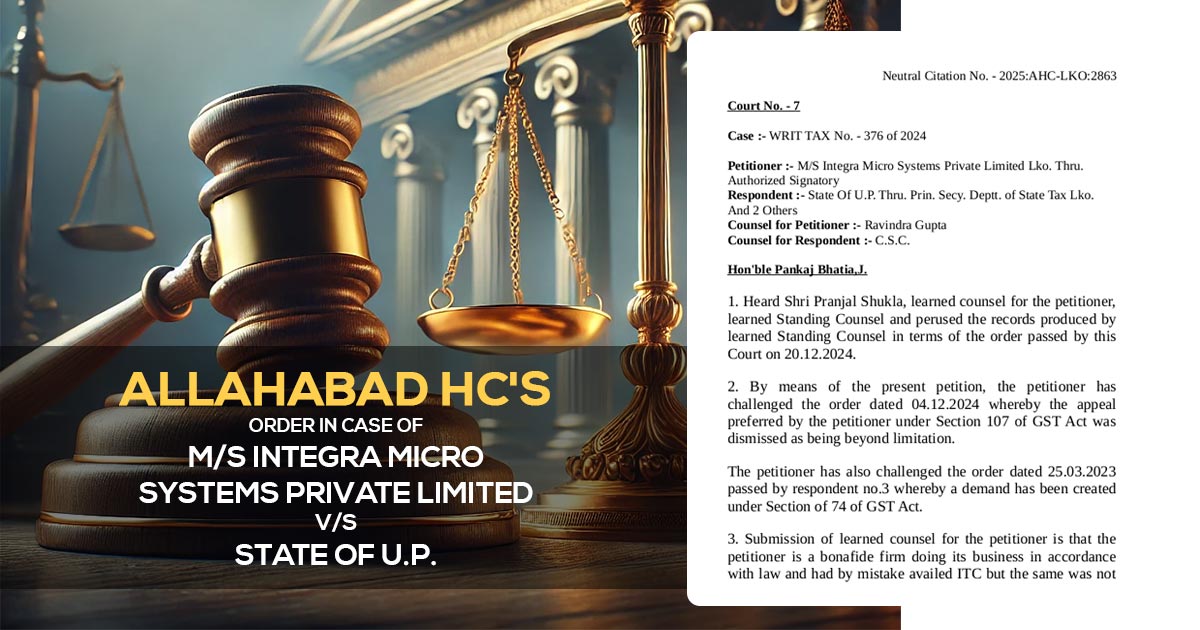

Allahabad High Court, in Integra Micro Systems Private Limited vs. State of U.P., ruled in the taxpayer’s favour setting aside a GST demand order because of the procedural lapses. The case comprises a tax demand of Rs. 2.11 crore u/s 74 of the GST act emerging from an alleged incorrect Input tax credit (ITC) claim.

It was ruled by the applicant that the ITC was mistakenly taken but never used and has been rectified in the forthcoming returns. Even after the same a SCN was issued dated June 21, 2022, followed via a demand order dated March 25, 2023, without granting a personal hearing. The plea of the applicant was subsequently dismissed dated December 4, 2024, for being beyond the limitation period.

It was discovered by the court that the Show Cause Notices (SCN) and the reminder notice were unable to cite the date, time or venue for a personal hearing and cited just the word NA. Also, the dept considered that no hearing was granted before passing the final order.

Section 75(4) of the GST Act explicitly necessitates that an opportunity for a hearing be given before issuing an adverse order. The court relied on its previous ruling in Party Time Hospitality Prop. Punita Gupta v. State of U.P. (2023), which reaffirmed the mandatory nature of personal hearings under GST law.

The court, stressing the breach of principles of natural justice, ruled that the demand order was legally unsustainable. The appellate order dismissing the appeal on limitation grounds was also quashed as the original order suffered from procedural defects. It was carried out by the court that the taxpayer should be provided with a proper opportunity to present their case before any tax obligation is charged.

Read Also: How to Effortlessly Check Validity of GST SCN & Orders

Hence the case was remanded before the assessing officer for fresh adjudication. The authorities were asked to furnish the applicant with a detailed chance to submit a response and present the claims before passing any fresh order.

The same judgement specifies the need for procedural compliance in the tax proceedings and serves as a reminder that tax authorities should comply with the legal safeguards before finalizing demands.

| Case Title | M/S Integra Micro Systems Private Limited Vs. State Of U.P. |

| Citation | WRIT TAX No. – 376 of 2024 |

| Date | 16.1.2025 |

| Counsel For Appellant | Ravindra Gupta |

| Counsel For Respondent | C.S.C. |

| Allahabad High Court | Read Order |