It was cited by the Mumbai Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) that as the refund claim is for the exports which has been taken place prior to the new notification, the provision to provide the returns as cited in the new notification does not apply and could not get used as a cause to refuse the refund.

The Bench of M.M. Parthiban (Technical Member) has observed that taxes and duties should not be exported, to enable a level playing field in the international market for exports.

Hence, indirect taxes on inputs and input services are to be refunded or rebated/reimbursed. As several input services are used in the export of goods, the Government had provided a mechanism for such refund/remission of service tax involved in such exports.

The Central Board of Excise and Customs (CBEC) issued Notification No. 41/2007-S.T. on 06.10.2007 in India to furnish a procedure for exporters to avail of the refund of service tax filed on specific input services used in the export of the goods.

The exports are obligated to satisfy the conditions to qualify for a refund along with proving that the service tax was filed on the particular services that the goods were exported in a set duration and that the refund claim was filed in a mentioned duration, particularly for 6 months from the date of export.

The taxpayer/appellants who are involved in the export of goods furnished the refund claims as per Notification No. 41/2007-S.T. on 06.10.2007 for input services, like banking/Courier/TTA Commission’ and ‘Commission paid to the Foreign Agent,’ under Business Auxiliary Service which are used in export of goods for the respective period, by claiming refund under Notification No.41/2007-S.T. on 06.10.2007, as amended.

Two Influential Claims were in Dispute

Refund Claim Filed on 31.03.2009: The period from October 2008 to December 2008 has been covered under the claim. The original authority rejected the claim via its order on 25.03.2010.

Taxpayers appeal has been rejected before the commissioner (appeals). The taxpayers furnish a plea to the Tribunal. The Tribunal remanded the case for fresh adjudication. On re-adjudication, the original approved a refund of Rs 9,81,612 dated 06.01.2016.

Read Also: CESTAT: Service Tax Can’t be Paid If TDS Already Deducted from Assessee’s Account

Refund Claim Filed on 31.03.2010: From April 2009 to July 2009 the claim for Rs 17,17,480 was covered. A part of the claim of Rs 91,275 (for July 2009), was permitted and Rs 16,26,205 (for April to June 2009) was rejected via the original authority on 22.01.2010.

The taxpayer filed an appeal before the Commissioner (Appeals) which was rejected. The taxpayer submitted an appeal before the Principal Additional Director General which was also rejected on 18.05.2018.

The order was contested by the taxpayer on 18.05.2018 passed by the Principal Additional Director General, DGPM, Customs & Central Excise, Western Regional Unit, Mumbai, before the Tribunal.

The Tribunal emphasized that taxes and duties must not be imposed on exports to ensure fair competition in the global export market. Therefore, refunds or rebates are to be provided for indirect taxes on inputs and input services.

Since several input services are utilized in the export of goods, the Government has established a system for refunding or remitting the service tax related to these exports.

Recommended: CESTAT: No Penalty If Pending Taxes Paid Earlier to the Issuance of Show Cause Notice

The Tribunal examined the directives released by the Ministry of Finance on April 17, 2008, and noted that these instructions indicate that service tax paid on input services utilized in exports should be refunded through a specified mechanism.

The court observed that to prevent baseless objections to refund claims, it has been directed that 16 taxable services have been identified, and service tax paid on these services attributed to exports will be refunded to exporters, regardless of whether they are utilized as input services.

Notification No.41/2007-S.T. on 06.10.2007 is one such notification extending the exemption to specific services, which was superseded by Notification No.17/2009- S.T. dated 07.07.2009 and further notification No.18/2009-S.T. on 07.07.2009 were also issued.

The Tribunal opined that the refund claim of the assessees was rejected on account of their claim not fulfilling the conditions 2, 3 & 4 of Notification No.18/2009-S.T. dated 07.07.2009 which relate to ceiling limit of refund, submission of half yearly returns and is the application in respect of export of canalized items.

Further, as the refund claim relates to exports of the period relating to April 2009 to June 2009, which have already been exported at the time of issue of the notification dated 07.07.2009, the conditions relating to the submission of returns as specified therein are not relevant for denying the exemption.

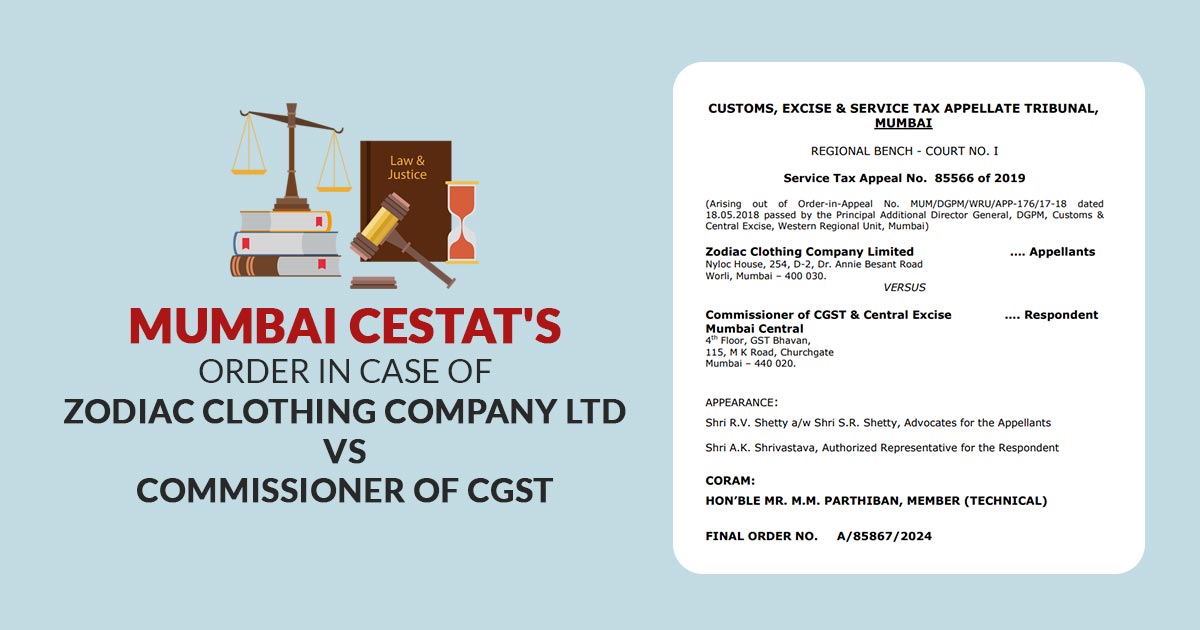

| Case Title | Zodiac Clothing Company Limited Vs. Commissioner of CGST |

| Appeal No | 85566 of 2019 |

| Date | 30.09.2022 |

| Appellants | Shri R.V. Shetty a/w Shri S.R. Shetty, Advocates |

| Respondent | Shri A.K. Shrivastava, Authorized |

| Mumbai CESTAT | Read Order |