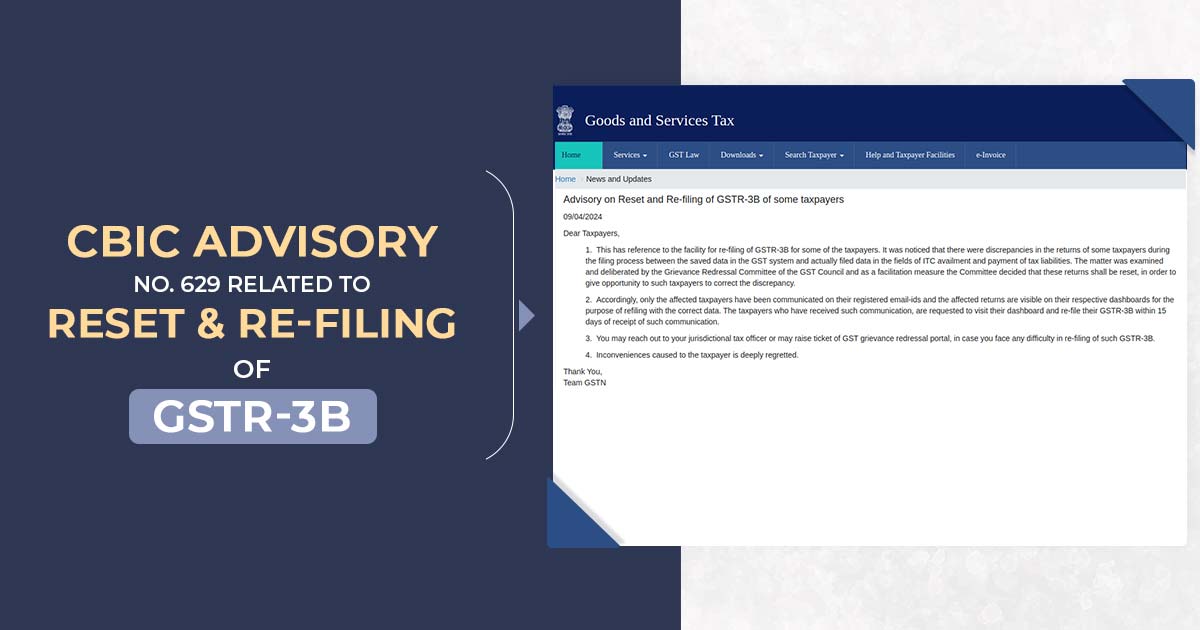

The same is pertinent to the ability of specific assessees to resubmit their GSTR-3B forms. At the time of process filing same was noticed that certain assessees’ returns comprised of the differences between the data that was furnished actually in the ITC claim and tax liabilities payment along with the data that was preserved in the GST regime.

Post validating the matter and debating the same the GST Council grievance Redressal Committee solved to reset the returns as a convenience step to permit the related assessees to complete the required corrections.

Consequently, the affected GST returns are available on their dashboards individually so that they might be refiled with the correct information and merely the affected assessees secure the obtained communications on the email addresses they have enrolled.

The assessees under 15 days post obtaining the same message are directed to proceed to their dashboard and resubmit their GSTR-3B form.

Assessee might contact their jurisdictional tax officer or create a ticket on the GST grievance redressal portal who faces issues in re-filing like GSTR-3B form.