The Bangalore Bench of Income Tax Appellate Tribunal ( ITAT ) remitted the case to the Assessing Officer ( AO ) for reassessment discovering that the Commissioner of Income Tax (Appeals) had sent notices to an inaccurate email address.

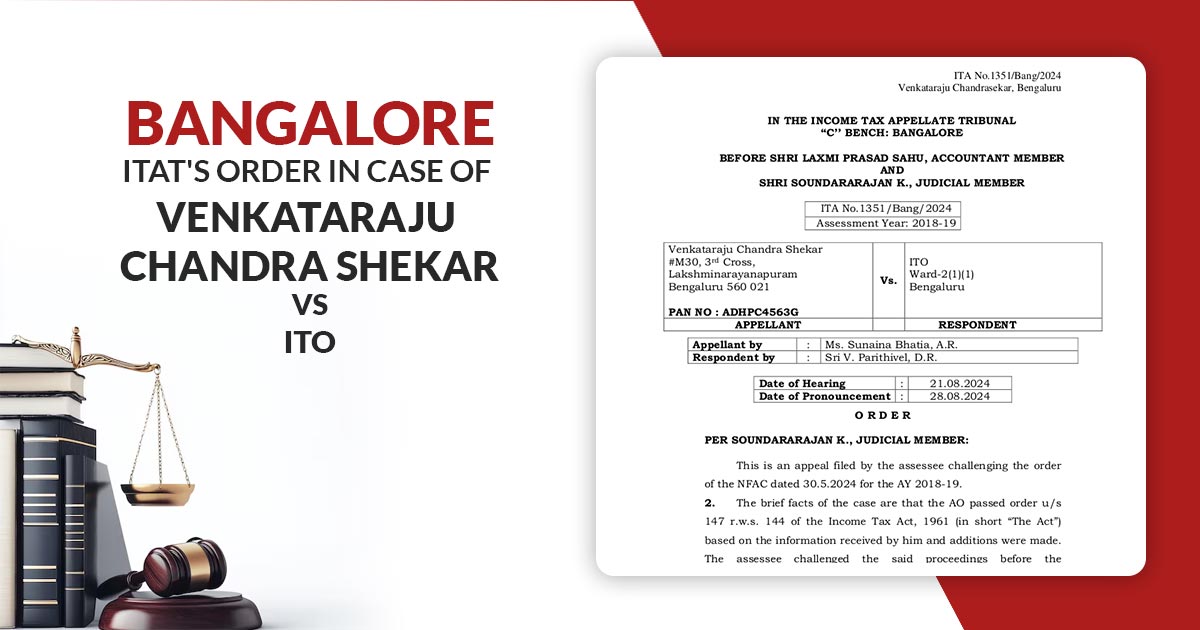

The appellant-assessee, Venkataraju Chandra Shekar, had filed an appeal contesting the order for the Assessment Year (AY)2018-19 on 30.5.2024 passed by the National Faceless Assessment Centre ( NFAC ).

AO issued an assessment order u/s 147 and 144 of the Act, making specific additions. The taxpayer has furnished a plea to the CIT(A) and argued that the order contending the additions were wrong. The plea has been dismissed by the CIT(A) as of the taxpayer’s non-appearance despite numerous notices.

The CIT(A) ex-parte order has been contested by the taxpayer contending it was not fair since it was issued without a proper chance to get heard. They disputed the Rs 1,21,50,000 addition as short-term capital gains claiming that it must be a long term and is qualified for deductions. They indeed argued that Rs 1,35,00,000 addition u/s 69, asserting it shows the sale consideration instead of an investment.

On hearing both sides of the tribunal it was discovered that the notices were sent before the csbasath2004@gmail.com rather than the correct email address, vcs201269@gmail.com, which was listed in the profile of the taxpayer. This error proved the taxpayer’s non-appearance before the CIT(A).

Read Also: Ahmedabad ITAT: AO Failed to Specify Tax Penalty u/s 274 and 271(1)(c)

The bench remarked that the order of the AO was ex-parte. The taxpayer elaborated that they did not obtain the notices as they did not know the technology and only viewed the assessment order when their Authoritative Representative ( AR ) logged into the e-filing portal.

The two-member bench Soundararajan K ( Judicial Member ) and Laxmi Prasad Sahu (Accountant Member) set aside both the assessment and appeal orders, remitting the case to the AO for a fresh review and hearing, and partly permitted the appeal.

| Case Title | Venkataraju Chandra Shekar Vs. ITO Ward-2(1)(1) |

| Citation | ITA No.1351/Bang/2024 |

| Date | 28.08.2024 |

| Appellant by | Ms. Sunaina Bhatia, A.R. |

| Respondent by | Sri V. Parithivel, D.R. |

| Bangalore ITAT | Read Order |