The Central Board of Direct Taxes (CBDT) in an update for the taxpayers via the Directorate of Income Tax (Systems), has issued Notification No. 5/2024 dated October 30, 2024, obligating the submission of certain forms electronically which is listed in Appendix-II of the Income Tax Rules, 1962.

The same directive applies to the needed forms under sub-rule (1) and sub-rule (2) of Rule 131, streamlining digital compliance and rectifying the efficiency of the process of the income tax.

Read Also: Form 3CA & 3CB: Applicability and Major Components

As per the amended regulations, all the cited forms should not get filed electronically which aligns with the initiative of the CBDT to modernize and ease the process of tax. The update is anticipated to streamline the process of filing, reduce paperwork, and support the timely processing via income tax authorities.

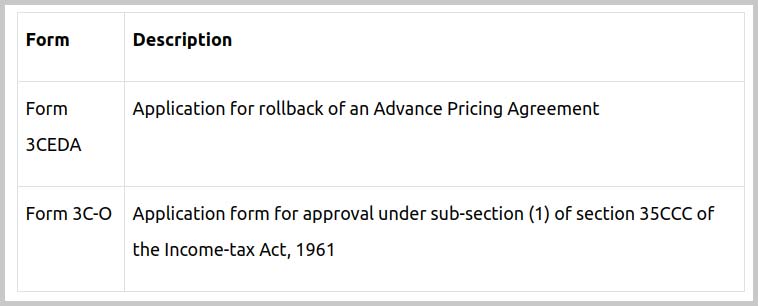

The Director General of Income Tax (Systems), Bengaluru in the exercise of the powers given under sub-rule (1) and sub-rule (2) of Rule 131 of the Income-tax Rules, 1962 (‘the Rules’), with the approval of the board cited that the following Forms will be provided electronically and would get verified in the said way under sub-rule (1) of rule 131-

From 31st October 2024, this Notification shall come into force.