The Ahmedabad bench of the Customs, Excise & Service Tax Appellate Tribunal (CESTAT) in a case carried that a show cause notice asking the service tax turns invalid if the taxpayer has filed the tax obligation including the interest before Show cause notice issuance.

The officers of the audit wing Jayhind Buildcon Pvt Ltd, dated 06.08.2015 performed the audit of record carried via the appellant for the period 2010-11 to 2014-15. In their tax audit report for the fiscal year 2014-15, the appellant has declared a service tax liability of INR 42,92,189. On 01.09.2015 an inquiry was initiated by the officers of the anti-evasion wing, Rajkot, and recorded statements of the director of the appellant.

The relevant documents for the audit officers were produced before the anti-evasion wing officers. On the foundation of the same documents, the audit officers furnished the final audit report on 03.11.2015 inter alia observing the short payment of service tax of INR 43,07,981.

An SCN on 31.08.2018 asking the service tax of INR 40,65,565/-, for the same period as the audit, by invoking an extended period of limitation, was allocated. Earlier the appellant deposited the service tax of INR 40 Lakh as duty noted in the SCN and interest amounting to INR 6,34,560/- before issuance of the SCN. The adjudicating authority has validated the demand of INR 46,65,565/- and has also assessed an obligatory penalty of INR 40,65,565/- u/s 78 of the Finance Act, 1994, against which the appellant furnished an appeal before the Commissioner (Appeals) who has rejected the appeal.

On behalf of the appellant consultant Shri Vikas Mehta appeared that furnishes that not filing the service tax was based on the issues of finances and not on the grounds of any mala fide in as much as the same was not duly accounted in the final tax report, the obligation was released and service tax returns were too furnished before the SCN issuance. He based on that claimed that an easier opinion may be opted in penalty u/s 78 and it may be set aside.

Also, it furnished that as regards the invoice on 05.06.2013 issued to M/s Kalpataru Power Transmission Ltd for an amount of Rs. 9,84,270 +VAT @ 4% (Rs. 39370.80) + additional VAT @ 1%(Rs. 9,842/-) amounting to Rs. 10,33,483 on which the appellant had duly paid VAT as per the VAT form-201A as well as certificate of chartered accountant M/s Sunecha and Amlani. Consequently, the service tax demand of Rs. 1,13,687/- (Sr. No. 2 of the year 2013-14 of annexure B to the show cause notice) is not tenable.

Consequently, the net service tax liability of the appellant is Rs. 39,51,878/- (Rs. 46,65,565- Rs. 1,13,687). The appellant has deposited Rs. 40Lakh earlier for the service tax liability including interest before issuance of SCN.

Read Also: Ahmedabad CESTAT: No Excise Duty If Factory Closes Due to Unavoidable Reasons

It was discovered under the Tribunal that the appellant is arguing merely the penalty. However, there are certain discrepancies in the computation. Concerning the issued invoice by the Kalpataru it could be reconsidered by the adjudicating authority. Hence we are addressing the problem merely of the levied penalty u/s 78.

It was noted by the single bench of Ramesh Nair, Member (Judicial) that if the taxpayer files the tax obligation including interest before the SCN issuance, the whole matter gets closed and no show cause notice (SCN) is to be furnished. The case of the appellant was held to be not hit by section 73(4) as the appellant does not hold the mala fide intention.

It was discovered by the Tribunal that the appellant has been able to show reasonable cause for not filing the service tax and set aside the levied penalty u/s 78 of the act.

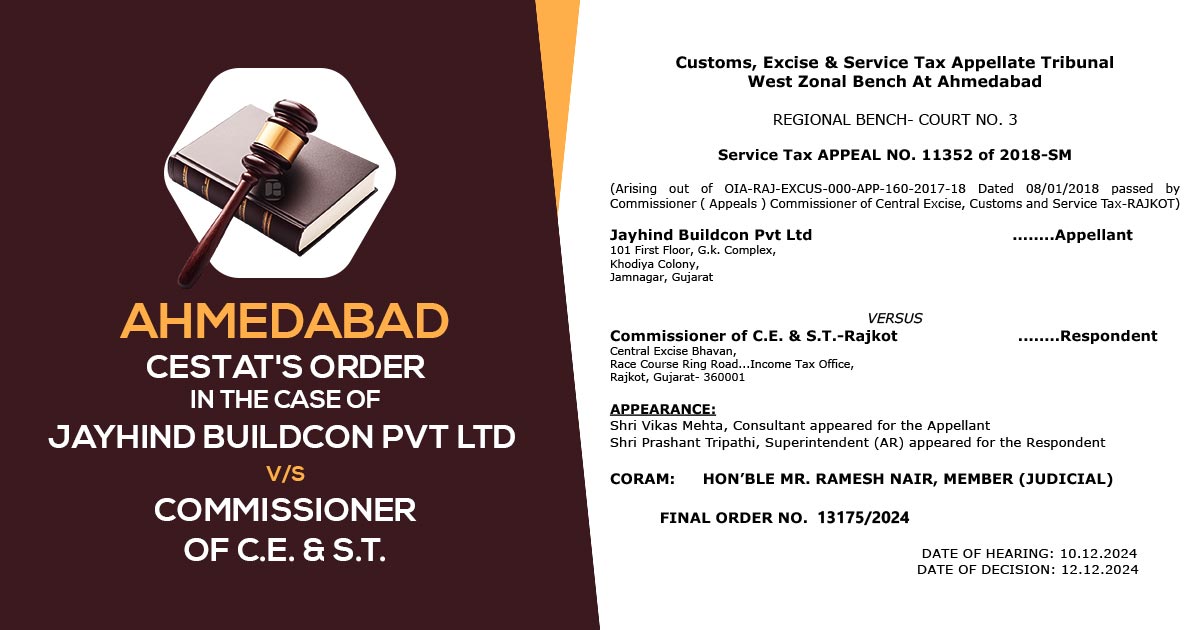

| Case Title | Jayhind Buildcon Pvt Ltd vs. Commissioner of C.E. & S.T. |

| Citation | Service Tax Appeal NO. 11352 of 2018-SM |

| Date | 12.12.2024 |

| For the Appellant | Shri Vikas Mehta |

| Counsel For Respondent | Shri Prashant Tripathi |

| Ahmedabad CESTAT | Read Order |