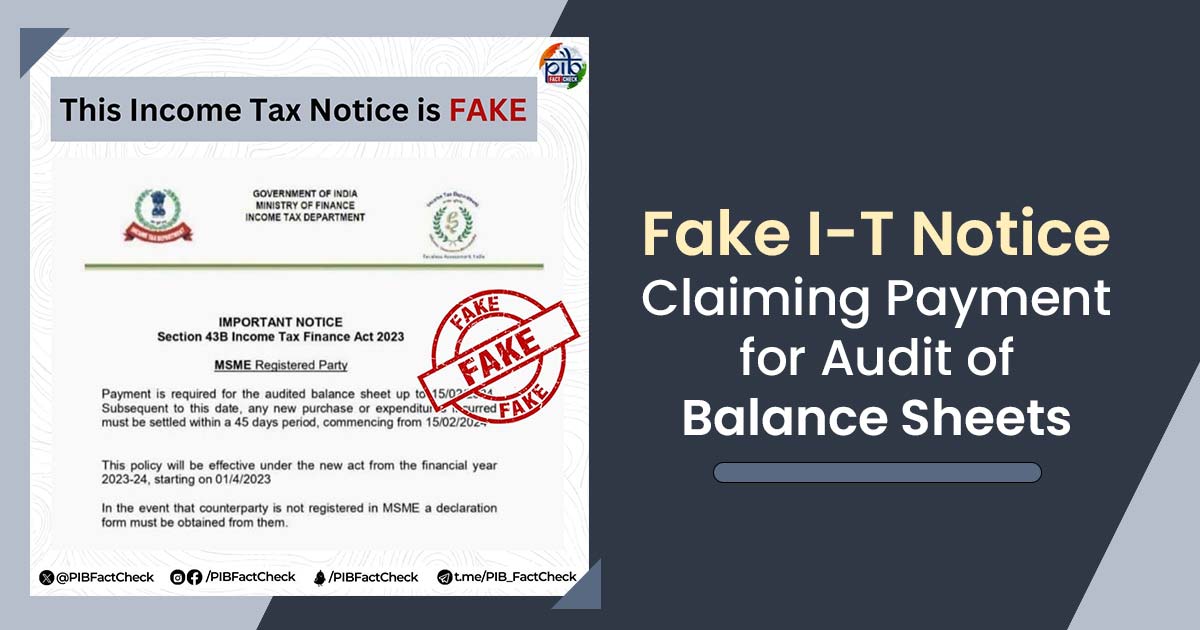

There has been an alert given by the government of India regarding a counterfeit income tax notice that has been circulating from the online process. The tax notice, allegedly from the Income Tax Department, asks for payments for audited balance sheets through February 15, 2024.

This notice, however, has been deemed fraudulent by the govt, and there is no legitimate reason for receiving such a payment.

What is the Actual Meaning of Fake Notice?

MSME-registered businesses need to settle payments for audited balance sheets by February 15, 2024, according to this false notice. Moreover, it requires new purchases and expenditures to be cleared within 45 days of the date.

Despite appearing to be an official document of government, complete with the logos of the Ministry of Finance and I-T Department, there are multiple indications it is a counterfeit.

Read Also: Solved! How to Check Income Tax Notices Fake or Genuine?

Taxpayers are cautioned by the IT Department to authenticate suspicious tax notices via the official website of incometax.gov.in.

How to Identify the Fake Notice?

- Look for grammatical errors and typos.

- The tax notice references a non-existent section 43B of the Income Tax Act.

- Furthermore, it demands payment via unspecified channels, which deviates from the Tax Dept standard tax collection process.

What Steps Should You Take After Receiving a Fake Notice?

- Not should make any payments

- Give notice to the I-T Department

- Stay alert for other phishing scams targeting taxpayers

- The government emphasizes the importance of vigilance and urges taxpayers to verify any dubious notifications with the Income Tax Department before proceeding with any actions.