If due to any unavoidable situation the factory gets closed then it is not obligated to pay the excise duty, the Ahmedabad Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) cited.

The Bench of Ramesh Nair (Judicial Member) and Raju (Technical Member) has marked that “the closure of the factory was not on the choice of the assessee whereas, they were compelled to keep the factory closed as per the direction of the Gujarat Pollution Control Board. Therefore, closing of the production was beyond the control of the assessee.”

Section 11A(1)(a) of the Central Excise Act, 1944 is related to the recovery of excise duties that were either not levied, short-levied, short-paid, or incorrectly refunded. If a duty has not been collected or refunded precisely because of reasons other than fraud or deliberate misstatement, then the Central Excise Officer would required to issue a notice within 2 years from the pertinent date. This notice will require the individual responsible to justify why they should not settle the specified amount.

The taxpayer was operating under a compounded levy scheme to file the excise duty. Between March 2015 and April 2015, they should discontinue production as they did not obtain the important authorization order from the Gujarat Pollution Control Board to start the operation again. They notified the excise department about the factory’s closure; however, even with the closure, the range officer insisted on collecting excise duty for March 2015 and April 2015.

The taxpayer answered that the closure was due to a situation beyond their governance and asked for an obligation abatement for the same duration. SCN was being issued via the Assistant Commissioner, asking for Rs 2,40,000 including the interest and penalty. The adjudicating authority affirmed the demand, citing that the factory has remained closed for exceeding than 3 months.

Read Also:- CESTAT Ahmedabad Ruling: Used Fire Bricks Not Subject to Excise Duty as Waste

The taxpayer is dissatisfied and therefore furnished a petition to the Commissioner (Appeals) who carried the Adjudicating Authority’s order. The order was contested by the petitioner before the Tribunal which the commissioner (appeals) has passed.

It was argued by the taxpayer that the factory closure was not voluntary but instead due to outer situations i.e. the absence of a consent order from the Gujarat Pollution Control Board. Hence in these strange cases, the taxpayer could not be asked for the excise duty for the period when the factory remained close

It was remarked by the Tribunal that the closure of the factory was not in the taxpayer’s option while they were forced to keep the factory closed under the Gujarat Pollution Control Board directive. Hence production closing was not under the taxpayer’s control.

According to the Tribunal, the assessee cannot be charged with duty liability during the factory’s shutdown for two months since the situation was out of their hands.

The tribunal concerning the above permitted the appeal.

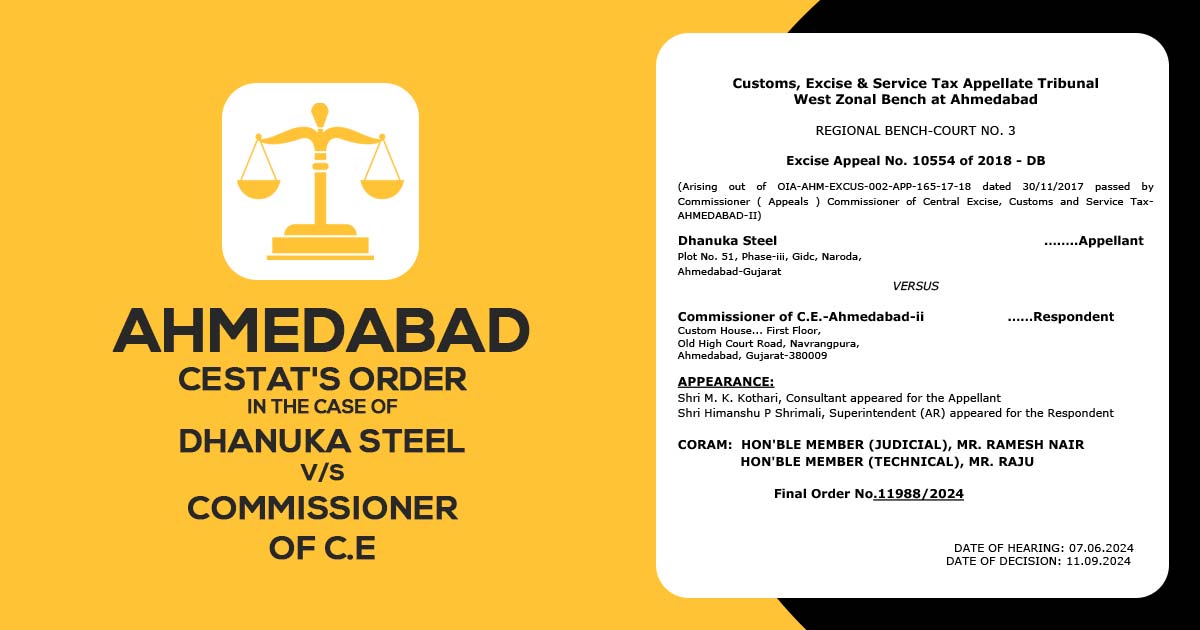

| Case Title | Dhanuka Steel V/S Commissioner of C.E.-Ahmedabad-ii |

| Citation | Excise Appeal No. 10554 of 2018 – DB |

| Date | 30.09.2022 |

| Counsel For Appellant | M.K. Kothari |

| Counsel For Respondent | Himanshu P Shrimali |

| Ahmedabad CESTAT | Read Order |