In the current era, people need ready data to execute their chores more easily and in less time. CA or tax practitioner companies need effective best income tax return software. Also, they seek effective practice management software for ease of filing compliance and laws.

Work in distinct companies is executed through distinct capable software. On the other side, Chartered accountants are also working with the help of income tax software rather than executing tax chores manually.

The majority of chartered accountants choose to follow distinct software for their tasks. It just protects the time, and manual efforts are reduced to the last measure. You can precisely compute income tax, advance tax, TDS, wealth tax, and others.

Working with the help of this income tax return filing software reduces the chances of human error, and the results obtained will be accurate. Inside the software, all the information related to the clients is saved. You do not need to add the information every time, and you can obtain the records whenever you need them.

Check out office management software. And check out its efficiency in managing the overall employee base and their respective practices.

Submit Query Regarding Income Tax Filing Software

There are various CA-supportive income tax e-filing software programs available in the market. The selection shall be implemented on the grounds of the work needed, which provides the intention in an effective way. With the sharp discussion, we shall know about the most beneficial income tax return filing software that CAs can use for official tasks.

Finding the Best Income Tax Software for Returns in India

Now, you can view the best income tax e-filing software in a hassle-free and convenient manner. Taxpayers can easily select the top filing software in this article:

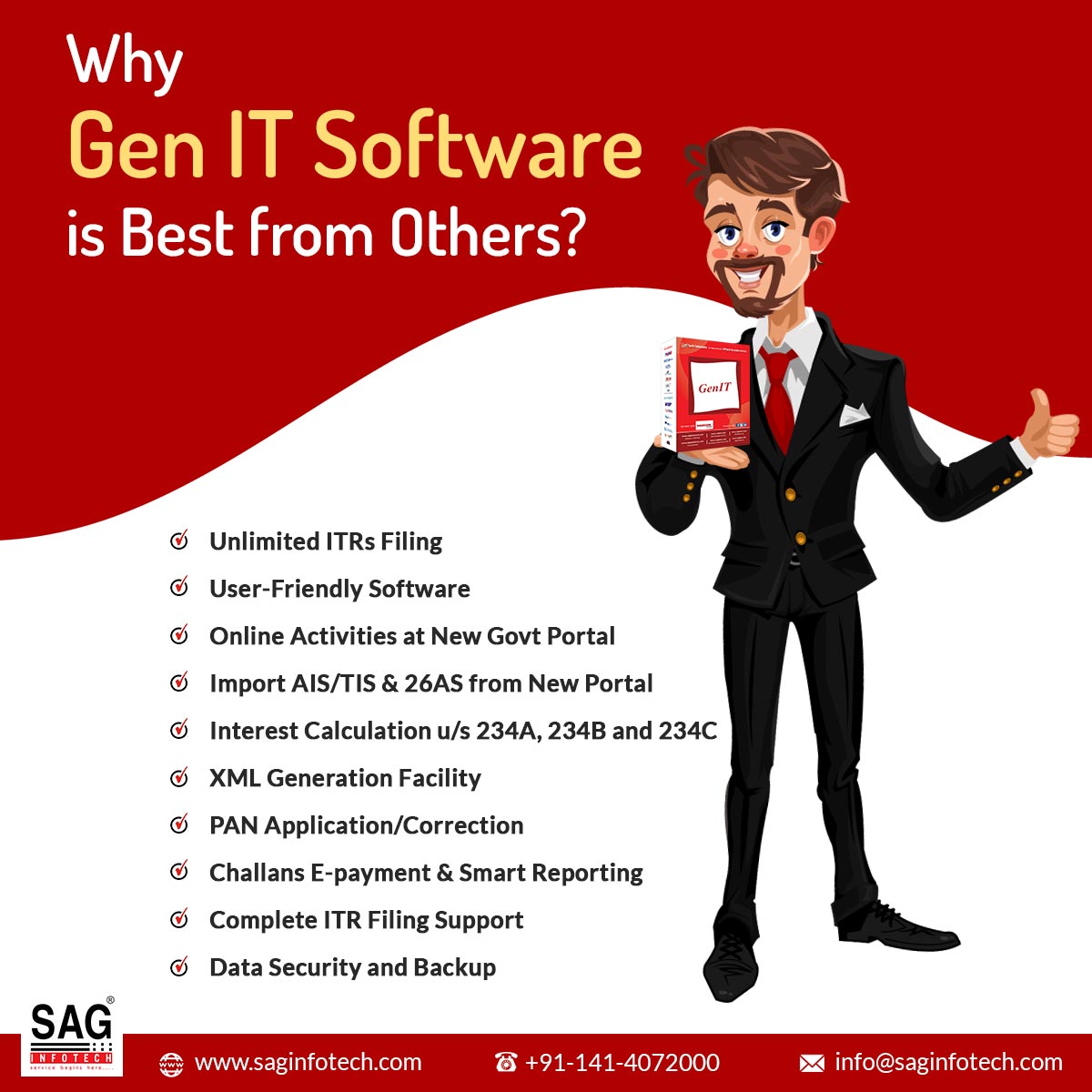

#1. Gen Income Tax Software

Gen Income Tax Software is the leading and most favourable ITR filing solution for taxpayers across India, with more than 60,000 clients using the software for more than a decade.

Accurate and easily generated income tax self-assessment tax with a facility for advance tax. The Gen IT software can also calculate the additional interest under sections 234A, 234B, and 234C of the Income Tax Act.

This tool is made to avoid errors and mistakes while filing taxes. The Gen Income Tax e-filing software is best for a perfect ITR filing solution. SAG Infotech has been providing taxation e-filing services for more than 10 years, and hence various organisations have used the free demo of the income tax software and selected it in their return filing. It comes under the subsidiary of the well-known and recognised Genius in the taxation industry.

SAG Infotech’s Gen income tax software can also automatically select the ITR forms with numerous other features, such as a master data importing facility and XML generation for ITR forms. Other than that, it is also better in the verification of challan e-payment with the arrear relief calculation.

One of the most important things about the company is that it provides the ERI facility in the circumstances of furnishing the bulk returns along with MAT/AMT Calculation and income deductions summarised report, immediate income tax return uploading through ITD web services, along with other additional features, which are essential for the assessee as well as for the customers.

| Price | INR 7000* per year |

| Rating | 4.9/5 |

| Product Page | https://saginfotech.com/genit.aspx |

| Help Desk Number | 0141-4072000 |

Why Did You Need to Choose Gen Income Tax Software?

There are several features that Gen Income Tax software offers that give it an edge over all other tax preparation software. This is an end-to-end solution to all ITR requirements for businesses, clients, and taxpayers. The tax e-filing software acts as both an income tax management tool and a software to file ITRs. Below is the list of main features of the software:

- Fast Uploading and e-filing of ITR forms

- Importing Pre-Filled JSON and Filled ITR Data

- Generating the XML file

- Smart Calculator for Advance Tax

- Calculation of MAT/AMT

- A new PAN Application and correction

- E-payment through Challans

- Contact Verification in bulk

- Depreciation Chart

- Importing AIS, TIS, 26AS

- Sending Email via Document

- Additional Reporting Tools

- OTR and NTR Comparison

- New e-Pay Tax Facility for Payment

- Send Any Document or PDF File Through WhatsApp or Email

- New Format for Non-Corporate Financial Statements

- E-Verification of ITR With Aadhaar OTP/DSC Available

- Annual Information Statement(AIS) & Taxpayer Information Summary

- Filing of Online Forms like 10B, 29B, 29C, 10CCBBA, 10CCBC, 10CCBD, 10CCC, 56FF

#2. Govt New Income Tax Portal

The income tax department gives the facility for the e-filing of the ITR by JSON and offline Excel utilities. Prior to explaining the procedure engaged in the e-filing of the ITR, it is important for the assessee to save the credentials for computation and reporting the information in the income tax returns.

Visit the home page of the Income-tax portal, and then fill in all your information in the downloaded file, and verify all the details that are inserted. After that, just convert the format of file format to JSON format. Now, upload the particular file to your Income Tax portal. Below are the features of the Govt I-T portal:

- Easy ITR filing and quick refund process for taxpayers

- Taxpayers can easily see all their interactions, uploading files, and pending ITR in a single dashboard

- The new income tax portal offers multiple payment options, RTGS/ NEFT, credit card, UPI and net banking

- Assessee can request a change to an ITR and also view their tax credit statement (Form 26AS)

- It is possible to pre-fill some details regarding certain incomes on the new portal. It can relate to a salary, a house property, a business or profession, etc

| Price | Free |

| Rating | 5/5 |

| Product Page | https://www.incometax.gov.in/iec/foportal/downloads/income-tax-returns |

| Help Desk Number | 1800-180-1961 |

#3. ClearTax Software

Simplify your tax filing process and maximise your savings online with ClearTax. With their expert assistance, you can confidently file your Income Tax return and claim your tax benefits under Section 80C and other applicable sections. Whether you have a single Form-16 or multiple ones, these experts can handle it seamlessly. They are well-versed in handling various sources of income, including rental income, withdrawals from PF and bank deposits, capital gains from property, etc.

ClearTax specialises in providing comprehensive tax filing solutions. They cater to Indian residents with foreign income, offering guidance on income earned outside India and income earned in India for NRE/NRO Accounts, ensuring compliance with DTAA regulations.

Moreover, they have knowledge of capital gains earned through several sources, covering up to 200 transactions. ClearTax Experts also provides services for preparing account summaries, P&L statements, and balance sheets, making sure your financial records are accurate and organised. Some of the best features of this software:

- e-file your ITR in a very short period

- Automatically select the suitable income tax return form

- Quickly adjust advance tax payments

- A filing facility for three people at the same time

| Price | No Information |

| Rating | 4/5 |

| Product Page | https://cleartax.in |

| Help Desk Number | 8067458777 |

#4. Webtel Income Tax Software

ITR forms 1,2,3,4,5,6, and 7 e-return and paper returns, it is also used to generate the tax audit report inside Form 3CA, 3CB, and 3CD. The direct import of Form 26 AS information in the software facility is also available.

The software provides the option to digitally sign Income-tax return forms and others. The bulk upload and e-filing of the ITR. The tax return software is engaged in filing the DIT dashboard towards the online activities of ITD.

Web tax enables easier calculation of income tax, MAT, MATC, etc. Also, the software posts easier computation of the total income, Interest u/s 234A, 234B, & 234C, Late Filing Fees u/s 234F, and Deductions. The company is also engaged in calculating advance tax and self-assessment tax. Indeed, the company’s major services are HRA, NSC, Rebate u/s 89, etc. Here are some features of this software:

- The facility of the multi-user option

- Digitally signed ITR Forms and other utilities

- Tax Audit Report creation in Form 3CA, 3CB, 3CD

- Data backup and restoration

- For online actions of ITD, the DIT dashboard

- Through the software Download ITR-V

- Import Form 26AS data directly into the software

| Price | INR 3,400* – 6,800* per year |

| Rating | 3.7/5 |

| Product Page | https://webtel.in/WEB-e-TAX.aspx |

| Help Desk Number | 011-45054000 |

#5. Taxcloudindia ITR Software

Cleartax has its own best ITR filing software known as Taxcloudindia. It is a limited cloud-based app that is present in the market.

Specifications:

- Pre-fill the return of your customer: Get pre-filled information via the government portal in one Tap. Furnish the IT returns in just two minutes

- Directly File Without Client’s XML. – TaxCloud has an ERI license that allows you to directly e-file returns

- The calculator reports towards all your customers: Edit and share with your customers

- Tax Cloud India examines the user-entered data and further selects relevant ITR Forms for them to accurately

- Record keeping of users’ income and TDS is done automatically owing to the software’s advanced data backup system

- The platform is embedded with amazing features like an ERI license that lets users e-file their returns directly without using XML

- With this software, users can prepare and file their ITR along with TDS returns efficiently from anywhere

- With the help of Taxcloud India, even multiple clients can be handled easily at once, as the software permits multiple logins from a single

| Price | INR 6000* per year |

| Rating | 3.3/5 |

| Product Page | https://taxcloudindia.com/ |

| Help Desk Number | No Information |

#6. Winman Tax Return Software

The income tax calculation can be implemented from a single window. With tax filing software, the bulk import of last year’s files and documentation can be done through the data. It also enables the import of information from an XML file. Depreciation of the table, which covers the circumstances. Complete mapping of documents of ITRs prefilled. Enables the paper return and e-return. It provides Copy/paste from Excel, and the Software provides automatic carry forward and set off of losses.

It provides auto-import of the information from the companies to furnish the partner file. The software gives you a warning for not completing the data entry. It mentions the icon when your e-return is due, and it displays the user list through the editing option. It is used to calculate the option for any status, and the software provides the option to transform the output cell into the input cell. A list of different features of this software is as follows:

- Filing taxes online gives a seamless experience with this software

- The software’s backup feature allows users to create backups of their data and use them for reinstallation or security purposes

- This platform lets tax professionals and businessmen create extensive and detailed MIS reports for a deep understanding

- All the information about the business regarding tax can be kept in a ledger using this software. It also helps in data reconciliation for auditing

| Price | No Information |

| Rating | 4.6/5 |

| Product Page | https://www.winmansoftware.com/ |

| Help Desk Number | 9448327637 |

#7. EZTax ITR Filing Solutions

Through this software, customer management is the portion of the dashboard that enables you to handle your customers from one portal. The software is a 100% straight-through process (STP), which you are not required to sign in to your customer’s income tax e-filing login to furnish the taxes. It auto-reads Form 16 in PDF and image formats.

The income tax software just reads automatically Form 26AS along with all the related elements. It provides a creative audit service that verifies errors and generates income tax returns free from glitches. EZhelp is a supportive solution that is provided to your customers. You might switch on/off based on your decision, which might assist you if you are a fresher in CA. A few of the features of this software are as follows:

- Taxpayers may register online with EZTax and begin filing their taxes

- The software produces a complete analytical PDF report regarding tax-related issues

- Automatically upload Form 26AS and extract the data for TDS, TCS, and other advanced taxes

- You may handle your income tax return and get a complete resolution to all of your tax-related problems by filing through this software

- Income tax returns and the E-filing procedure are now simple thanks to EZTax. A button labelled “Assisted Income Tax Filing” is included in the software

| Price | INR 8,840* |

| Rating | 4.6/5 |

| Product Page | https://eztax.in/ |

| Help Desk Number | 7288900900 |

#8. HostBooks ITR Software

You can access cloud-based Income tax return filing software services anywhere, anytime. It also provides you with validation. Generate and download the XML. The software has the feature of Income-tax return upload and e-verification, which enables you to directly go to the e-filing website. It is easy to file the return by logging into the e-filing website.

Hostbooks provides the computation of the income under the head salary, Capital Gains, House Property, Business, etc., calculation of the total income, tax payable, interest under sections 234A, 234B, and 234C, and Late Filing Fees under section 234F. Amount calculation eligible for deduction. The calculation of the advance tax and the self-assessment tax is based on the grounds of the payment date. Some of the best features of this software are:

- Easy login on the website of e-filing

- From one head income auto mapping to another head

- XML Validation, generation, and download process

- You can also download ITR-V, Acknowledgement, and ITR forms

- Redirecting to the income tax e-filing website, and uploading the ITR and e-verify

- Automatic set-off of house property loss up to the limit stipulated in section 71(3A)

- Tax Payable, Total Income, Interest u/s 234A, 234B, and 234C, and Late Filing Fees under section 234F would get calculated

| Price | INR 12,499* |

| Rating | 4.5/5 |

| Product Page | https://www.hostbooks.com/in/income-tax-software/ |

| Help Desk Number | 0124-4201354 |

#9. Electrocom ITR Software

The software provides direct e-return and e-payment facilities. It allows seeing the generated XML file through the e-return file viewer. The software is engaged to see the ITR V and the notification in the software. It allows saving the acknowledgement receipt with an automatic function. The software indeed provides the user with a facility to verify the PAN and TAN online.

Make the statement of the accounts for taxpayers. Transfer the master data next year from the previous assessment year. It provides the export facility and edits files. The software has a unique feature in which it traces the errors in e-return. Facility to generate an online submission of Form 49A/PAN Correction Form. The following are some of the features of the software:

- Online validation of PAN/TAN

- File export and editing facilities

- Create the taxpayer’s Statement of Accounts

- To view the created XML file, use the E-Return file viewer

- The software has the utility to view the ITR-V and Intimation

- Transfer of Master Data from the Previous to the Next AY

- The pre-validation facility is unique in tracing errors in e-returns

- The software has the option to file Direct e-returns and e-payments

- The acknowledgement receipt number would be saved automatically

| Price | INR 1,900* (100 Assessees) or INR 2,900* (Unlimited Assessees) |

| Rating | 4.1/5 |

| Product Page | https://www.electrocom.in/incometaxsoftware.php |

| Help Desk Number | 079-27562400 |

#10. CompuTax ITR Filing Software

Computax is a well-known software among the CAs; it makes the preparation and furnishing of the returns simpler. You can make the balance sheets and profit and loss accounts according to the amended schedule VI and several audit reports through the assistance of Computax. We mentioned the advantages that are given through the Computax tax filing software:

You can simply execute the PAN verification, as all the information, like PAN, TAN, NSC information, MAT credits, and others, gets automatically transferred.

TDS returns can be furnished without any effort as all the information relevant to the TDS returns, like Advance tax, TCS, self-assessment tax from 26 AS, etc., are assigned. The tax calculation will look for deductions, set-off losses, clubbing, carry-forward losses, and others.

You could state that it is the full package for the Chartered accountants through the assistance of which they can obtain an automated solution and lessen the manual efforts. This software includes the following features:

- ITR–V auto download

- DSC Registration

- E-return online filing

- View and Import data through 26AS

- Status of bulk refund

- ITR rectification uploading

- CPC Autofill ITR-V Receipt date

- Generate EVC by linking the Aadhaar with the PAN

- Through Aadhar OTP or EVC, e-verify the return

- Registration of a user and revision of the contact information of a profile

- ADD CA and authorise the Audit Report

- Automatically control notifications and other communications delivered to your email address by ITD and its management

| Price | INR 4,500* per year |

| Rating | 4.1/5 |

| Product Page | https://www.computaxonline.com |

| Help Desk Number | 0141-2609277 |

#11. TaxbasePro ITR Software

For Chartered Accountants, Tax Consultants, and Other Tax Professionals, TaxbasePro is the best income tax computation and return filing software in India. The same would be the Complete tax-based software solution that delivers diverse facilities for Income Tax, TDS, Advance Tax Register, Wealth Tax, Billing Management, AIR modules, Office Management, and Post-filing management at no extra cost to perform the calculation.

TaxbasePro, which is an ITR filing software, allows quick calculations of taxable income, taxes, and interest. The ITR is rapidly generated and uploaded to the department website in both paper and electronic versions (JSON/XML). Additionally, through several crucial modules, the software functions as a miniature ERP solution for handling electronic data in your office. A 30-day trial version that is fully functioning is available for download. Some of the key features of this software are:

- Import the data utility from last year

- User Access rights for extra security of data

- Warnings and Validations at distinct levels

- Import facility of data utility from 26AS, AIS/TIS, MOS, and XLS templates

- From the firm’s return auto-update data to partners’ accounts

- Old and New Regimes of tax calculation for Comparison and tax savings

- From the TDS module, the Auto-populates employee data in the home grid

- Secure an overview of Income and Tax for a family. Group-wise income report

- Income Tax is calculated for the assessment year and the previous assessment year for quick comparison

| Price | Approx INR 9420* |

| Rating | 5/5 |

| Product Page | https://sinewave.co.in/ |

| Help Desk Number | 020-49091000 |

#12. TaxPoint ITR Software

TaxPoint ITR Software provides a comprehensive solution for individuals and companies to handle their income tax returns. With its user-friendly features and powerful interface, TaxPoint facilitates the tax return filing process, time-saving and reducing a lot of pressure.

One of the key features of this software is its capacity to import appropriate financial data from different sources, such as invoices, bank statements, and other records. This helpful feature stops the requirement of manual data entry, providing accuracy and reducing miscalculating errors.

The Software presents a range of tax calculators, which allow users to calculate their tax liability and easily optimise their financial planning. These calculators consider tax deductions, income, and investments to provide accurate results and informed decisions.

Similarly, it assures compliance with the latest income-tax laws and regulations. It also automatically corrects its database with the latest income tax rules, confirming that users still have access to proper information.

The software also gives real-time updates on modifications to the tax code, so users can adjust their tax methods accordingly. Below are some features of this software:

- It will import the return data from another online tax prep service

- Option of the Tax calculator

- Import the W-2 data very easily

- Fast rewards and refunds

- International or Local tax planning and compliance

| Price | No Information |

| Rating | 4.2/5 |

| Product Page | https://www.taxpoint.in/ |

| Help Desk Number | 011-45510073 |

#13. Saral Tax Software

The process of filing the ITR is automated to bring a feasible solution. The tax filing software featured an easy taxpayer master interface to capture the information, with accessibility to monitor the status of work and returns. Bulk ITR furnishing and bulk checking of process status for the filed return via e-return intermediary service.

You can easily find out the e-filing process status, download the ITR-V, and furnish all kinds of taxes, refund status, etc. Directly combining information along with the ITD website towards all the ITR-relevant information, excluding any dependency on the website. A taxpayer can see the income under distinct heads and the tax, along with the interest needed to pay. This software has the following features:

- To facilitate shareability, the software permits an individual to export the entire data through the tax audits to an Excel sheet

- Users of Saral IncomeTax can upload large amounts of data using Excel sheets

- From the software, the users can export the data in Excel or PDF formats in a direct way. The same shall indeed permit the export of the balance sheet for the users

- Users of this software can easily file income taxes on behalf of themselves or their clients

- Before filing tax returns, people can do all the necessary preparations and maintain their documentation close at hand

- Important data, such as GST ID, name, and contact details, could be stored by the users in the software for the purpose of automated IT forms filing

| Price | INR 8,800* |

| Rating | 4/5 |

| Product Page | https://www.saraltaxoffice.com/ |

| Help Desk Number | 1860-425-5570 |

#14. Tax2win Income Tax Software

Tax2win is one of the revolutionary e-filing platforms, which provides the easiest way of e-filing your income tax return in India. The portal has many cool features and details as well. The portal also provides a personal ECA service, which makes things even more hassle-free. Here are the top features of Tax2win you should know about.

Tax2win offers personal ECA services too. Personal ECA can do the tax filing for you without much effort required from your side. This service is personalised, convenient and fast, with the maximum refund calculated for you. You just have to hire a personal ECA from all the available eCAs, and then you just have to upload the Documents. This software offers some of the following features:

- Simpler ITR filing procedure

- Report of tax saving

- Supporting e-verification

- Improving the CTC format

- Creation of a rent receipt

- Updation of the status of a refund

- Analysis of maximum tax deductions

- All tax scenarios, excluding capital gains

- Intimation support under section 143(1)

- 26AS (Tax Credit Statement) verification

- Select between the new and old regimes

- Auto-extracted information for ITR filing from the IT department

- E-file your income taxes and obtain confirmation through the IT department

| Price | Not Available |

| Rating | 4.5/5 |

| Product Page | https://tax2win.in/ |

| Help Desk Number | 9660996655 |

#15. TaxSpanner Software

TaxSpanner is an income tax return filing software that is a part of Span Across IT Solutions. You can prepare and file your ITR online through a department-authorised e-return intermediary. E-filing services start at just Rs. 500, and expert tax practitioners can also help with tax planning.

According to TaxSpanner, it does not cross-sell to its clients after obtaining their information, and it values client privacy and confidentiality highly.

Online Income Tax Returns (ITRs) can be prepared and filed using Taxspanner. Filing your taxes is easy with it. You can upload multiple PDFs or scanned documents with this tax calculation software. Below is the list of main features:

- E-filing is available for all types of ITR

- It furnishes protection via 256-bit SSL encryption

- This website automatically estimates the return filing as per the appropriate tax rules

- You will earn a comprehensive solution for e-filing ITR 2, ITR1, ITR3, and more

- Taxspanner allows you to organise, fill and set your income tax

- It maintains your document securely so that you do not have to keep a particular tax file

| Price | INR 3500* |

| Rating | 3.7/5 |

| Product Page | https://www.taxspanner.com/ |

| Help Desk Number | +91 11 4084 4781 |

Top Income Tax Return Filing Services in India

Above, we have included details of the best income tax return filing software. Nowadays, some taxpayers are not familiar with using the software option as they want to file their income tax returns via online website services. Individuals need a tax expert who can guide them while filing their online returns.

Below, we have mentioned some of the top ITR filing services for individuals. These are the top services and are very popular in the taxation market. Read all the instructions carefully before getting any ITR services.

TaxBuddy

TaxBuddy provides an intuitive e-filing platform that ensures accurate tax return filing. TaxBuddy uses advanced technology to furnish experts’ advice through the platform at competitive pricing.

It offers comprehensive financial solutions and is a technology-based service platform that caters to individuals, professionals, HUFs, firms, and registered firms in India. Its primary aim is to assist seekers in tax planning and tax filing and provide consultation on personal investment and growing wealth.

The TaxBuddy software for all your income tax solutions ensures the accurate filing of tax returns through its user-friendly e-filing platform. It also utilises technology to offer affordable professional advice to taxpayers.

Additionally, this assisted tax filing platform offers a centralised dashboard, tax advisory services, ITR filing, and more to individuals such as market traders, salaried taxpayers, futures/options traders, and others.

Here are the features of TaxBuddy –

- With TaxBuddy, getting the submission approved and filing the income tax return (ITR) within a day is hassle-free

- It offers personalised tax advice through customised advisory services dedicated to your specific requirements

- Tax experts will handle the income tax filing process for your employees. Additionally, it offers tax planning advice and notice management for ITRs filed through the platform

- Business owners can conveniently estimate the tax statement for each employee in their organisation by bringing TaxBuddy for their taxation-related solutions

- Offers a comprehensive tax solution that helps in managing your clients through a centralised dashboard

Website: https://www.taxbuddy.com/

Quicko

Quicko, an Ahmedabad-based company established in 2015, is a comprehensive platform for filing taxes, including Income Tax, GST, and TDS. The most amazing feature of Quicko is that it’s free for individuals and businesses in India to plan, prepare, and file their ITR, GST, and TDS returns through the platform.

It has also created a separate platform called learn.quicko.com to educate and inform taxpayers regarding various important tax matters, such as Income Tax Forms, Due Dates, Penalties, and Refunds. Salaried individuals can quickly upload their Form 16, review it, and file their ITR within minutes through Quicko.

Additionally, Quicko assists stock traders in figuring out the relevant ITR forms, the applicability of tax audits, and due dates, and helps them file Tax Returns, including Profit and Loss statements and Balance Sheets. In December 2019, Quicko received seed funding of Rs 2 crore from Rainmatter, a Bengaluru-based fintech fund and incubator company.

Some of the key features of Quicko –

- Easily pay advance tax and self-assessment tax directly using UPI

- Calculate your tax liability under both the old and new tax regimes

- Speedy and easy onboarding, with the ability to pre-fill your ITR, import investments, and instantly e-file your taxes

- Visualise Tax Profit and Loss, compare different tax regimes, identify tax-saving opportunities, and calculate and pay advance tax

- Calculates Profit and Loss for all trades carried out within a specific period, grouped by scrips

- Pre-fill incomes, tax credits, and bank accounts to maximise deductions, e-file instantly, and monitor your refund

Website: https://quicko.com/

All India ITR

All India ITR boasts of delivering exceptional and affordable online tax return filing services for individuals and businesses. All India ITR’s core belief revolves around utilising technology to achieve accuracy and excellence, which is reflected in the services they offer.

The company’s goal is to dispel the most common misconception that the tax return filing process is time-consuming and complex. It tries to let the taxpayers know that filing is a mandatory process, but simplified with the All India ITR.

To streamline the tax return filing process, this platform has developed an advanced filing system that excels in simplicity and user-friendliness. The platform assures minimising the time required to file Income Tax Returns while maximising potential refunds.

Whether you have filed Form 16 or not, the All India ITR platform allows you to file your tax return effortlessly. As an authorised e-return intermediary, they guarantee the authenticity of the services offered. Moreover, All India ITR services cater not only to individual taxpayers but also to business owners.

This platform’s automated system is built to handle all calculations through an advanced income tax calculator, ensuring 100% data accuracy. All India ITR boasts of offering a seamless, accurate, and speedy process for filing income tax returns, challenging the traditional methods of ITR filing.

Highly trained professionals associated with the company are dedicated to providing you with the correct e-filing guidelines and a smooth filing experience. Additionally, the services extend beyond the ITR filing process, such as assistance with taxation guidelines prescribed in the Indian Taxation Laws.

List of some important features of All India ITR –

- Easily file your Income tax return through the All India ITR application and eliminate the unnecessary hassle

- Track the status of your refunds within minutes

- All India ITR easily calculate income tax

- Generate a Rent Receipt along with the lease agreement and the Landlord’s PAN Card details

- With All India ITR, calculate your House Rent Allowance (HRA) accurately if you are a salaried individual or employee eligible for rent deductions under the applicable slab

Website: https://www.allindiaitr.com/

MyITreturn

MyITreturn portal is the trusted e-return gateway that has been registered with the Income Tax Department, Government of India. The same would assist people in providing their Indian income tax filings and would get acknowledged by the income tax department as an established service provider. MeitY, the Government of India, has also provided the AatmaNirbhar Award to the firm.

The website has chosen the Q&A method in order to facilitate the tax filing for the customers, which ensures the inclusion of all important details. The backend staff and the machine learning algorithm also work together to ensure the accuracy of the output. These steps are taken to streamline the tax filing process and increase the amount of prospective tax refunds.

MyITreturn, which now has 29,41,846 users, simplifies the tax filing process by guaranteeing accuracy and providing individualised tax-saving advice and support from professionals. It offers a comprehensive strategy for a range of income tax-related needs.

Key features of the MyITreturn portal-

- Import data options from the income tax and recheck the precision

- With a few taps, quickly upload PDF Form 16 and E-file

- Upload your Investments and Tax Documents

- For confident filing, the option to choose the expert review

- Upload the Income-tax notice obtained via the Department

- Answer the simple questions and ensure the maximum refunds

Website: https://myitreturn.com/

FAQs on Income Tax Return Software India

Q.1 – How Is It Safe to Use Tax Return Filing Software?

Yes, it is easy and safe to use. Although it is fit for the users to recognize a few factors such as feedback of the company, security features offered, and so on before selecting a tax return filing software to avail. Users should also recognize paid software that offers more security characteristics.

Q.2 – What is the Procedure to Pay a Tax Return?

Following are the steps to pay tax returns under tax return filing software:

- Fix and collect all essential documents needed such as PAN card, bank statement, etc.

- Download and install one of the above-mentioned online tax software.

- Open the tax software & sign up or log in with the user name or password.

- Move your cursor to the ITR section & start filing your return of income tax.

- Fill in the basic details and select the next option.

- Enter your information about income for the FY & select the next option.

- Put other details of expenses and deductions.

- Enter advanced paid tax details in case relevant and then go to the end section.

- Review your ITR & file it if all the information are correct.

- Take a printout of acknowledgment in terms of the need for reference.

Q.3 – Which Factors Should You Determine While Choosing an Online Tax software?

You should go for the following factors while choosing an Online Tax return filing software;

- Easy to manage and set up.

- License Cost if applicable

- Customer support Quality

- The price includes training employees on the tax filing software

- Feedbacks of the company

- Security specialties offered

- Several payment integration options.

- Specialties and functionalities offered

Q.4 – From Where Should I Purchase & Compare ITR Filing Software?

There are many income tax returns preparation software applications that are remarkably easy to use. You can work it on your own with the directions given, either you also take the help of free trial sessions to be easier with this software.

Q.5 – Which is the Best ITR Filing Software in India for CA and Professionals?

Generally, a chartered accountant leans on these income tax software solutions for ITR preparations like Government software, Gen IT Software, Clear Tax, Winman, Saral Tax, Tax Raahi, etc.

Q.6 – How Far Do Chartered Accountants Work on Income Tax Software?

This income tax software is specially designed for chartered accountants to enhance their accurate financial calculations and mark their track for ITR, Returns filing

Q.7 -How Does Income Tax Software Work?

There are many income tax returns preparation software applications that are remarkably easy to use. You can work it on your own with the directions given, either you also take the help of free trial sessions to be easier with this software.

Q.8 – Which Income Tax Filing Software is Known as the Best?

There is multiple income tax filing software that can be included in the best category. Eventually, it all relies on the requirement. So, all you have to find the software that fulfills all your needs. There are multiple free as well as free income tax software available online. The top all-in-one software for income tax is Gen Income Tax software, Clear Tax, Winman, Tax Raahi, Saral Tax.

Q.9 – Which is Free Open Source Tax Management Software?

The best income tax software in India totally relies on the needs and demand. Sometimes what is best for you will possibly not be best for another one. This is why you need to be very sure about the characteristics you need in your tax return software. There are several paid and free tax software available in the market. Besides the best free CA return filing software, there are multiple advanced tax solutions that are accessible to handle your taxes.