The Allahabad High Court in a judgment addressed the problem of levying the penalties for non-filing of Part-B of the GST E-Way Bill without proof of intention to evade tax. The case, Rs Industrial Solutions vs Additional Commissioner Grade 2, sheds light on the interpretation of tax laws and penalties under the Act.

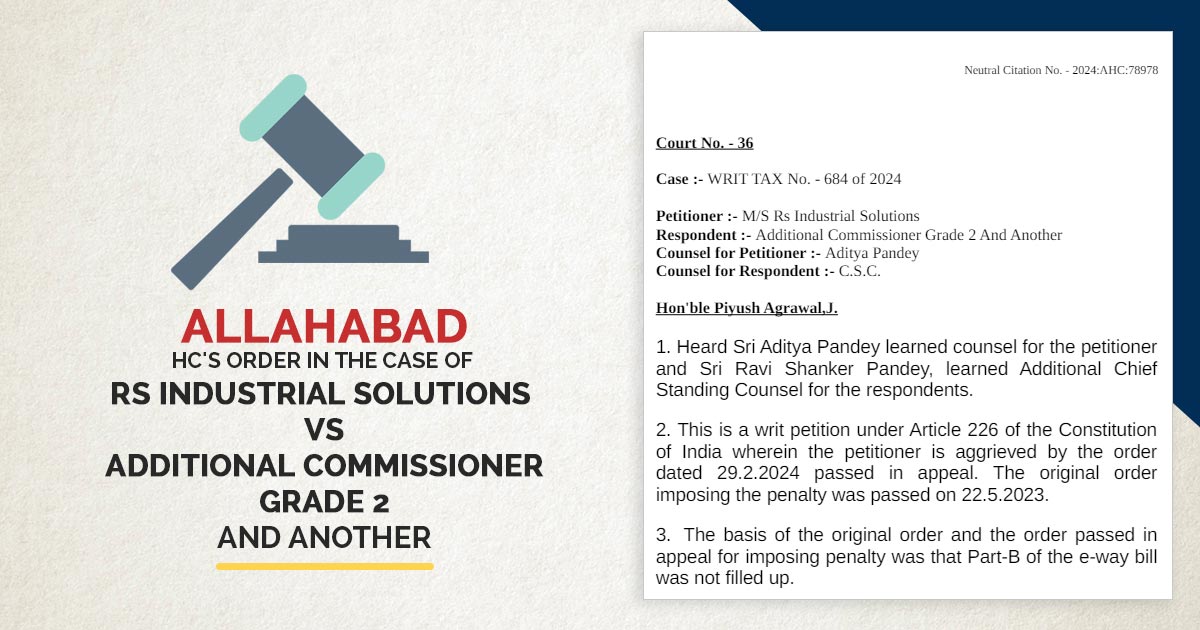

The matter before the Allahabad High Court concerned a writ petition under Article 226 of the Constitution of India. The order passed in the appeal is contested by the petitioner, which imposed a penalty for the non-filing of Part B of the E-Way Bill. On May 22, 2023, the original order levying the penalty was passed, while the appeal order was on February 29, 2024.

The major point of the case was that the failure to fill Part B of the e-way bill warranted the levying of the penalty under Section 129(3) of the Act. the counsel of the applicant claimed that an identical issue had been addressed in a former judgment on January 16, 2024, in the case of M/s Roli Enterprises vs State of U.P. and others.

It was ruled in that judgment that the non-filing of Part B of the E-Way Bill, lacking any evidence of intention to evade tax, shall not lead to the levying of a penalty.

The related additional chief standing counsel for the respondents does not dispute the same particular. The court on acknowledgement of the particular and the precedent set via the previous judgment revealed no cause to opt for a distinct opinion in the current matter. The e-way bill error was considered to be technical and no proof was there to recommend an intention to evade tax.

The Allahabad High Court quashed and set aside the order that levies the penalties permitting the writ petition furnished via Rs Industrial Solutions. The court stresses that the penalties must be levied just when there is proof of wrongdoing intent or tax evasion. In the same case, the error in filing Part B of the e-way bill did not warrant these punitive actions.

Closure

The judgment for the matter of Rs Industrial Solutions vs Additional Commissioner Grade 2 acts as a critical precedent in interpreting tax laws correlated to E-Way Bills and penalties.

Important: Rajasthan HC: Imposing Heavy Penalties for E-way Bill Expired by Only 44 Minutes is Unjustified

It emphasizes the principle that penalties must not be charged arbitrarily, significantly in cases where no evidence of intentional tax evasion is there. The ruling furnishes transparency on the interpretation of Section 129(3) of the Act and reaffirms the significance of regarding the purpose behind technical errors in tax compliance.

| Case Title | RS Industrial Solutions Vs Additional Commissioner Grade 2 and Another |

| Case No.:- | WRIT TAX No. – 684 of 2024 |

| Date | 02.05.2024 |

| Counsel For Petitioner | Aditya Pandey |

| Counsel For Respondent | C.S.C. |

| Allahabad High Court | Read Order |