ARN is an acronym of Application Reference Number (ARN) which is created at the time of submitting an enrollment application that is signed electronically or Digital Signature (DSC) at GSTN Portal. Under this, a unique number is provided for doing any transaction at GST System Portal. It must be noted that ARN can also be used in the future course of GST.

After submitting the enrollment application successfully at the GST System Portal, an ARN number will be created automatically. In Fact, you also can use ARN for tracking the position of your enrollment application. ARN will help existing taxpayers to migrate into new Goods and Service Tax (GST). GST portal is the official portal created by the government authorities which will help to do all activities of GST online. ARN number is basically used for checking GST registration status online.

Compulsory Documents required for Application Reference Number (ARN):-

- Directors or partners list along with their identification and address proof. It is necessary to mention that you are doing business in the partnership or incorporation

- Memorandum of Association (MOA)/ Articles of Association (AOA), Certificate of incorporation, partnership deed

- PAN Card of Business Organization

- Cancelled cheque of bank account in which mentioned account holder name, IFSC code, MICR and branch details of bank

- Rent agreement or electricity bill as a feature and document of area of business

Process of GST ARN (Application Reference Number) in India

- The candidate will be required to mention PAN, E- Mail Address and Mobile Number in Part A of Form GST REG–01 at the GSTN Portal or through Facilitation centre

- The candidate will receive OTP on mentioned Mobile Number and E-mail address. After receiving OTP, PAN is verified at GSTN Portal

- After submitting the applicant successfully at GSTN portal, the candidate will be allotted Application Reference Number ARN number on the mentioned mobile number or e-mail. A confirmation message will be sent to the candidate in FORM GST REG-02 electronically

- After the confirmation message, the candidate must have to provide all the information in Part- B of Form GST REG-01 and also mentioned the application reference number

How to Check Application Status by ARN Number:

Once a taxpayer has applied for GST registration, they will be able to keep track of their registration on the government’s official GST portal. The Application Reference Number (ARN) or submission period can be furnished on the official portal to track their GST registration.

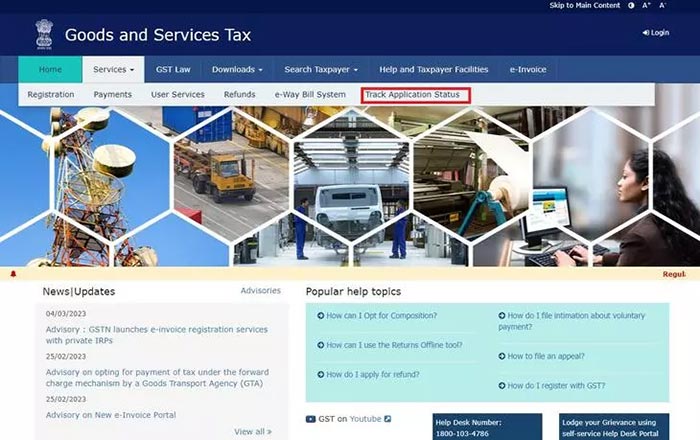

Step 1: Go to the link- https://services.gst.gov.in/services/arnstatus

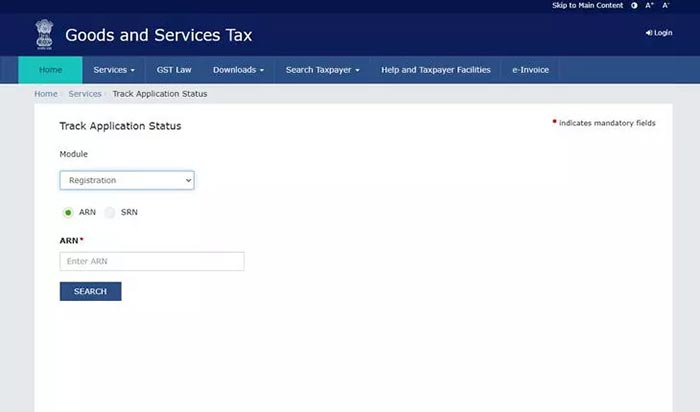

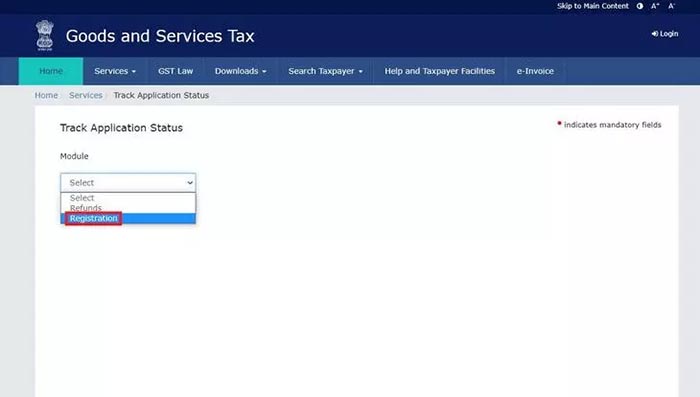

Step 2: Select the Module list form registration form and enter the ARN number

Step 3: Enter the Captcha shown in the box

Step 4: Click on the search tab

Step 5: You will be shown the status of the application