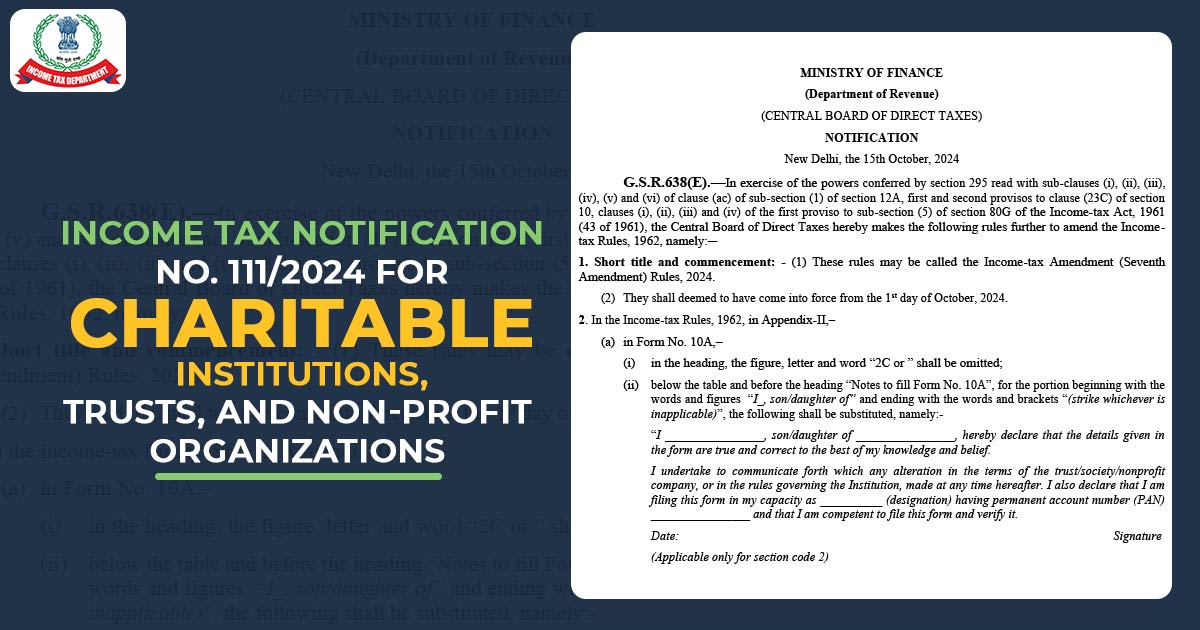

Amendments have been announced for Income-tax Rules through Notification No. 111/2024, dated October 15, 2024, by the Central Board of Direct Taxes (CBDT). These amendments effective from 1st October 2024 have the motive to facilitate the registration process for charitable institutions, trusts, and non-profit organizations under sections 12A and 80G of the Income-tax Act.

Introduced Amendments

The amendments are concerned with Forms 10A and 10AB, which are significant for the registration of entities asking for tax-exempt status. Significant updates are-

- Elimination of Outdated References: The changes remove mentions of particular clauses and figures in the titles of Forms 10A and 10AB, making the application process easier.

- Streamlined Declarations: Applicants are needed to do straightforward declarations ensuring the precision of the information furnished. Before applying for registration they should confirm the absence of any tax-exempt income.

- Revised Documentation Requirements: The organizations that were functional before their registration should provide self-certified copies of the pertinent certificates along with the financial records. The same amendment has the motive to ensure transparency and accountability among applicants.

Implications and Clarifications

The accompanying explanatory memorandum specifies that these modifications will be retroactive, taking effect from October 1, 2024, and will not have any negative impact on individuals or organizations. The CBDT guarantees that the changes are aimed at streamlining the registration process while avoiding extra demands on applicants.

Such amendments directed to the previous changes that were made to the income tax rules in June 2024 which exhibits the effort of CBDT to improve compliance and facilitate the process for charitable companies.

Closure

The Income-tax Amendment (Seventh Amendment) Rules, 2024, keep an influential measure for easing the process of registration for non-profit entities in India. Central Board of Direct Taxes (CBDT) through refining the needs and ensuring clarity in the process of application has the motive to support the growth and transparency of charitable institutions and maintain the standards of accountability. The companies looking for registration must verify these amendments to ensure compliance and promote a streamlined application process.