The petition of the taxpayer ruling has been permitted by the Ahmedabad Bench of Income Tax Appellate Tribunal (ITAT) which collected income could be applied to the acquisition of the fixed assets u/s 11(6) of the Income Tax Act,1961.

Gujarat Safety Council, the appellant-assessee, was a trust that led safety training programs. It filed a return for the assessment year 2014-15, exhibiting no income, and claimed an exemption of Rs. 1,18,11,274 u/s 11. An accumulation of Rs. 5,92,352 from assessment year 2008-09, which was not used within 5 years has been asked by the Assessing Officer (AO).

It was sought by the taxpayer that the same amount was spent on capital expenditures amounting to Rs 7,96,543. The same explanation has been rejected by AO and deemed the unused amount as income. It was claimed by the Senior counsel that the problem was not analyzed and asked the case be sent to the AO for the verification and precise relief.

The plea was delayed by the taxpayer by 13 days as of the National Faceless Appeal Centre (NFAC) order being sent to the spam folder. The delay was condoned with no revenue objection.

The rival submissions have been analyzed by the tribunal who remarked that the AO does not validate the claim of the taxpayer that the accumulation of 5,92,352 from A.Y. 2008-09 was utilized for capital expenditure. The AO mistakenly concluded that the capital expenditure could not be offset against the accumulation as per Section 11(2) of the Act.

It was discovered by the bench that the same finding was irregular with the provision of the act, particularly section 11(6), which permits the application of income for fixed assets without a double deduction for depreciation. From 01.04.2015 section 11(6) was introduced, it was clarificatory and applicable to the present year. Also, the claim of the taxpayer has been dismissed by the Commissioner of Income Tax (Appeals).

The appellate tribunal remanded the case to the assessing officer to verify the taxpayer’s assertion about the utilization of accumulated income for fixed assets. The AO was directed to resolve the issue after providing the assessee with a fair hearing and examining the relevant evidence.

The taxpayer was instructed to submit the necessary evidence to back up the claim. The taxpayer’s appeal has been permitted by the two-member bench including T.R Senthil Kumar (Judicial Member) and Narendra Prasad Sinha (Accountant Member).

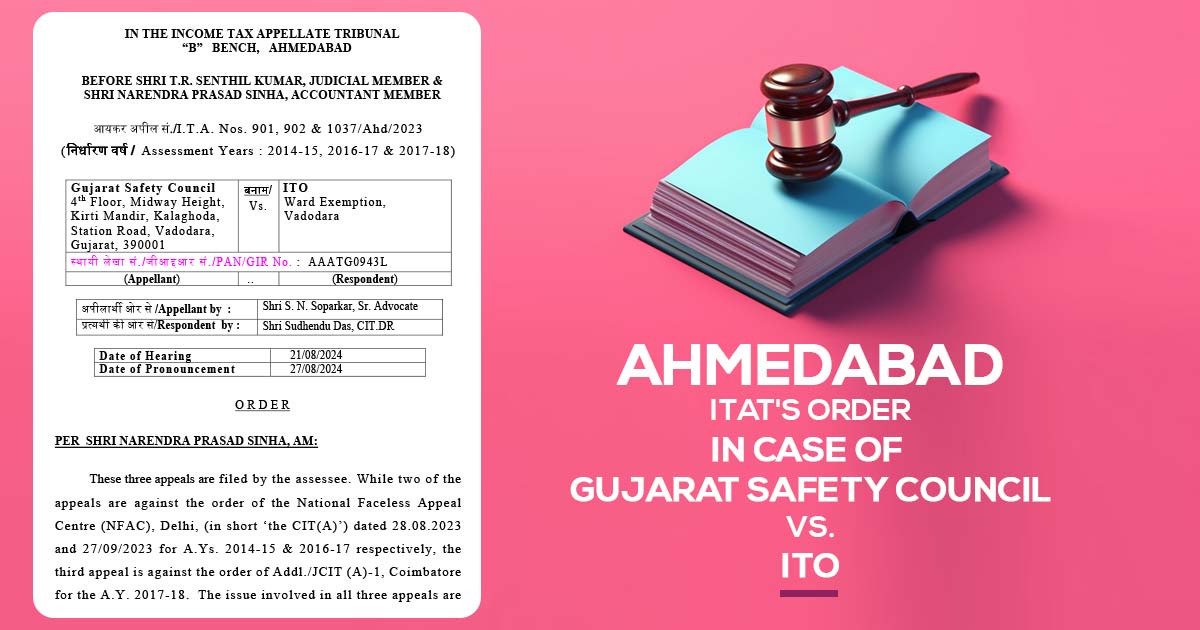

| Case Title | Gujarat Safety Council Vs. ITO |

| Citation | ITA No. 901, 902 & 1037/Ahd/2023 |

| Date | 27.08.2024 |

| Appellant By | Shri S. N. Soparkar |

| Respondent By | Shri Sudhendu Das |

| Ahmedabad ITAT | Read Order |