M/s Stellar Cold Chain Inc. asked for an advance ruling u/s 97 of the Central Goods and Services Tax (CGST) Act, 2017, and Uttarakhand State Goods and Services Tax (SGST) Act, 2017. The petitioner is in the business of cold storage in Uttarakhand, processes raw green peas into frozen peas, and furnishes storage and refrigeration services before other companies. On processing services, they levy 5% GST and 18% GST on storage services but questioned whether storage services for frozen green peas should be subject to NIL GST under Notification No. 04/2022-Central Tax (Rate) on 13.07.2022.

Advance Ruling Issues

Various issues have been raised by the advance ruling asked via M/s Stellar Cold Chain Inc. associated with the taxability of their services under the GST Act and the applicability of GST notifications. These are-

- Storage Charges’ Taxability Under the GST Act: The issue is drawn by the petitioner for the taxability of storage charges levied for the frozen green peas kept in cold storage facilities. The petitioner asked for transparency on whether such storage charges are within the GST under the provisions of the GST Act 2017. The motive of the query is to find the pertinent GST treatment applicable for the services rendered via M/s Stellar Cold Chain Inc., particularly involving the storage of processed and frozen green peas.

- Application of the Zero Tax Tariff on Storage Fees: An important part of the query of the applicant related to the applicability of the NIL GST tariff as mentioned under Notification No. 04/2022-Central Tax (Rate). It was claimed via the applicant that their storage services for the frozen green peas must be waived from the GST on the grounds of the same notification. Notification No. 04/2022-Central Tax (Rate) organizes services pertinent to the storage or warehousing of cereals, pulses, fruits, and vegetables under a NIL GST rate.

The petitioner argued that as the green peas are sorted as vegetables, their storage services must counted beneath the purview of the same exemption. An analysis is been needed for the issue of whether the services furnished via the applicant are entitled to the NIL GST rate under the defined terms mentioned in the notification.

- Importance of Notification No. 04/2022-Applicant’s Central Tax (Rate): The applicant aimed for clarification on the applicability of Notification No. 04/2022-Central Tax (Rate) to their case. They asked the Advance Ruling Authority to establish whether the provisions of this notification, which waived some classes of storage services from GST, particularly applied to the services proposed via M/s Stellar Cold Chain Inc. The same investigation has the motive to define the scope and extent to which the provisions of the notification can be interpreted to waive the charges of storage imposed by the applicant to store frozen green peas.

Submissions of the Applicant

The applicant, M/s Stellar Cold Chain Inc., in their application for an advance ruling, placed multiple contentions for the taxability of their services concerning the storage of processed and frozen green peas. In shaping the decision-making process of the authority, such submissions were crucial.

- Type of Business Activities: The petitioner specified their major business operations that comprise various factors within the cold storage sector. They stated that their business model concerns not only the purchase, processing, and subsequent sale of frozen green peas but also expands to delivering storage facilities for green peas owned by other companies. They levy charges that include GST @18%, for these storage services.

- Reference to Notification No. 04/2022-Central Tax (Rate): Central to their argument was their interpretation of Notification No. 04/2022-Central Tax (Rate), issued under the GST framework. They argued that the services they deliver, the storage of green peas must be entitled to GST exemption under the same notification. On the grounds of their claim on the provision of notification that services associated with the storage or warehousing of cereals, pulses, fruits, and vegetables are qualified for a NIL GST rate.

- Green Peas Classification as Vegetables: An additional sort of contention from their side is towards the classification of green peas as vegetables. They claimed that as the green peas are sorted under vegetables, they must inherently counted beneath the exemption furnished in Notification No. 04/2022-Central Tax (Rate). The same classification as the petitioner explained that the proposed storage service must not be levied to GST.

- Asking for clarity and confirmation: From the Advance Ruling authority the petitioner asked for clarity on whether their interpretation of Notification No. 04/2022-Central Tax (Rate) was precise and applicable to their particular matter. They asked for confirmation that the services they furnish for the storage of green peas comprising processed and frozen varieties must also get waived from the GST under the provisions of the above-said notification.

Individual Hearing and Explanation

On 26.07.2023, the petitioner at the time of the personal hearing assured that they store “Frozen Green Peas.” The Deputy Commissioner from the State Authority was present and urged a decision established on merits.

Discussion and Conclusions

The Advance Ruling Authority investigated whether the storage services furnished for processed and frozen green peas qualify for exemption under Notification No. 12/2017-Central Tax (Rate), as amended by Notification No. 04/2022-Central Tax (Rate). The considerations and findings are summarized below:

- Understanding Agricultural Produce: First, the authority referenced the definition furnished in the pertinent notifications. Under such notifications the Agricultural produce is related to the products originated from the cultivation that either perform no additional processing or minimal processing that does not fundamentally modify their basic features. Since it describes the applicability of the GST exemptions the same definition is important which has the motive at unprocessed or minimally processed agricultural goods.

- Characteristics of Frozen Green Peas: The major concentration of inquiry was on the nature of the frozen green peas managed via the petitioner. The same was found that transforming raw green peas into frozen green peas procedure comprises influential modification of the product’s important features. Opposite to the raw produce that retains its primary attributes post-harvest or performs minimal processing typical of cultivation or primary market preparation, frozen green peas are within processing that alters their original state.

- GST Exemption Criteria as per Notification No. 04/2022-Central Tax (Rate): Then the council moved to compute whether the storage services furnished for the processed and frozen green peas can be entitled to the NIL GST tariff under the particular notification. Notification No. 04/2022-Central Tax (Rate) furnished a NIL GST rate for services pertinent to the storage or warehousing of cereals, pulses, fruits, and vegetables. The major motive of the exemption is for the unprocessed or minimally processed items counted beneath the class of agricultural produce, under the said criteria.

- Final Conclusion on Applicability: On the grounds of examination of the definitions and the product nature engaged, the authority concluded that processed frozen green peas are not entitled to agricultural produce under the said definitions. Hence the services pertinent to the storage of the processed and frozen green peas are not counted under the NIL GST tariff furnished under Notification No. 04/2022-Central Tax (Rate).

Read Also: Food Grains Merchants Demand a Solution for Grievances Concerning GST from the Centre

Closure: It was concluded by the authority that processed frozen green peas are not deemed agricultural produce as the transformation from raw to frozen peas changes their essential characteristics. Accordingly, the NIL GST exemption under Notification No. 04/2022-Central Tax (Rate) does not apply to processed or frozen vegetables, including frozen green peas, since the exemption only applies to unprocessed vegetables.

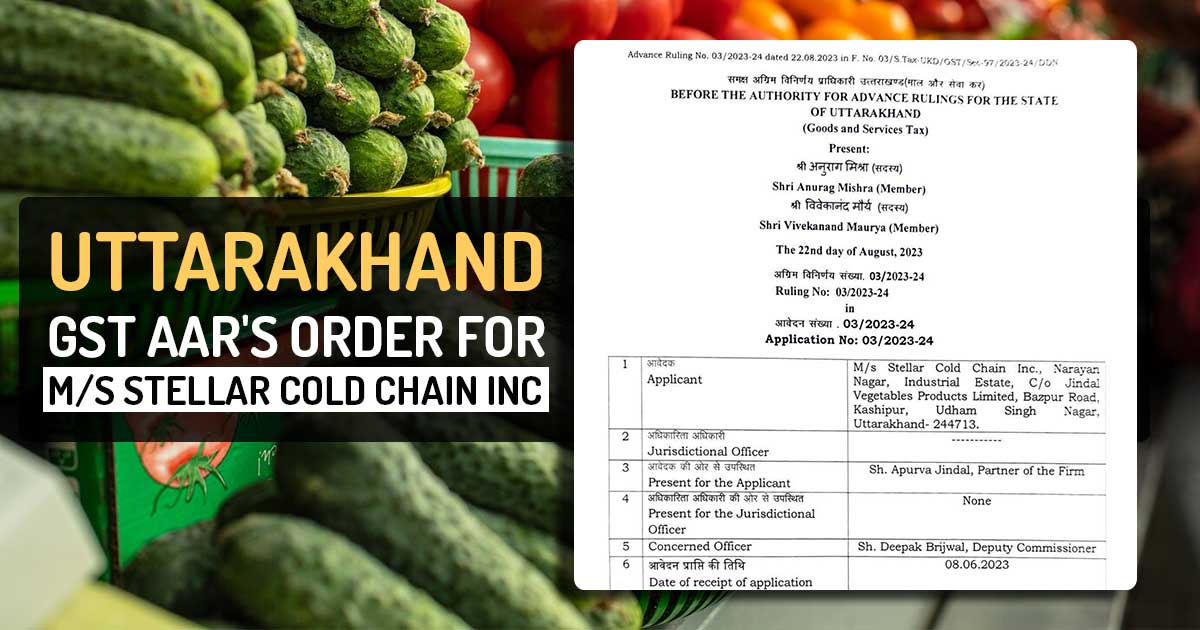

| Case Title | M/s Stellar Cold Chain Inc |

| Case No.: | 03/2023-24 |

| Date | 26.07.2023 |

| Present for the Applicant | Sh. Apurva Jindal |

| Concerned Officer | Sh. Deepak Brijwal |

| Uttarakhand GST AAR | Read Order |