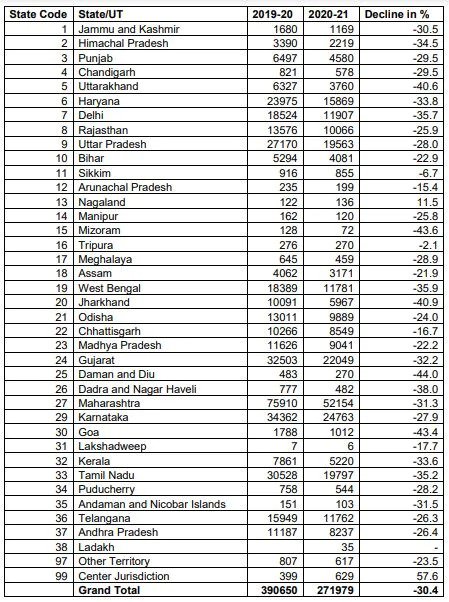

In April and August of the current year, the Goods and Service Tax GST revenue sees a sharp decline of 30.4% in comparison to the last year.

On September 14 the centre states that around Rs 2.72 lakh crore was the GST revenue between April and August 2020-21, and that was 3.90 lakh crore in the last year.

In the period the 5 states and union territories have seen a 40% decline year on year in their GST revenue. Uttarakhand GST revenue was Goa -43.4%, at -43.6%, Daman and Diu at -44.0%, Jharkhand at -40.9%, and -40.6%, Mizoram.

S.Jothimani the congress supporter has explained the reasons for the GST revenue fall some of these reasons are the decline in state wise GST revenue of states and state-wise details of amounts disbursed as compensation of GST till date.

The Finance Ministry announced the budgeted measures for GST revenue in FY21. “were projected on the basis of an assumption of higher growth of GDP; however as per CSO, MoS&PI press release [on August 31, 2020], the Nominal GDP for Q1 (April-June), 2020-21 shows a contraction of 22.6 percent which is one of the major reason for a revenue shortfall in GST”.

More reason for the lower collection of GST is lockdown and related restrictions taken since march between the coronavirus, late fee, extending GST return filing

In between the Covid-19 Pandemic, an 18-day monsoon session of parliament has started today. Both the 2 houses are conducting shifts in time. Expecting on 1st day the Rajya Sabha will start in morning shift from 9 am to 1 pm whereas the Lok Sabha shift from 3 pm to 7 pm.