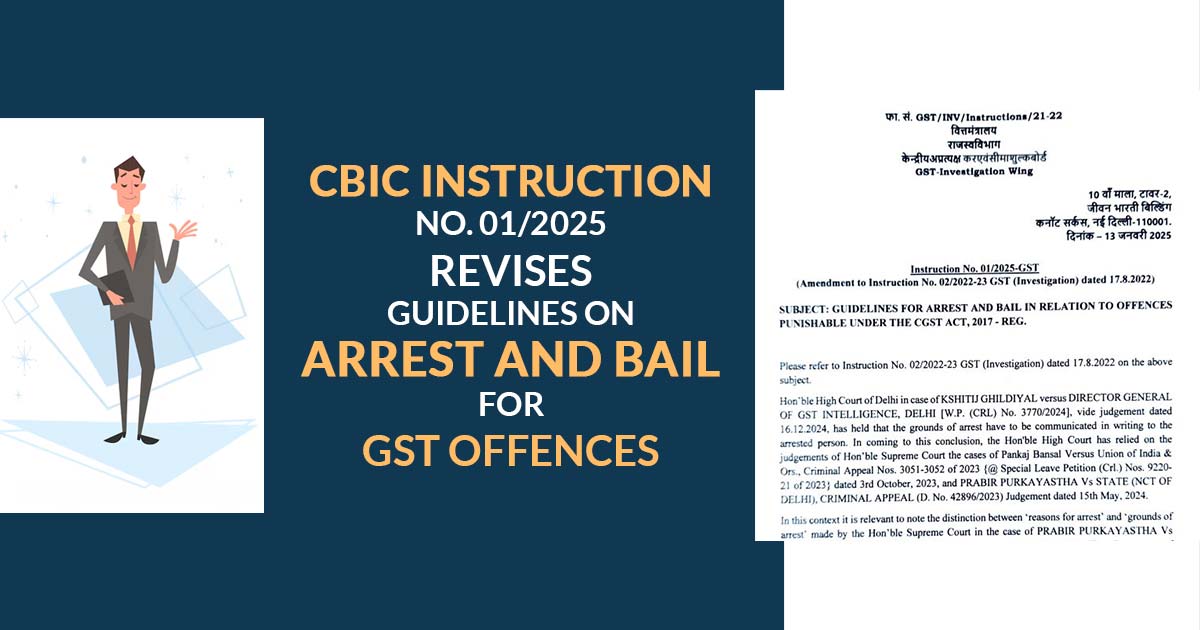

The Central Board of Indirect Taxes and Customs (CBIC) has issued a new set of guidelines, known as Instruction No. 01/2025-GST. These guidelines update the previous rules regarding how arrests and bail work for offences related to the Goods and Services Tax (GST) under the CGST Act of 2017.

The very amendment complies with the ruling of the Hon’ble High Court of Delhi and the Hon’ble Supreme Court of India, underscoring the distinction between “reasons for arrest” and “grounds of arrest.”

The amendment mandates that the grounds of arrest must

- Be provided in writing as an annexure to the arrest memo.

- Be explained to the arrested individual.

- Have an acknowledgement from the arrested person upon receipt of the arrest memo.

Read Also: MP HC: Officials Can’t Use IPC Provisions for Tax Offences Covered by the GST Act

In the case of Kshitij Ghildiyal v. Director General of GST Intelligence, This update is based on a Delhi High Court judgment outlining the significance of clarity in the arrest process.

The court directed to the earlier judgments of the Apex court like

- Pankaj Bansal vs. Union of India & Ors. (3rd October 2023)

- Prabir Purkayastha vs. State (NCT of Delhi) (15th May 2024)

It was mentioned by the Apex court that the distinction between “reasons for arrest,” which are general in nature, and “grounds of arrest,” which are precise and personal to the accused. The latter should have detailed facts that explain the arrest, allowing the accused to defend against custodial remand and seek bail effectively.

For ensuring accountability and transparency in GST-related investigations the same amendment marks an influential step. The guidelines have been disclosed before all Principal Chief Commissioners, Chief Commissioners, and the Directorate General of GST Intelligence (DGGI).