ADT-1 Form for Appointment of First Auditor

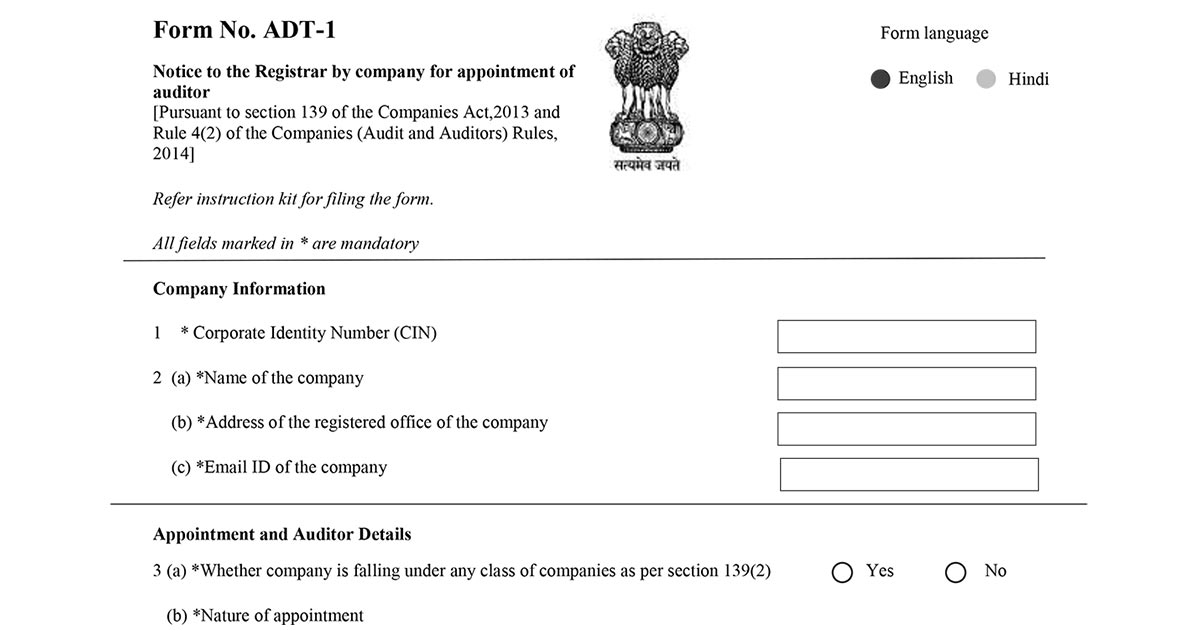

When a company appoints an auditor, it is under an obligation to notify the Registrar of Companies (ROC) about the appointment in a prescribed manner as per section 139 (1) of the Companies Act 2013. Form ADT-1 is used for this purpose.

Under Section 139 (1) of the Companies Act 2013, a company shall communicate to the auditor of its appointment. At the same time, a notice of such appointment must be filed with the registrar of companies within 15 days of this appointment. As per the rules, such notice regarding the auditor appointment is required to be filed in Form ADT 1 in the MCA portal.

Through this article, we are trying to narrate to you a brief understanding of form ADT-1. Here we go:

File ADT-1 Form via ROC Software

What is Form ADT-1 MCA?

Form ADT- 1 can be referred to as an intimation filed by every company with the Registrar of Companies about the appointment of an auditor after the inference of its Annual General Meeting (AGM) u/s 139 of The Companies Act, 2013 (fourth proviso to sub-section (1)).

ADT-1 includes details such as the auditors’ consent cum eligibility certificate, the auditors’ name and the company’s information.

When Should the MCA Form ADT-1 be Filed?

In Case of New Company Incorporation:- Form ADT-1 is required to be filed within 15 days from the first board meeting of the company, which is required to be held within 30 days of incorporation, in which the auditor is appointed by the board of directors of the company.

For Existing Company:- Form ADT-1 should be filed by the company with the registrar of companies within 15 days of the AGM in which the Auditor was appointed or reappointed, as the case may be. For example, if the company’s AGM was conducted on 30 September 2026, then the company should file Form ADT-1 by 14th October 2026.

What are the Documents that Need to be Attached to Form ADT-1?

The following is the list of documents that need to be attached to Form ADT-1:

- Company’s Board resolution copy/resolution passed in the annual general meeting

- Written consent from the Auditor regarding the appointment

- A certificate from the Auditor that he/she/it is not disqualified or ineligible to be appointed as an Auditor u/s 141

- Copy of the intimation given by the company to the auditor

Read also: Complete Guide to Filing ROC Return E-forms

Differences In V2 Portal Vs. V3 Portal

Below, we mentioned the major difference between the MCA (Ministry of Corporate Affairs) V2 and V3 portals. The official department has made many changes to ease tax compliance.

Shift from PDF to Interactive Web Format

- A PDF version of Form ADT-1 is to be downloaded by the companies in the V2 portal, fill it online, attached the Digital Signature Certificate (DSC), and then upload the signed file to the MCA portal, which often involves multiple steps, software problems, and formatting challenges.

- The method in the V3 portal is easier. V3 is web-based, in which the information may be entered directly on the portal. If crucial, then save the form midway and submit it when it is complete.

Increased Data Visibility

- The companies in the V2 portal are mandated to furnish the basic details of the auditors, like name, PAN, and address.

- The companies in the V3 portal are required to furnish the basic details, as well as provide the details of the audit firm’s members, and need to cite the SRN of Form INC-28, wherever applicable, particularly in cases concerning tribunal orders. The Audit Committee, if made, should include remarks or observations. The company’s new declaration for the appointment of the auditor has been made obligatory, which is in line with the declared rule dated May 30, 2025.

Auditors’ Term

- The system in the V2 portal does not review whether the term of the auditor matches the fiscal year cited in the filing.

- The system shall automatically reject the form if the auditor’s term entered does not match the entered financial year in the V3 portal.

Insolvency Management and Dissolution

- Filing of form ADT-1 was restricted under the V2 portal to just the regulatory auditors, and under the V3 portal, the Interim Resolution Professionals (IRPs), Resolution Professionals (RPs), or Liquidators can file directly.

File Size

- The size of each file was limited to 2MB under the V2 portal. As per that, under the V3 portal, the same permits a total file size of up to 10 MB, which allows easier documentation.

Forms Linked

The ADT-1 form alone was filed under the V2 portal, while under the V3 portal, it is integrated with other key filings like AOC-4 and the Auditor’s Report. The system shall cross-check the validation of SRNs (Service Request Numbers) of these corresponding forms.

What are the Filing Fees of MCA Form ADT-1 with the Registrar of Companies?

The filing fees for Form ADT 1 with the registrar of companies are as follows:

| Sl.No | Nominal Share Capital of the Company | Fee in (INR) |

|---|---|---|

| 1 | < INR 1,00,000 | 200 |

| 2 | Between 1,00,000 and 4,99,999 | 300 |

| 3 | Between 5,00,000 and 24,99,999 | 400 |

| 4 | Between 25,00,000 and 99,99,999 | 500 |

| 5 | > or equal to 1,00,00,000 | 600 |

What is the Amount of Penalty That is Imposed on the Delayed Filing of Form ADT-1?

Late due date and filing penalty of the ADT 1 form will lead to the imposition of the following penalties:

| Sl.No | Delay in Filing (in no. of days) | Penalty Leviable |

|---|---|---|

| 1 | Up to 15 days | 1 time of normal fees |

| More than 15 days and up to 30 days | 2 times the normal fees | |

| 2 | More than 30 days and up to 60 days | 4 times of normal fees |

| 3 | More than 60 days and up to 90 days | 6 times of normal fees |

| 4 | More than 90 days and up to 180 days | 10 times of normal fees |

| 5 | More than 180 days | 12 times of normal fees |

Other Important Points for ADT-1 Form

- All companies are mandatorily required to file Form ADT 1, be it a listed, unlisted, public, private, or any other company.

- The only company responsible for filing Form ADT 1 and not the auditor.

- The company has to file Form ADT 1 even when the appointment of the auditor is for a casual opening.

- In general, it is believed that Form ADT 1 is not to be filed when the first auditor is appointed because Rule 4 (2) of the Company Rules, 2014 states Sec 139 (1) – appointment of auditors only and not Sec 139 (6) – appointment of the first auditor. However, it is recommended that Form ADT 1 should be filed even for the appointment of the first auditor.

E-filing of Form ADT-1

- Form ADT 1 can be filed electronically and is available for download on the website of the Ministry of Corporate Affairs (MCA)

- E-form is auto-approved

- The concerned Authority sends an acknowledgement email to the registered email ID on the successful registration of the E-form

Companies (Audit and Auditors) Amendment Rules, 2018.

Conclusion

Form ADT-1 holds the utmost importance when it comes to the appointment of an auditor in your company. These Forms are mandatory to be filed by the companies within the prescribed deadline of 15 days.

Well, with the advancement of technology and the launching of new software every day, this process has also been simplified and automated.

Many software are available in the market, but we shall talk about the best and widely preferred software that complies with the prevailing norms & notifications of the GOI and let you be in the good books of the Government.

SAG Infotech’s Gen Complaw ROC/MCA return filing software is an all-inclusive solution for ROC filing, ROC e-Forms, Resolutions, XBRL, Registers, Minutes, and different MIS reports. Gen Complaw is an advanced & refined MCA software that executes all the “XBRL” E-filing promptly and accurately. It gets updated regularly with the latest notifications from the government and adheres to all statutory compliances of the Companies Act, 2013. Fast in action and Credible in performance!