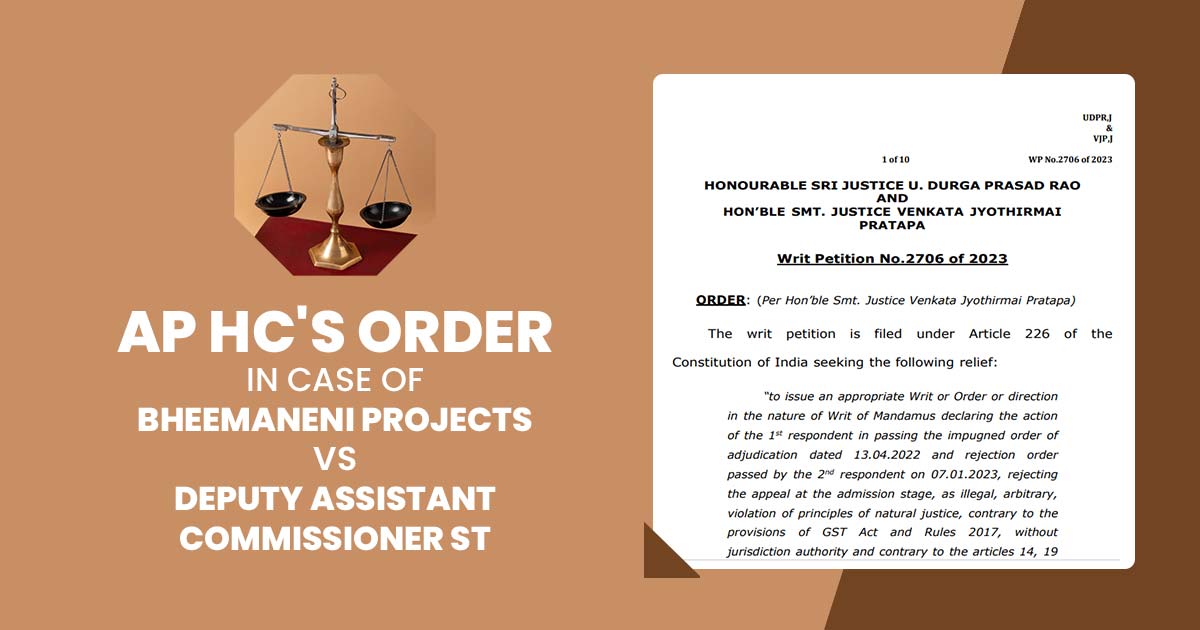

The petitioner in the matter of Bheemaneni Projects v. Deputy Assistant Commissioner ST III, heard by the Andhra Pradesh High Court under Article 226 of the Constitution of India, asked for relief against the rejection of their appeal contesting an adjudication order and subsequent rejection by the 2nd respondent.

The applicant, a firm headed by a 72-year-old woman, involved in works contracts and additional services, contended that they had not learned about the adjudication order due to their accountant’s absence driven by a Covid-related illness.

As per the applicant even after the genuine issues in filing a timely petition, it was dismissed by the 2nd respondent as being beyond the condonable duration.

The dispute engaged a substantial amount of Rs. 6,54,67,099 in taxes. Section 107 of the GST Act, has been analyzed by the HC remarking on the stated 3-month limit for filing the petitions and provisions permitting a 1-month condonable delay under specific conditions.

The medical certificate submitted by the applicant concerning the accountant’s illness, which averted timely action has been regarded by the Court. No proof was shown contesting the genuineness of this certificate.

Stressing the legal nature of the right to appeal and its limitations, the court mentioned the precedent showing the liability of the applicants to verify the claims of incapability to file within the said durations.

Lastly, under Article 226 High Court has practised its jurisdiction, permitting the writ petition. It set aside the cancellation of the appeal via the 2nd respondent and condoned the delay of 112 days in filing, conditional to the applicant depositing 20% of the disputed tax amount and costs of paying within 6 weeks.

The very decision enabled the applicant to move with their petition and ordered the 2nd respondent to expedite the adjudication process within the applicable laws.

| Case Title | Bheemaneni Projects Vs Deputy Assistant Commissioner ST |

| Order No | Writ Petition No.2706 of 2023 |

| AP High Court | Read Order |