The Calcutta High Court asked the applicant to contest the order before the appellate authority as the failure to Receive show cause notice ( SCN ) u/s 73 of the Central Goods and Service Tax ( CGST ) Act 2017 was due to GST Portal Issue.

The applicant Mitali Saha, filed the writ petition contesting the notifications issued u/s 168A of the CGST/WBGST Act, 2017. The applicant said he does not wish to proceed with the challenge. The petition is now limited to the challenge of the show cause notice issued u/s 73 of the said Act.

U/s 73 and Section 73 (9) of the said Act, neither the Show Cause Notice nor the adjudication order issued has been uploaded in the “view notices and orders” section of the portal, the uploading of the notice on 6th April 2023, and the order on 6 December 2023, in the portal, in other section does not include service of such notice or order on the petitioner.

As per him, the SCN issued u/s 73 of the said Act and the order issued u/s 73(9) of the said Act were uploaded on the “view additional notices and orders” section of the portal. The portal’s complex nature, before the same being redesigned had made it excessively difficult for the registered taxpayers to access data from the portal.

As per the above said reasons the applicant has refused the chance to answer to that and as per that an ex-parte order has been passed. He provided that in the facts of the case, the adjudication order must get set aside as it has been passed in breach of the principles of natural justice.

Read Also: How to Effortlessly Check Validity of GST SCN & Orders

Also via pulling the attention of the Court to the notice in Form GST DRC 13 on 6th May 2024, it was proposed that the respondents had in pursuance to the ex parte order purported to attach the bank account of the applicant. From the disclosure made by the petitioner’s banker, the aforesaid described fact had been drawn.

For the respondent, Mr. Siddiqui, an advocate appeared while it furnished that the applicant was constantly notified about the service of notices along with the service of SCN u/s 73 of the said act. Through directing to the above-mentioned email communications he furnished that the emails categorically record the exact location in the portal where the said notice is available. The respondents cannot be made responsible if the applicant has decided to skip the same.

It was contended that SCN issued u/s 73 of the said act was not uploaded in the “view notices and orders” section of the portal. , the petitioner via email was notified of the location of the SCN on the portal. The same fact would confirm the email communications which remain uncontroverted.

There is confusion about uploading the Show cause and the order particularly acknowledging the fact that the dashboard of the portal has been re-designed, the single bench of Justice Raja Basu Chowdhury regarded that the applicant must be allowed to contest the above-mentioned adjudication order on the 6th December 2023 passed under Section 73(9) of the said Act to the appellate authority.

Within 30 days from the date, the applicant can approach the appellate authority from the date and file a petition along with an application for condonation of delay, the appellate authority, through condoning the delay would hear and dispose of the petition on the merits via passing a reasoned order within 12 weeks.

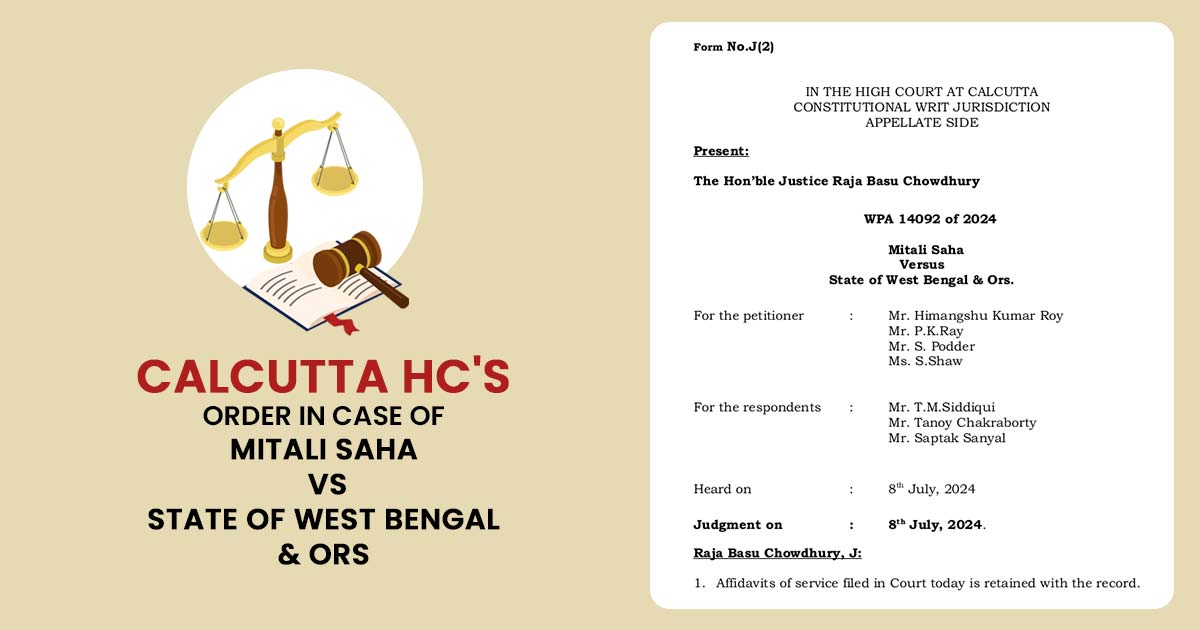

| Case Title | Mitali Saha Versus State of West Bengal & Ors. |

| Citation | WPA 14092 of 2024 |

| Date | 08.07.2024 |

| For the petitioner | Mr. Himangshu Kumar Roy Mr. P.K.Ray Mr. S. Podder Ms. S.Shaw |

| For the respondents | Mr. T.M.Siddiqui Mr. Tanoy Chakraborty Mr. Saptak Sanyal |

| Calcutta High Court | Read Order |