It was ruled by the Calcutta High Court that cellular mobile service providers are not obliged to deduct the tax at source (TDS) on income received by distributors/franchisees from customers.

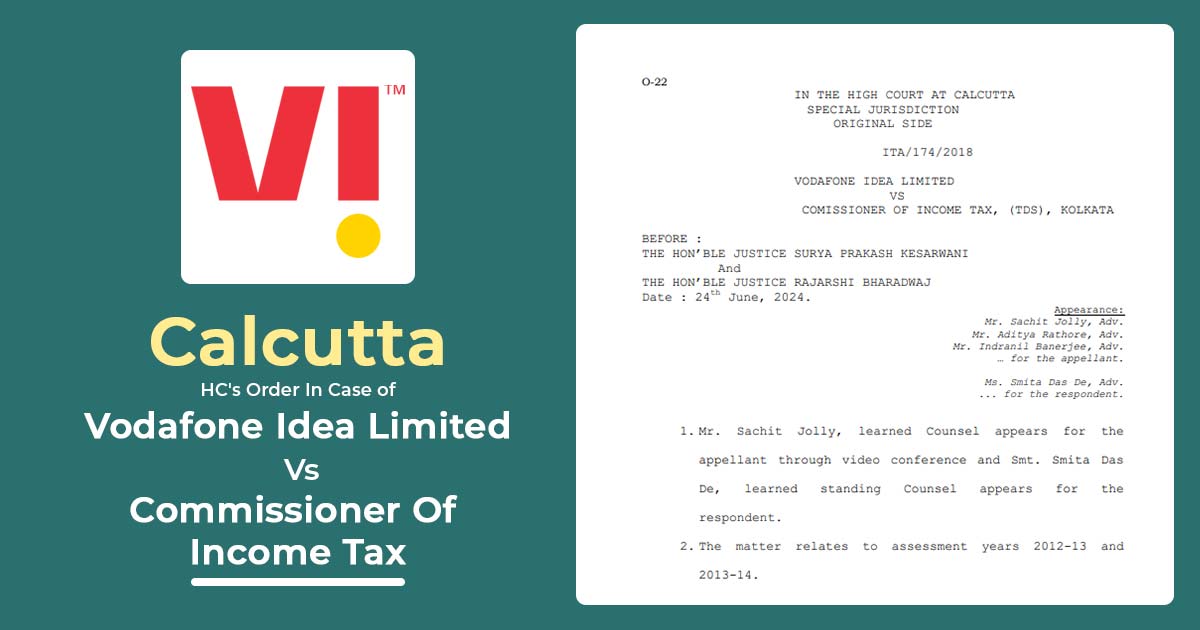

The bench of Justice Surya Prakash Kesarwani and Justice Rajarshi Bharadwaj has relied on the Supreme Court’s decision in the case of Bharti Cellular Limited Vs. Assistant Commissioner of Income Tax Circle-57, Kolkata and Anr.

In Which It Was Held That The Assessees Would Not Be Under A Legal Obligation To Deduct Tax At Source On The Income/Profit Component. The Payments Received By The Distributors/Franchisees From The Third Parties/Customers, Or While Selling/Transferring The Pre-Paid Coupons Or Starter-Kits To The Distributors.

The applicant, Vodafone Idea Limited Is An Indian Telecommunications Company With Its Headquarters Based In Mumbai And Gandhinagar. It Is An All-India Integrated GSM operator Offering Mobile Telephony Services.

The taxpayer Had Entered Into Franchise/Distribution Agreements With Several Parties About Their pre-paid Connections.

Read Also: Andhra Pradesh HC Quashes Prosecution Proceedings When Assessee Deposits Belated TDS

The problem was whether the Relationship Between The Appellant And Its Distributors And the Course Of Dealings Between Them, The Appellant Needed To adhere to The Provisions Of Section 194h Of The Income Tax Act, 1961 Associating To Tax Deduction At Source Concerning The Discount permitted before the Distributors concerning Pre-Paid Sim Cards And Pre-Paid Vouchers/Recharge Coupons.

Section 194H of the Income Tax Act furnishes for Tax Deduction at the Source (TDS) on commission or brokerage to a resident individual. Any person not being an individual or huf paying any commission or brokerage is liable for TDS u/s 194h since commission or brokerage performs as an income source.

While complying with the ruling in the matter of Bharti Cellular Limited the court replied to the substantial questions of law in favour of the taxpayer and against the department.

| Case Title | Vodafone Idea Limited Vs Commissioner Of Income Tax |

| Citation | ITA/174/2018 |

| Date | 24.06.2024 |

| Appellant By | Mr Sachit Jolly, Mr Aditya Rathore, Mr Indranil Banerjee |

| Respondent By | Ms. Smita Das De, Adv |

| Calcutta High Court | Read Order |