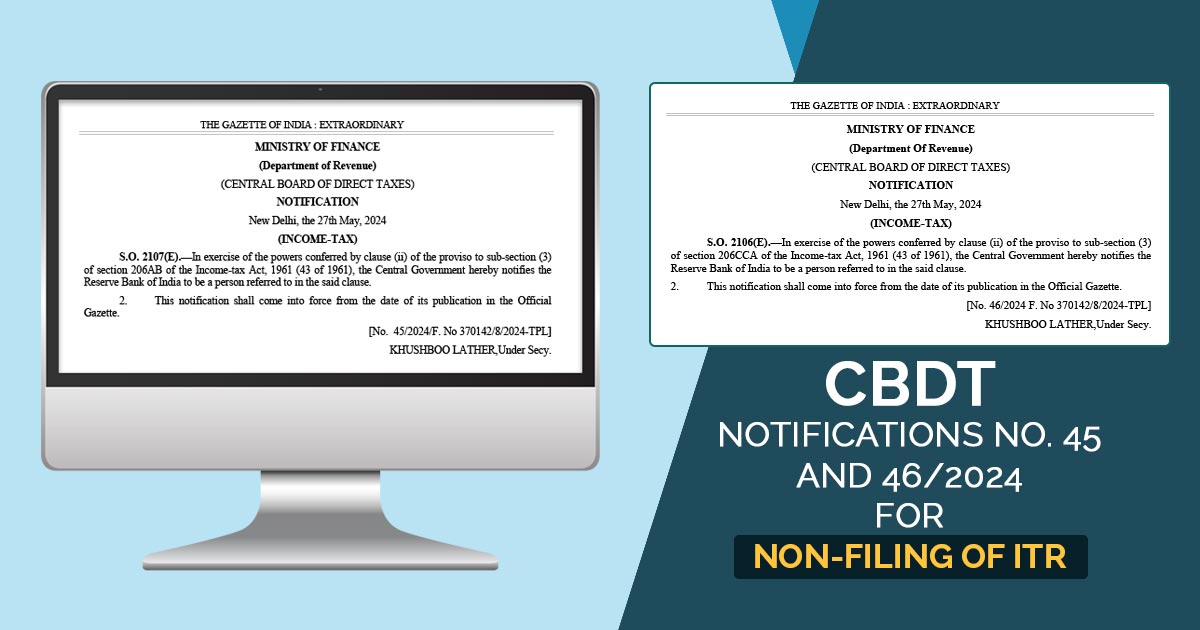

On May 27, 2024, two notifications were released by CBDT, presenting higher rates of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) for individuals and entities who were unable to file their Income Tax Returns (ITR). In Notifications No. 45 and 46/2024, these directives are detailed and specify an important development in the enforcement of tax compliance.

Notifications Key Highlights

- Exclusion of RBI from “Specified Person” Status

- Notification No. 45/2024 (S.O. 2107(E):- Under the authority allotted via clause (ii) of the proviso to sub-section (3) of section 206AB of the Income-tax Act, 1961, the Central Government has formally not included the Reserve Bank of India (RBI) from being categorized as a “specified person” for higher TDS rates.

- Notification No. 46/2024 (S.O. 2106(E):- Likewise, leveraging clause (ii) of the proviso to sub-section (3) of section 206CCA of the Income-tax Act, 1961, the RBI (Reserve Bank of India) is waived from being recognized as a “specified person” for higher TCS rates.

2. The Date on which the Rule was Implemented

Immediately from the date of their publication in the official Gazette, both notifications are effective.

Such exemptions for the RBI provide the assurance that the central banking institution does not within the surge of compliance load of higher TDS and TCS rates applicable for the non-filers of income tax returns.

Intended Impacts on Taxpayers

The government’s intent has been underscored in the notifications of stringent compliance measures and incentivized filing of tax returns within the due date. The assessees who are unable to file their ITR shall suffer higher rates of TDS and TCS, consequently supporting the significance of complying with income tax filing due dates.