The Calcutta High Court has issued a favourable decision for G.P. Tronics Private Limited and another party involved. They are now allowed to appeal against an order passed under Section 73 related to the West Bengal and Central Goods and Services Tax Act, 2017, even though they didn’t reply to a notice that was sent to them.

As per the bench, through the legal appeal, the disputed factual problems should be addressed instead of the writ jurisdiction.

Writ jurisdiction is not effective for solving the disputed questions of fact when a multi-tiered adjudication procedure and an appellate remedy are available, the bench of Justice Raja Basu Chowdhury outlined.

Read Also: Calcutta HC Upholds GSTN Cancellation and Application Rejection Due to Non-Existence of Business

An order on 13th September 2024 was contested by the applicants, which covers the tax period from April 2018 to March 2019, based on the fact that the proper officer adjudicated the case ex parte without a hearing and without granting enough adjournments.

On 31 October 2023, the SCN in Form DRC-1 was furnished, and as the applicant had applied for an adjournment as they had not submitted a reply, the adjudicating authority determined the case on the merits without additional input from the taxpayers.

Not enough explanation was proposed for the delay as the writ petition was submitted dated 18th October 2024, Justice Basu Chowdhury cited and then opined that it would be imprudent for the HC to entertain the petition when a plea lay under the GST framework.

The writ of relief has been declined by the court, it said that the applicants should not be provided any remedy.

Then the petition was disposed of by them asking applicants to submit a plea to the first appellate authority within 4 weeks from the order date, finish all formalites, and comprise an application for the condonation of delay, the appellate authority was directed to mark both the pendency of the writ petition and the observations of the Calcutta High Court and to determine the appeal on its merits.

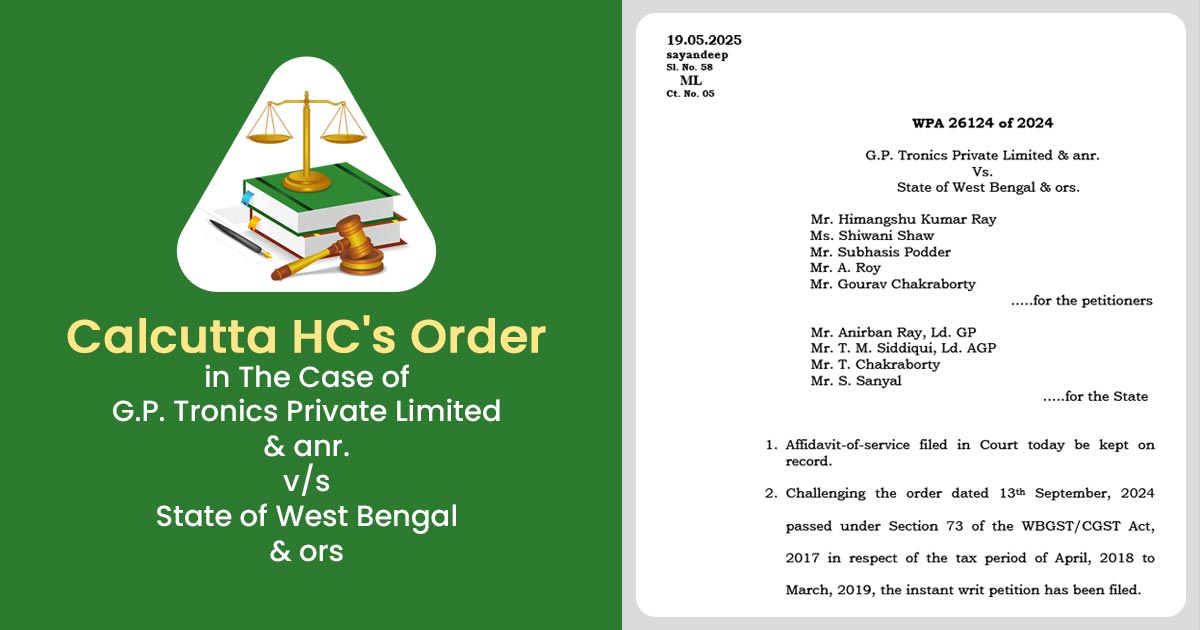

| Case Title | G.P. Tronics Private Limited & anr.vs. State of West Bengal & ors |

| Case No. | WPA 26124 of 2024 |

| For The Petitioner | Mr. Himangshu Kumar Ray, Ms. Shiwani Shaw, Mr. Subhasis Podder, and Mr. Gourav Chakraborty |

| For The Respondents | Mr. Anirban Ray, Mr. T. M. Siddiqui, Ld. AGP, Mr. T. Chakraborty, and Mr. S. Sanyal |

| Calcutta High Court | Read Order |