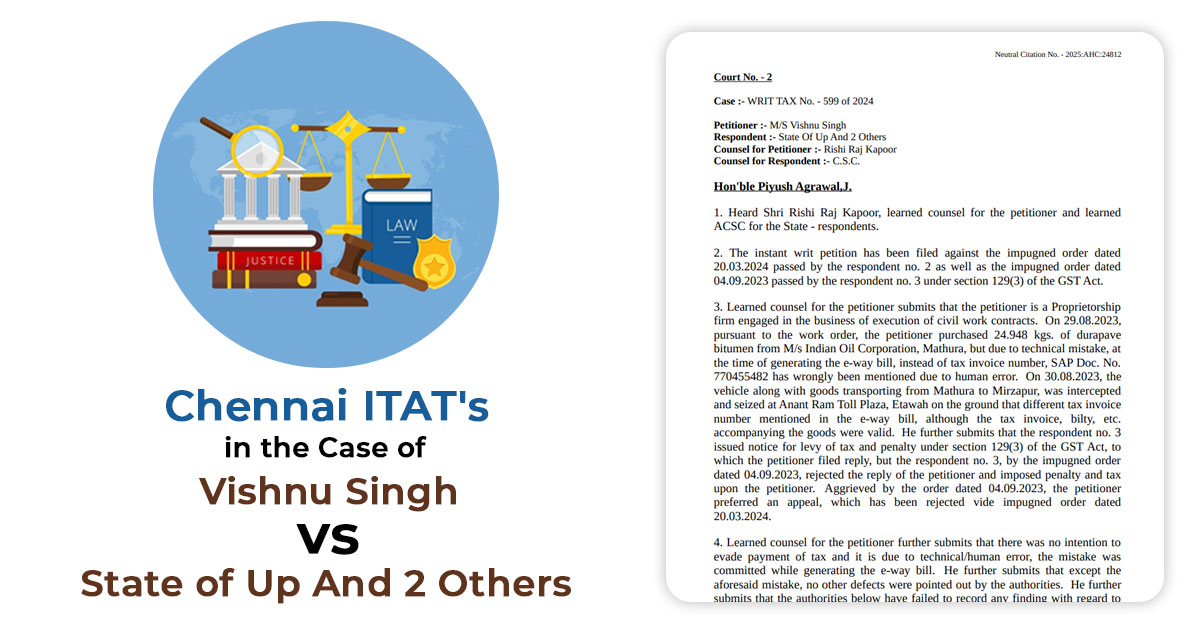

The Allahabad High Court, in the case of Vishnu Singh vs. the State of UP, held that a clerical error in a GST e-way bill does not explain the levying of penalties or the seizure of goods unless tax evasion is found.

The case comprises a proprietorship firm, which is in the civil work contracts that purchased durapave bitumen from Indian Oil Corporation.

An internal document number was mistakenly entered due to human error instead of the GST invoice number while generating the e-way bill. The authorities, even after the validity of the accompanying tax invoice and other transport documents, intercepted and seized the goods, alleging a mismatch.

U/s 129(3) of the GST Act, a notice was issued levying the tax and penalties, which were carried in the plea.

It was held by the High Court that as the e-way bill had been generated precisely and not cancelled, the genuineness of the transaction could not be questioned only based on a clerical mistake. It was outlined by the court that the objective of an e-way bill is to monitor the movement of goods, not to penalize unintentional errors.

It is noted that no differences were discovered in the nature or quantity of goods and that no intent to evade the tax was found. The court, quoting identical rulings, carried that these technical mistakes could not explain seizure or penalties.

Therefore, the impugned orders were quashed, supporting that the procedural errors in e-way bills must not automatically be directed to punitive measures until tax evasion is established.

Case Facts

In the case of Vishnu Singh Versus the State of UP, the Allahabad High Court ruled that the objective of the e-way bill is that the dept must know the movement of goods. Once the e-way bill has been generated and it has not been cancelled, the movement of goods and the genuineness of the transaction in question cannot be disputed merely based on a clerical error in the e-way bill

The petitioner is a Proprietorship firm that is in the business of execution of civil work contracts. Under the work order, the applicant of durapave bitumen from M/s Indian Oil Corporation, Mathura, but as of a technical error at the time of generating the e-way bill instead of the tax invoice number, internal document no. wrongly mentioned due to human error.

The vehicle including the goods transporting from Mathura to Mirzapur was intercepted and seized on the basis that different tax invoice numbers cited in the e-way bill although the tax invoice, Bility etc, accompanying the goods were valid, notice for levy of tax and penalty u/s 129(3) of the GST Act was issued, to which the applicant submitted a response, though the response rejected the response and tax including a levied penalty, being dissatisfied via the order on the applicant preferred a plea which has been rejected too.

Observation of the High Court

It is admitted that the goods in question were on an onward journey from Mathura to Mirzapur at the time of its interception at Etawah, and on physical verification, it was discovered that there was a mismatch in the tax invoice and e-way bill. The SAP document number was cited in the e-way bill instead of the tax invoice number, which was present in the tax invoice itself.

No other discrepancy apart from the abovementioned discrepancy has been pointed out by the authorities below. Once the authorities below have not specified any other mismatch pertinent to the quality, quantity, items of goods, etc, as revealed in the tax invoice, then the error could be a genuine human error while generating the e-way bill.

The objective of the e-way bill is that the department must know the movement of goods. Once the e-way bill has been generated, and it has not been cancelled via the applicant within the mentioned time under the act, then the movement of goods along with the genuineness of the transaction in question cannot be disputed.

Therefore, it is just on the technical basis that in the e-way bill accompanying the goods in question, the place of shipment has been incorrectly cited; therefore, the seizure or imposing of penalty could not be made.

Closure: Concerning the abovementioned facts and circumstances of the case as the law specified by the court in M/s Zhuzoor Infratech Private Limited, the order passed via the adjudicating authority u/s 129(3) of the GST Act cannot be upheld in the sights of the law. Hence, the order is quashed.

| Case Title | Vishnu Singh Vs State of Up And 2 Others |

| Citation | WRIT TAX No. – 599 of 2024 |

| Date | 20.02.2025 |

| Counsel for Petitioner | Rishi Raj Kapoor |

| Counsel for Respondent | C.S.C |

| Allahabad High Court | Read Order |