Order Section 73 of the Goods and Service Tax Act, 2017 cannot be passed to a company under the Corporate Insolvency Resolution Process (CIRP) under the Insolvency and Bankruptcy Code, 2016, the Allahabad High Court ruled.

Section 73 of the Goods and Service Tax Act, 2017 designates a proper officer to start proceedings if he is pleased that any tax has not been paid or short paid or erroneously refunded, or where input tax credit has been erroneously taken or used for any reason, other than the reason of fraud or any willful-misstatement or suppression of facts to evade tax by any taxpayer.

The applicant has approached the High Court against the order passed by the respondent authority u/s 73 of the GST Act.

Read Also: Issuance of SCN Under GST Section 73(10) with Time Limits

The Court noted that under Section 73, a show cause notice was issued to the petitioner dated 10.04.2024. The petitioner, answering on 12.04.2024, informed the authority that the petitioner was under CIRP and asked the authority for time to seek instructions from the Interim Resolution Professional.

While no additional chance of hearing was granted to the petitioner, the Court marked that the insolvency process was set aside by the National Company Law Appellate Tribunal, Chennai dated 15.04.2024.

Marking that the order of the NCLAT could not be conveyed to the assessing authority in time, the bench of Justice Saumitra Dayal Singh and Justice Donadi Ramesh said that

Once the petitioner was experiencing resolution before the Interim Resolution Professional and the fact of the IRP appointment was conveyed to the adjudicating authority, it may not have passed the impugned order at the time of the pendency of that CIRP. The umbrella of the Insolvency and Bankruptcy Code was raised only dated 15.04.2024.

Consequently, the Court set aside the order passed u/s 73 and asked the petitioner to file a fresh response to the Show Case Notice (SCN).

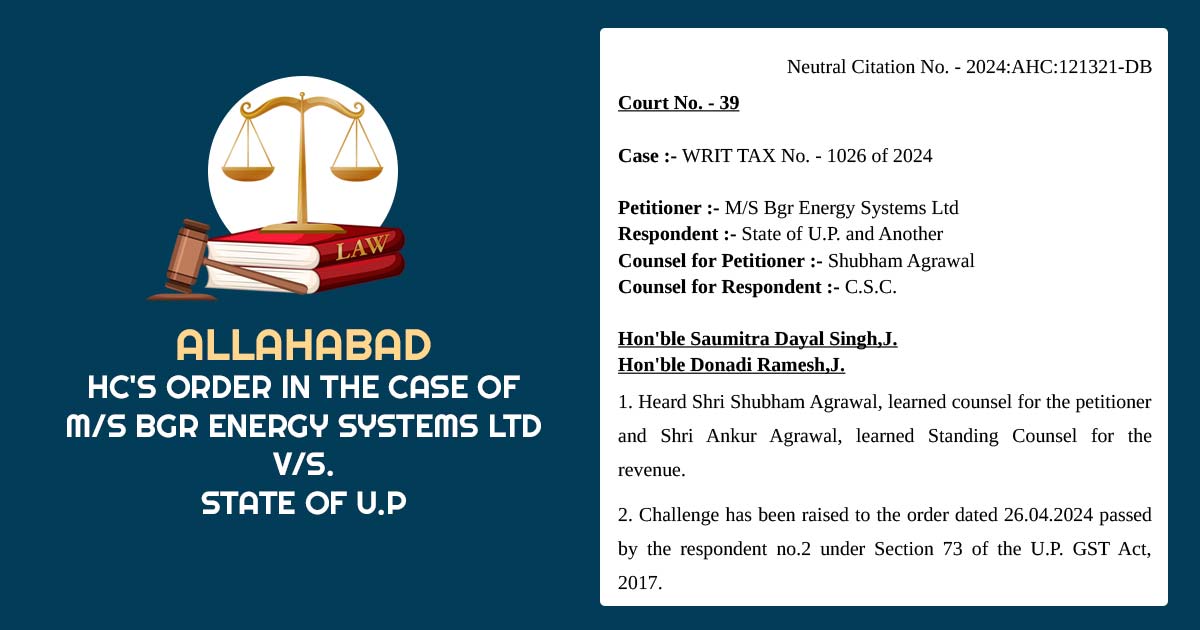

| Case Title | M/S Bgr Energy Systems Ltd V/S. State of U.P |

| Citation | WRIT TAX No. – 1026 of 2024 |

| Date | 29.07.2024 |

| Counsel For Appellant | Shubham Agrawal |

| Counsel For Respondent | C.S.C. |

| Allahabad High Court | Read Order |