The Bombay High Court has quashed a show cause notice issued in a standardized printed format, which only included the period, date, and time, but lacked any specific details regarding the information or documents required from the petitioner to be presented.

The bench, consisting of Justices K. R. Shriram and Jitendra Jain, observed that before issuing the best judgment assessment, Section 23(2) of the relevant legislation stipulates that if a registered dealer fails to adhere to the terms of any notice issued under this subsection, the Commissioner is obliged to assess the tax due from the assessee to the best of his judgment.

In this case, the court noted that the show cause notice did not specify the documents that needed to be produced, indicating that the necessary preconditions for passing the best judgment assessment were not satisfied.

The petitioner, engaged in the exploration of petroleum resources in the ‘Panna and Mukta’ and ‘Mid and South Tapti’ fields located off the coast of Mumbai, argued that their operations are situated between 60 to 120 nautical miles from India’s territorial baselines.

Based on the exploration in contract areas, the petitioner sells petroleum, crude, and natural gas to the designated agencies of the Government of India. The petitioner contended that the title to crude oil and natural gas is transferred to the government nominee at the delivery point within the contract areas of the oil fields.

As such, they asserted that their operations do not fall within the jurisdiction of the Deputy Commissioner of State Tax, who operates under the Maharashtra Value Added Tax Act, 2002.

Calling the petitioner to attend the respondent’s office to hand over the show cause notice which was issued without any details in it. The show cause notice is in the printed form and does not bear any details as it can be seen on the notice.

Despite the challenges posed by the vague nature of the notice, the petitioner took proactive steps and submitted their annual financial statements for the fiscal year 2019-20, along with the auditor’s report for the same period, a copy of the filed VAT and CST returns, and an acknowledgement of the audit report in Form 704.

Read Also:- How to Effortlessly Check Validity of GST SCN & Orders

This response, however, was complicated by the lack of clarity in the original show cause notice, which did not provide the petitioner with adequate guidance on what was required.

The court’s ruling underscores the necessity for tax authorities to issue clear and detailed communications, ensuring that taxpayers are fully informed of their obligations and can respond appropriately. The decision serves as a reminder that procedural fairness is essential in the assessment process, particularly in complex tax matters.

The petitioner received another letter demanding compliance with assessment requirements within seven days. Subsequently, the department issued an order under Section 23 of the Maharashtra Value Added Tax (MVAT) Act, relying solely on best judgment under Section 23(2) of the MVAT Act without addressing any specific points.

Following Section 23(2) of the MVAT Act, when a registered dealer submits their return for a specific period by the designated deadline, if the commissioner deems it necessary to verify the accuracy and completeness of the return and requires additional documents, they must issue a notice to the dealer.

Also Read:- Bombay HC Overturns ₹3,731 Crore GST Demand via SCN Against Employees

This notice specifies a date and location for the dealer to either present all supporting documents for the return or provide the specified evidence requested.

The court deemed the letter akin to the vague show cause notice, lacking reference to the documents submitted by the petitioner on January 6, 2024.

It was stated by the court that the commissioner must first determine the necessity of ensuring the correctness and completeness of the return before requesting specific documents.

Failure to comply with such notice under Section 23(2) may lead to a best-of-judgment assessment by the Commissioner. As the order lacked details on the documents required, the prerequisites for a best-of-judgment assessment were not met.

Consequently, the court quashed both the order and the demand notice, reinforcing the need for clarity and specificity in tax assessments.

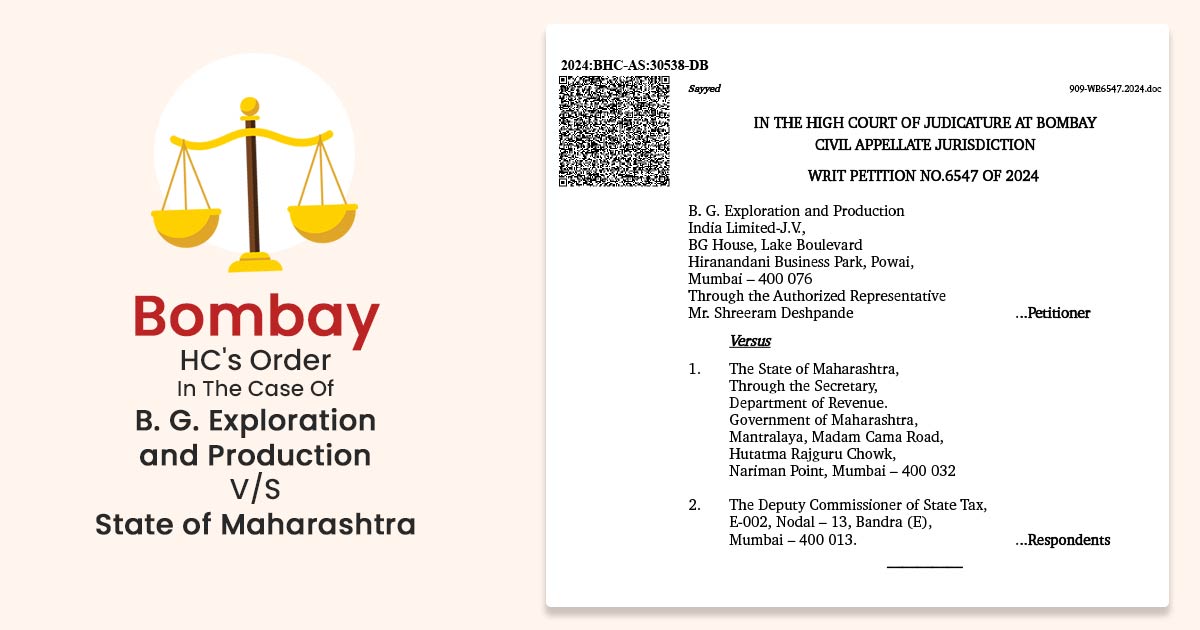

| Case Title | B. G. Exploration and Production India Limited V/S State of Maharashtra |

| Case No.: | Writ Petition No.6547 Of 2024 |

| Date | 30.07.2024 |

| Counsel For Appellant | Mr Rohan P. Shah, Ms. Sheeja John, Ms. Surabhi Prabhudesai i/b. M P Savla & Co. |

| Counsel For Respondent | S. D. Vyas |

| Bombay High Court | Read Order |