The Allahabad High Court, relying on the Supreme Court’s decisions in Vaibhav Goyal & Another vs. Deputy Commissioner of Income Tax & Another, ruled that the claims of the Goods and Services Tax Department are restricted after the approval of the resolution plan by the National Company Law Tribunal (NCLT).

In the case of Vaibhav Goyal & Another Vs. Deputy Commissioner of Income Tax & Another, the Supreme Court ruled that if statutory dues owed to the government are not included in the Resolution Plan at the time it is approved, those dues will be extinguished. Reviving such claims after the approval of the Resolution Plan would hinder the corporate debtor’s ability to restart its business effectively.

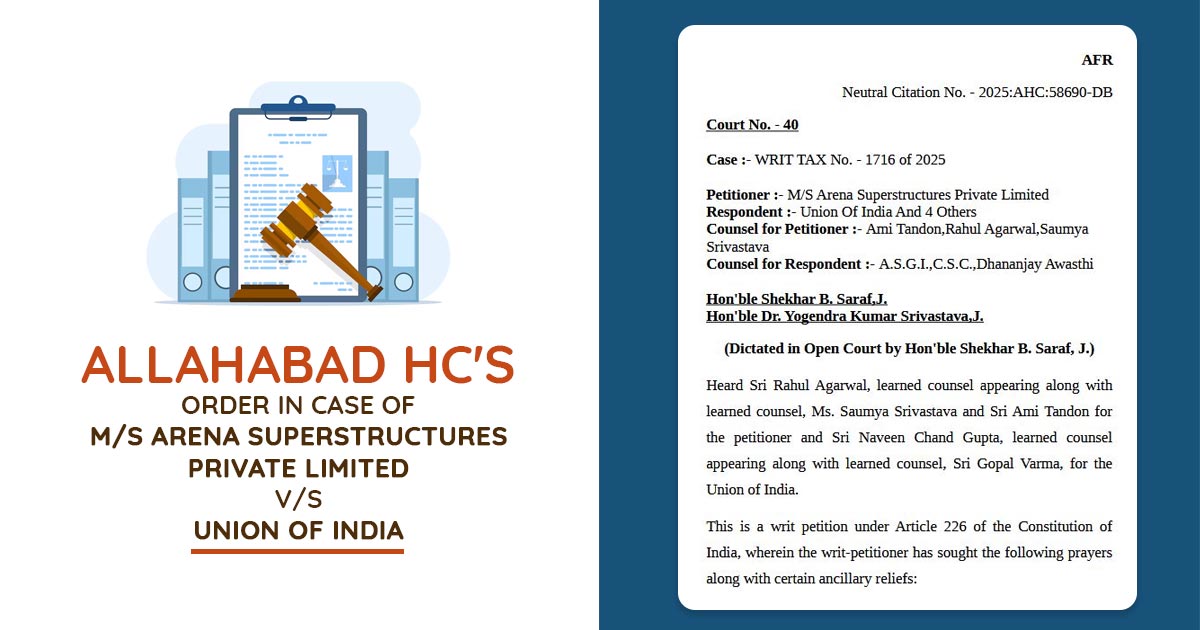

The bench of Justice Shekhar B. Saraf and Justice Dr. Yogendra Kumar Srivastava ruled that,

“In view of the above law laid down by the Supreme Court, we are of the view that the principle is crystal clear that once the Resolution Plan has been approved by the NCLT, all other creditors are barred from raising their claims subsequently, as the same would disrupt the entire resolution process. The Supreme Court has categorically held the same as indicated above.”

In the Corporate Insolvency Resolution Process, the applicant was considered dated October 10, 2020, and a resolution professional was appointed. The creditors were asked to file their claims for the applicant, particular notice was sent before the GST department. The NCLT has approved the resolution plan dated 19.07.2022.

Under Section 74(9) of the Goods and Services Tax Act, 2017, for AY 2017-18 GST Department passed an order dated 4.02.2025. The applicant has approached the HC for quashing the order on 4.02.2025 and thereafter asked for the notice.

Read Also: Allahabad HC Penalises SGST Joint Commissioner Ghaziabad in GST Demand Case

The court kept its ruling in M/S NS Papers Limited and Another Vs. Union of India Through Secretary and Others, where ruled that,

“The law cannot be read in a manner wherein the basic structure of the Code is breached by hindering the flow of the same by creation of roadblocks and dams – the underlying principle of the Code is to give a fresh start to the Resolution Applicant. Any new liability being fastened after the approval of the Resolution Plan would inherently and palpably be illegal and go beyond the Lakshman Rekha of the Code.”

As per that, the court has quashed the impugned order and the forthcoming demand notice.

| Case Title | M/s Arena Superstructures Private Limited vs. Union of India |

| Case No. | Writ Tax No. – 1716 of 2025 |

| Counsel For Appellant | Ami Tandon, Rahul Agarwal, Saumya Srivastava |

| Counsel For Respondent | A.S.G.I.,C.S.C.,Dhananjay Awasthi |

| Allahabad High Court | Read Order |