The council is not estopped from availing a measure against the bogus claim of the ITC only because the firms with which the transactions were alleged to have proceeded were enrolled during alleged transactions, Allahabad HC ruled.

Justice Subhash Vidyarthi noted that fraud vitiates the most solemn proceedings and ruled that the I.T.C. benefit had earlier been granted to the applicant only due to the firms were registered, would not make any estoppel against the authority taking relevant action for claiming refund of the benefit availed by the petitioner incorrectly on the ground of receiving inward supplies from non-existent firms.

Section 16 of the Goods and Service Tax Act provides conditions for taxpayers to claim the input tax credit. Section 16(2)(b) furnishes that no person is qualified for ITC unless he has obtained the goods or services or both. Rule 36 of Goods and Service Tax Rules enlists the documents and further conditions to avail ITC.

As per the court, Receiving the goods means the person availing the ITC should actually receive the goods.

The Court, Input tax credit cannot be claimed only on the foundation of the production of documents listed in Rule 36 of GST Rules when the taxpayer has not actually received any goods. If it is cited that the transaction was only for a paper transaction, the Court ruled that these taxpayers shall be disentitled to receive the benefit of input tax credit u/s 16(2)(b) of the GST Act.

An Overview of the Facts

The applicant furnished GSTR 3B for May 2019, August 2019, and December 2019. A survey was conducted on 25.02.2020, by the Deputy Commissioner, Special Investigation Branch, Commercial Tax, Lucknow on the petitioner’s business premises where it was revealed that the applicant claimed to have received certain inward supplies on which it had claimed ITC.

Subsequently, a survey of the firms from which the ITC is cited to have been availed was not discovered and is fake. As per that the Special Investigation Branch witnessed that the applicant has claimed a Rs 15,93,491/- ITC in breach of law based on fake invoices.

Under Section 74 of the Act in proceedings, the applicant furnished the invoices, copies of GR (goods receipts), e-way bill, ledger and bank statements of the firms, proof of transaction of amounts through RTGS, proof of physical receipts of goods and stock register where inward supplies obtained via the petitioner were recorded.

Based on the SIB report the explanation of the applicant was refused and it was carried out that without actual supply of goods, the tax invoices have been raised. As per that the ITC advantage was refused for the applicant and the penalty accompanying the interest was levied on him.

A petition was filed via the applicant and was indeed rejected carrying that the taxpayer had adjusted in the produced bilties. It was seen that the firms with which the transactions were alleged did not actually transport the goods and were bogus.

The petitioner’s counsel furnished that during transactions the firms in question have valid GSTIN registration and the same was not learned to the applicant that his registrations were subsequently cancelled.

Laying on Section 16 of the Allahabad HC GST Act and Rule 36 of GST Rules, it was claimed that the taxpayer merely had to have tax invoices or debit notes issued by the supplier, receipt of goods, and actual payment of tax to the Government for claiming the ITC.

Verdict of the High Court

Established on the fulfilment of needs u/s 16, the court noted that the applicant was granted GST ITC benefit. As per the court, it carried that post investigation of the firms were subsequently discovered to be non-existent, bogus, and only existing on paper.

The court, as the registration was received, by the firms in question, in the name of non-existent firms, no supply is to be made to such firms.

It cannot be said that the department is mandated to give I.T.C. benefit to the applicant just due to the reason that the firm was registered on the date of the transaction, even though it has been revealed later on the firm was non-existent and it could not have made any actual supplies.

Important: New Complexities While Claiming GST ITC for Businesses

The court carried that to claim the benefit of input tax credit amounts to fraud against the department and public exchequer through the inward supplies received from non-existent.

To support the order passed through the Adjudicating Authority levying the penalty on the petitioner there was enough material in the SIB report, the court held. Subsequently, the writ petition was dismissed.

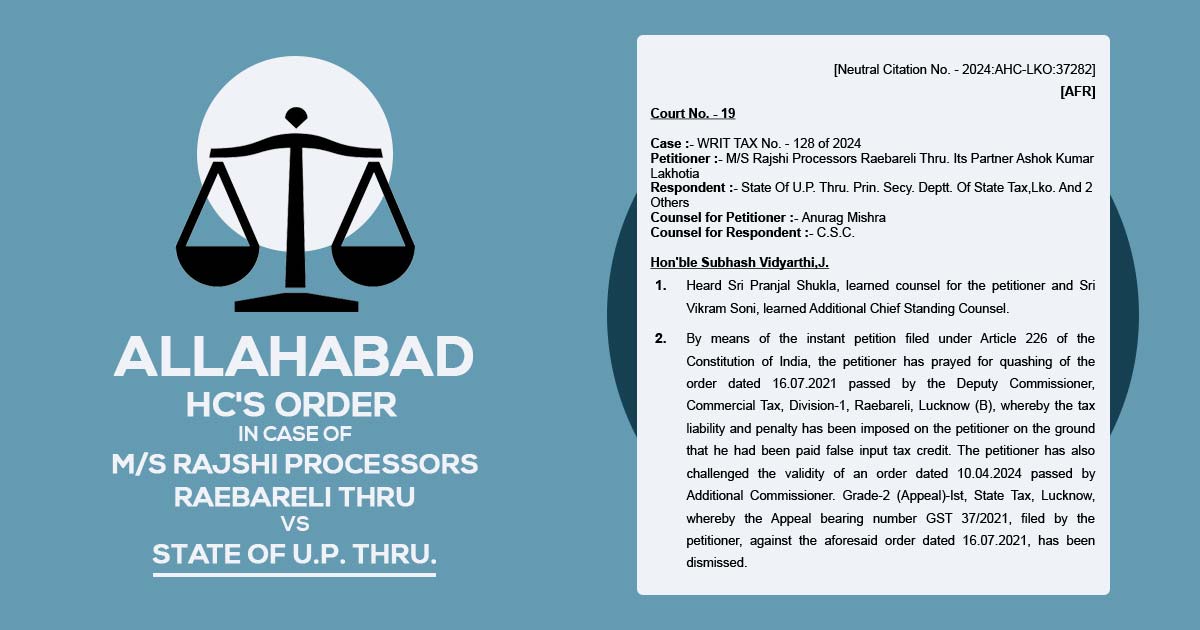

| Case Title | M/S Rajshi Processors Raebareli Thru vs State Of U.P. Thru. |

| Case No.: | WRIT TAX No. – 128 of 2024 |

| Date | 14.05.2024 |

| Counsel For Petitioner | Anurag Mishra |

| Counsel For Respondent | C.S.C. |

| Allahabad High Court | Read Order |