The Allahabad High Court in Mohini Traders Vs State of U.P. and 2 Others, addressed writ petitions contesting the seizure of goods and the charge of penalties under the GST Act.

The applicant, a GST-registered entity, had goods in transit from Aligarh that were intercepted on January 10, 2020, at Jalalpur. Post interception, the applicant produced an e-way bill, the goods were seized dated 11th January 2020, and proceedings under section 129(3) of the GST Act were initiated.

The goods were released post-depositing tax and penalty, and the appeal of the applicant against the seizure and penalty was rejected dated 23rd February 2021.

No intent was there to evade tax, the applicant stated and relied on the Allahabad High Court’s prior decision in Axpress Logistics India Pvt. Ltd. Vs Union of India & Others [Writ Tax No. 602/2018], arguing for relief.

The State said that the GST e-way bill was generated after the interception of goods, precisely at 1:19 p.m. on 10th January 2020, and relied on the Division Bench ruling in M/s Aysha Builders & Suppliers Vs State of U.P. & Another [Writ Tax No. 2415/2024], which held that the delayed generation of e-way bills does not invalidate seizure proceedings.

The court, on analysing the record, said that the e-way bill was not produced during the interception and was generated thereafter, aligning the case with the Aysha Builders precedent.

Read Also: GST E Way Bill Preparation Guide for Transport Companies & Suppliers

The court acknowledged such facts, discovered no reason to interrupt in the impugned orders, and dismissed the writ petitions.

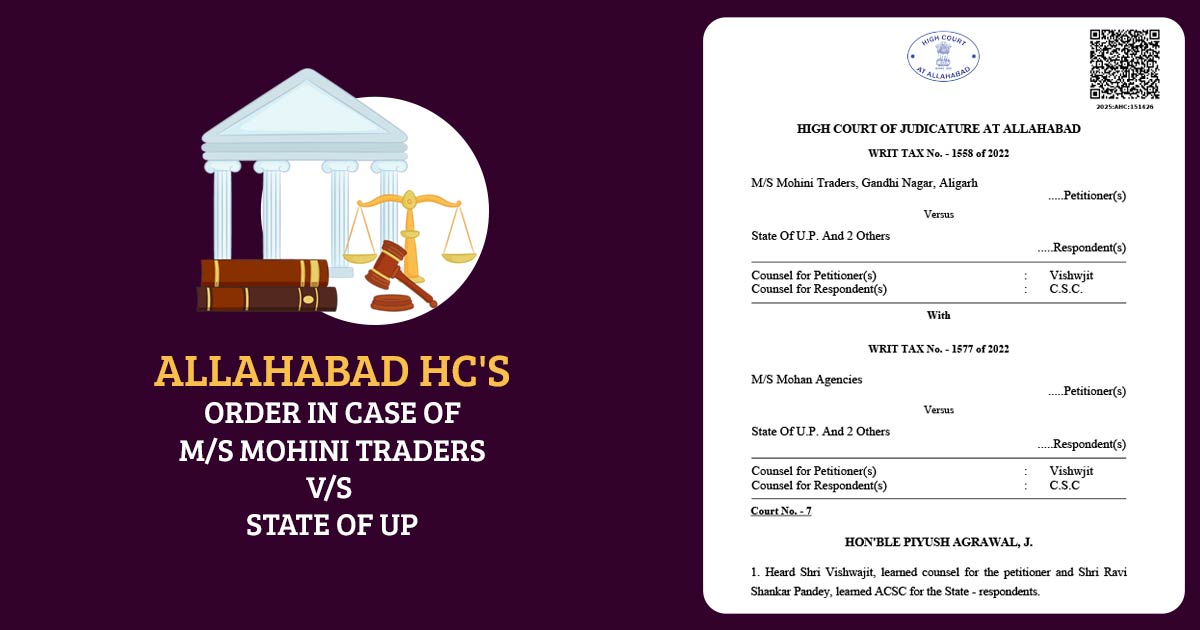

| Case Title | Mohini Traders Vs State of U.P. |

| Case No. | Writ Tax No. – 1558 of 2022 |

| For Appellant | Vishwjit |

| For Respondents | C.S.C |

| Allahabad High Court | Read Order |