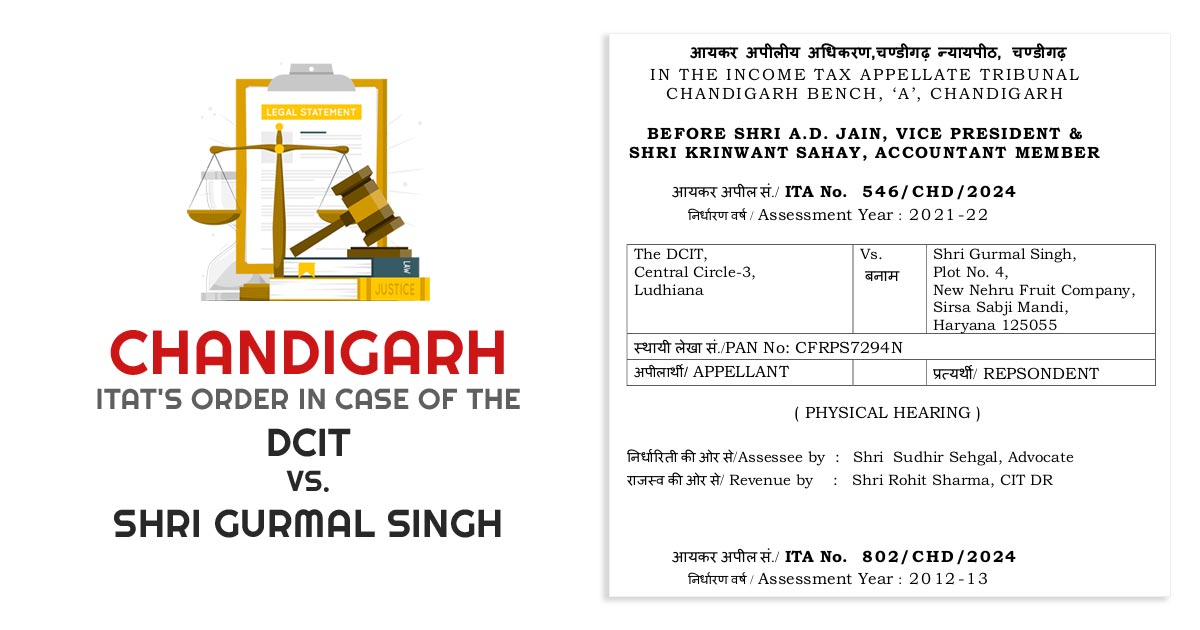

The Revenue, the appellant, challenged a decision made by the Commissioner of Income Tax (Appeals) on February 19, 2024, involving Gurmal Singh, the respondent-assessee. The tax amount in question for this appeal was ₹56,31,819.

Upon examination, it was observed that the tax amount was below the ₹60 lakh limit defined by the CBDT in its Circular No. 09/2024 issued on September 17, 2024, to maintain appeals before the tribunal.

As per this circular, appeals from the Revenue are only permissible if the tax effect surpasses ₹60 lakh limit. Since this case’s tax effect was below that limit, the tribunal concluded that the appeal could not proceed.

The CBDT Circular No. 09/2024 raises the monetary thresholds for income tax appeals to ₹60 lakh for ITAT cases, ₹2 crore for High Courts, and ₹5 crore for Supreme Court matters. This adjustment is designed to minimize unnecessary litigation and prioritize more important cases.

Read Also: Supreme Court Dismisses 573 Direct Tax Cases Due to Revised Monetary Limits

Appeals should not be initiated solely based on surpassing these monetary thresholds, decisions must be grounded in each case’s merits. This update applies to both new and pending appeals.

Consequently, the tribunal dismissed the appeal due to its low tax effect. However, it allowed the Revenue to request a reconsideration of this order if specific exceptions defined in the CBDT Circular were applicable. These exceptions permit proceeding with an appeal even when the tax effect is below the specified limit under certain circumstances.

The two-member bench, consisting of A.D. Jain (Vice President) and Krinwant Sahay (Accountant Member), made it clear that rejecting the appeal did not imply an endorsement of the CIT(A)’s ruling regarding its merits.

Revenue’s legitimate challenges remain unresolved, with an understanding that these issues could be addressed in a future appeal where the tax effect meets provisioned thresholds. Finally, the Revenue’s appeal was set aside.