It was ruled by the Calcutta High Court that the failure to comply with the legal provisions which obligate the consideration of explanation on the taxpayer’s end before passing the adverse order, breaches these orders.

It was ruled by the High Court that so while acknowledging that the applicant was prevented from filing his reply to the SCN as of the reasonable cause.

Single Bench of Justice Raja Basu Chowdhury Directing to Section 75(4) of the CGST/WBGST Act, 2017, noted that providing a chance of hearing is obligated where a request is obtained in writing from the person levied with tax or penalty or where any adverse decision is considered against the same person.

Case Fact

The taxpayer approached the writ court complaining that a SCN was furnished on the applicant in Form GST DRC-01, but, even after allowing the applicant to furnish his reply, the department respondent passed an order without furnishing enough chance of hearing.

Final Decision

The bench directed the submission of the taxpayer’s counsel that the applicant cannot furnish his reply within the said time being unwell.

The Bench acknowledged that, according to the law, if the Department plans to issue an unfavourable order, it must give the assessee the right to a personal hearing. If this opportunity is not given to the assessee, it is a violation of the statutory requirement.

The bench acknowledged that a final order made by a proper officer under Section 73 of the Act, without providing a proper hearing, is not valid.

Despite receiving a show cause notice in Form GST DRC01, the petitioner did not submit any response, as they were unwell, and they provided medical prescriptions to support this, according to the Bench.

After considering the possibility of an unfavourable ruling for the petitioner, the High Court returned the case to the appropriate officer, instructing them to reevaluate the issues presented in the show-cause notice by providing the petitioner or their representative with a chance for a personal hearing.

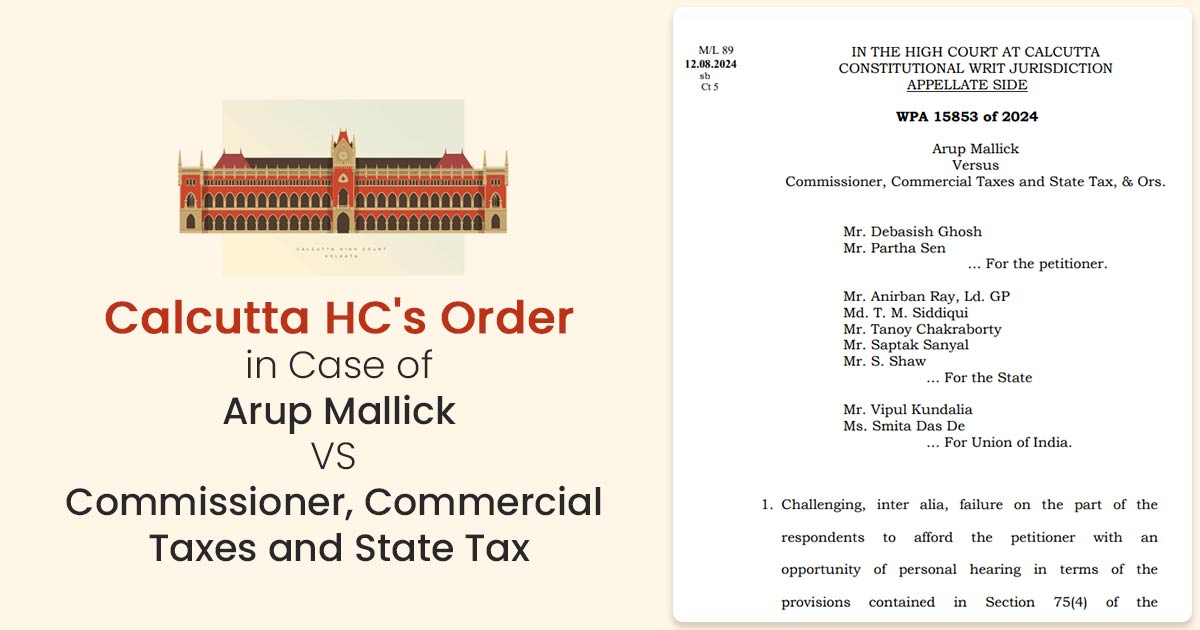

| Case Title | Arup Mallick VS Commissioner, Commercial Taxes and State Tax |

| Citation | WPA 15853 of 2024 |

| Date | 12.08.2024 |

| For the Petitioner | Mr. Debasish Ghosh Mr. Partha Sen |

| For the State | Mr. Anirban Ray, Ld. GP Md. T. M. Siddiqui Mr. Tanoy Chakraborty Mr. Saptak Sanyal Mr. S. Shaw |

| For Union of India | Mr. Vipul Kundalia Ms. Smita Das De |

| Calcutta High Court | Read Order |