The Lucknow Bench of the Allahabad High Court has quashed a GST demand order that exceeded the scope of the original show cause notice, which cited a breach of Section 75(7) of the CGST Act, 2017.

It was discovered by the court that the final demand of Rs 3.04 crore was more than Rs 2.10 crore shown in the SCN, rendering the order unsustainable.

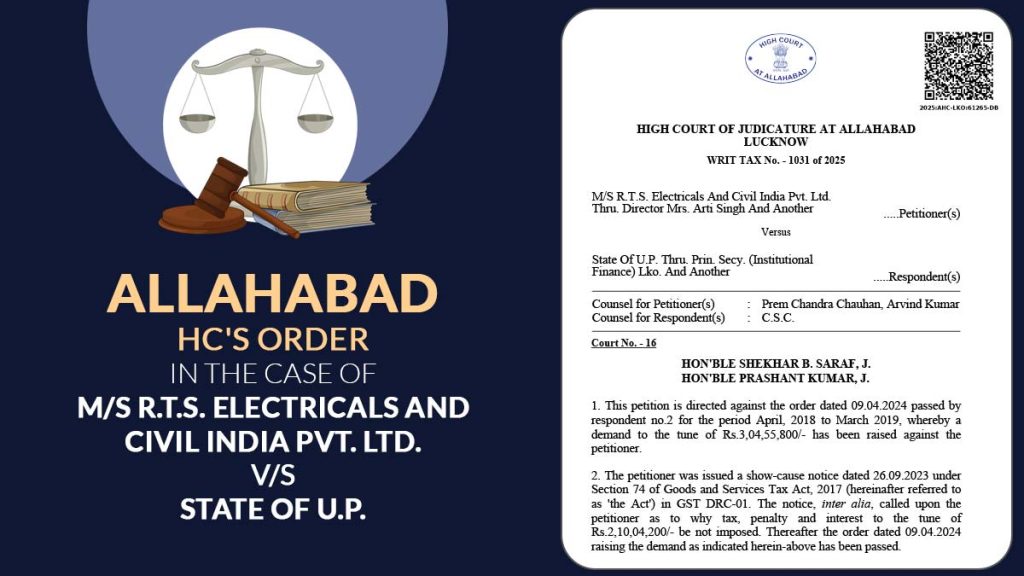

The applicant R.T.S. Electricals and Civil India Pvt. Ltd had been given a show cause notice, u/s 74 of the CGST Act via GST DRC-01, proposing recovery of ₹2.10 crore in tax, interest, and penalty.

The final order dated April 9, 2024, increased the demand to ₹3.04 crore, along with a penalty of ₹1.05 crore and interest of ₹94.51 lakh, figures that were not specified in the original notice.

Applicant’s counsel said that the demand breached Section 75(7), which restricts confirming any tax, interest, or penalty beyond what is articulated in the show cause notice.

They mentioned that the rise in the obligation without prior notice does not give the applicant a fair chance to reply.

The counsel of the state countered the petition, citing that the interest and penalty are regulatory elements and could be charged irrespective of whether they are specified in the notice.

They maintained that the authority acted under its legal powers and that the petition must be dismissed.

The division bench, including Justice Shekhar B. Saraf and Justice Prashant Kumar, does not agree. The court, referring to the language of Section 75(7), stressed that any final demand should comply with the amounts and grounds established in the show cause notice.

Read Also: Allahabad High Court: GST Orders U/S 75(6) Must Be Self-Contained, Not Just Refer SCNs

It held that the impugned order breaches this provision and could not be sustained.

Subsequently, the court quashed the order and remanded the case to the adjudicating authority. The applicant was allotted a chance to submit a fresh reply to the original SCN, and the authority was asked to pass a new order post furnishing a proper hearing.

| Case Title | M/S R.T.S. Electricals And Civil India Pvt. Ltd vs State Of U.P. |

| Case No. | WRIT TAX No. – 1031 of 2025 |

| For Petitioner | Prem Chandra Chauhan, Arvind Kumar |

| For Respondent | C.S.C. |

| Allahabad High Court | Read Order |