The Income Tax Appellate Tribunal (ITAT) of Bangalore in its judgment addressed the problem of whether the payments made via Herbalife International India Pvt. Ltd. to its associated enterprise (AE) abroad are authorized as “Fees for Technical Services” (FTS) under Indian tax laws and the India-USA Double Taxation Avoidance Agreement (DTAA).

The case, Herbalife International India Pvt. Ltd. Vs. DCIT (International Taxation), emphasizes the difficulties of international taxation, specifically concerning cross-border transactions and technical services.

Case of

Herbalife International India Pvt. Ltd., a subsidiary of the global Herbalife group, manufactures and supplies nutritional products. For the assessment year 2013-14, the company’s payments to its parent company in the USA for various services, along with royalties and technical services, came under scrutiny. U/S 201(1) of the Income Tax Act, 1961 the Assessing Officer (AO) initiated proceedings alleging that Herbalife India failed to deduct tax at source on these payments, classifying them as FTS.

CIT(A)’s Support and AO’s Findings

Herbalife India’s payments were for managerial, technical, and consultancy services, they counted beneath the norms of FTS according to section 9 of the Income Tax Act, AO claimed. Also, AO laid on Explanation 2 to Section 9(2) to conclude that the situation of services generated was in India. Therefore, the AO demanded tax and interest amounting to Rs 21,50,93,900 Under Sections 201 and 201(1A).

The decision of AO quoted that the services furnished via Herbalife USA were kept by the Commissioner of Income Tax (Appeals) [CIT(A)] they were not only administrative but contained influential advisory elements, consequently furnishing advantages to Herbalife India beyond the immediate transaction.

ITAT’s Appeal Against Herbalife India

The decision of the CIT(A) has been challenged by Herbalife India, claiming that the payments to its AE were reimbursements without any markup and did not “make available” any technical knowledge as demanded under Article 12(4)(b) of the India-USA DTAA. AO reliance has indeed been stressed by the appellant that the Shell India Markets Pvt. Ltd. case was misplaced since the Bombay High Court reversed this decision.

Analyze of ITAT Data

ITAT mentions whether Herbalife India incurred payments to its AE comprising FTS under the DTAA. To various key rulings, the tribunal has referred, along with-

- Raymond Ltd. Vs. DCIT: The tribunal emphasized that only rendering services does not entitle to “making available” technical knowledge unless the recipient can independently utilize the expertise without additional assistance from the provider.

- CIT Vs. De Beers India Minerals (P.) Ltd.: The Karnataka HC highlighted that for services to be regarded as “made available,” the recipient should be able to apply the technical knowledge independently in forthcoming endeavours.

- Tyco Fire and Security India Pvt. Ltd.: ITAT Banglore has carried out that payments for the services do not comprise FTS until the service provider delivers enduring technical skills to the receiver.

Conclusion: It was concluded by the ITAT that the AO failed to furnish proof that the technical skills were made available to Herbalife India. It was remarked that the ruling laid on via AO has been overturned weakening the matter against Herbalife India. The ITAT held in favour of Herbalife India, expressing that the payments were not entitled to FTS and therefore, were not levied to tax in India under the DTAA.

The petition of Herbalife International India Pvt. Ltd. was permitted, setting a precedent for the identical cases that engage the cross-border technical service payments and the interpretation of making them available under DTAAs.

In the case of Herbalife International India Pvt. Ltd. Vs. DCIT the Income Tax Appellate Tribunal Banglore ruling highlighted the distinction between furnishing services and making available technical skills under the DTAA. The same verdict specifies the scope of FTS and supports the norm that treaty provisions take precedence over domestic statutes when there is an emergence of conflicts.

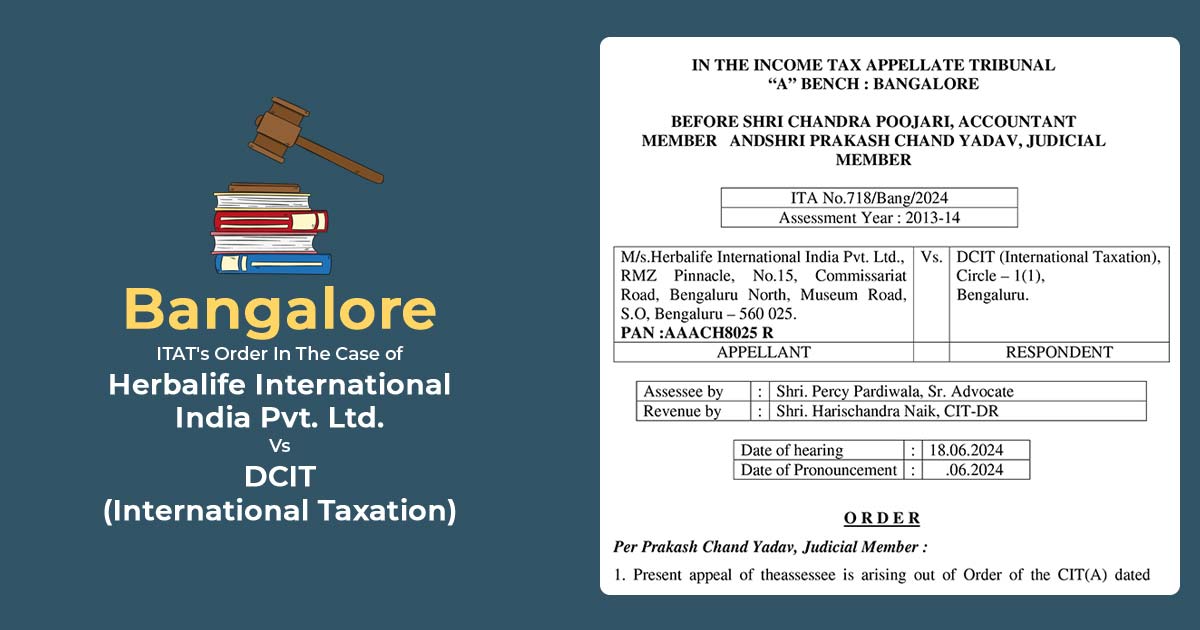

| Case Title | M/s.Herbalife International India Pvt. Ltd. V/S DCIT (International Taxation) |

| Case Number:- | ITA No.718/Bang/2024 |

| Date | 18.06.2024 |

| Counsel For Assessee by | Shri. Percy Pardiwala, Sr. Advocate |

| Counsel For Respondent | Shri. Harischandra Naik, CIT-DR |

| Bangalore ITAT | Read Order |