The Central Board of Indirect Taxes & Customs (CBIC) through a circular has notified that it plans to extend the Sanction for pending IGST refund claims, which are pending due to a mismatch in the data of GSTR-1 and GSTR-3B.

Over the past month or so, the Board has received multiple reports of instances where the records were not transmitted to ICEGATE because of some mismatch of data in the buyer and seller returns, which led to the rejection of IGST refund claims.

As a resolution to the problem, the Board had earlier advised an interim measure in respect to shipping bills that were filed up to March 31, 2019. However, according to CBIC, the IGST refunds for the shipping bills filed after March 2019 could not be processed if there was a mismatch error between GSTR-1 and GSTR-3B data.

As a result of the said error, a large number of IGST refunds remained stuck, since the taxpayers are not allowed to amend GSTR-3B return

The Board has decided that the interim solution will continue to be applicable, with changes as required, for the shipping bills filed during the last two financial years, i.e. FY 2019-20 and FY 2020-21, including the bill filed or to be filled up to March 31, 2021.

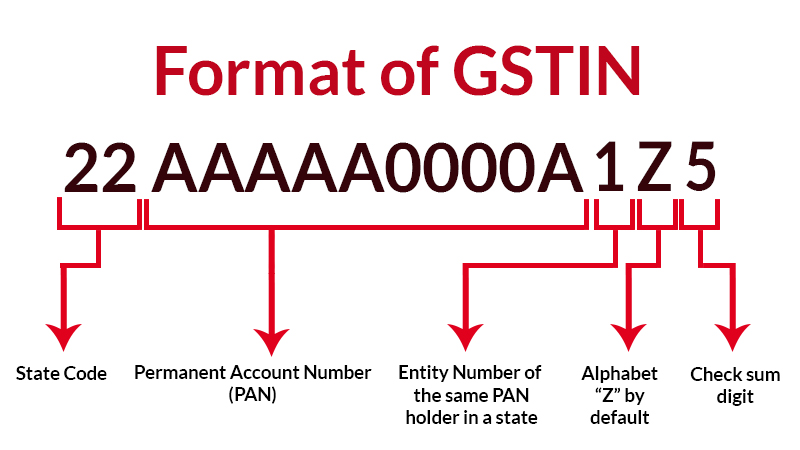

“The concerned Customs Zones shall provide the list of GST identification numbers

The CA certificate verifying that there is no discrepancy between the IGST refunded on exports and the actual IGST paid on exports must be furnished with the CBIC by 31st March 2021 for the period April 2019 and March 2020 and by 30th October 2021 for the period April 2020 to March 2021.