The order rejecting Integrated Goods and Service Tax (IGST) has been quashed by the Bombay High Court because the order was passed without any reason and without application of mind.

The CGST Commissioner does not hold the authority to condone the delay, but the writ court does, the bench of Justice K.R. Shriram and Justice Jitendra Jain remarked.

The bench further marked, Our judicial conscience does not allow us to reject this cause revealed as bogus, specifically because the petitioner was an individual and the GST regime was at a developing stage. There is no whisper for the merits of the application, in both orders impugned in the petitions.

The applicant is an individual who holds on business in the name and style of M/s. Air Miracle. The applicant undertakes heating, ventilation, air conditioning, and cleanroom projects for hospitals, pharmaceutical companies, IVF laboratories, biotech laboratories, etc. The applicant had supplied goods to one export-oriented unit, viz., Apothecon Pharmaceuticals Pvt. Ltd., and on the supply, the petitioner had charged IGST at the rate of 18% p.a., and the applicant has released the IGST obligation as well.

The taxpayer qualified for a refund of paid IGST and as per that filed an application for the refund to claim a sum of Rs 17,52,468. The order was been rejected by the application on 21st September 2019 passed via the Assistant Commissioner. Without providing any causes the rejection order has been passed and also without application of mind.

A petition has been filed by the taxpayer against the order passed via the Assistant Commissioner of CGST and Central Excise before the Commissioner of CGST and Central Excise, who had rejected the petition as per the petition needed to have been filed within 3 months with a provision to extend by 1 month on enough cause being revealed, however, the petition was filed nearly 29 days late and consequently restricted by the limitation.

The Commissioner remarked that he did not have the authority to extend the time limit after the extendable one-month period was over.

The order was contested by the applicant and has been passed via the assistant Commissioner of CGST and Central Excise and an order passed by the Commissioner of CGST and Central Excise.

The council argued that when the applicant does not approach the court within the said time for filing the petition then the court can not practice its jurisdiction under Article 226 of the Constitution of India.

The contention of the court has been rejected by the council that the writ petition is not maintainable since the same has been filed beyond the time furnished for a petition and ruled that the writ jurisdiction is invokable under Article 300A.

At the time of remanding the case for reconsideration, the court asked the council to reconsider the application on its merits.

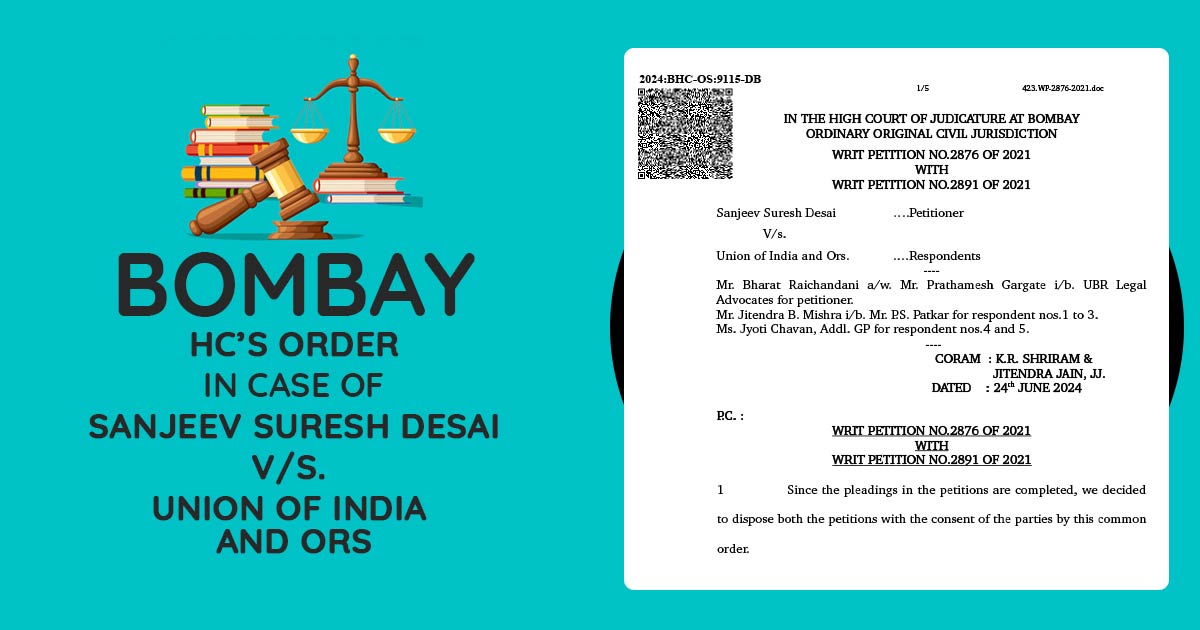

| Case Title | Sanjeev Suresh Desai V/s. Union of India and Ors |

| Case No. | Writ Petition No.2876 Of 2021 With Writ Petition No.2891 Of 2021 |

| Date | 24.06.2024 |

| Counsel For Petitioner | Mr. Bharat Raichandani, Mr. Prathamesh Gargate |

| Counsel For Respondents | Mr. Jitendra B. Mishra, Mr. P.S. Patkar, Ms. Jyoti Chavan |

| Bombay High Court | Read Order |