Maharashtra Authority for Advance Ruling (AAR) said that 0% or Nil Goods and Services Tax (GST) is applicable for the work allotted by the Maharashtra Jeevan Pradhikaran (MJP) as part of the Jal Jeevan Mission, a Government of India operation.

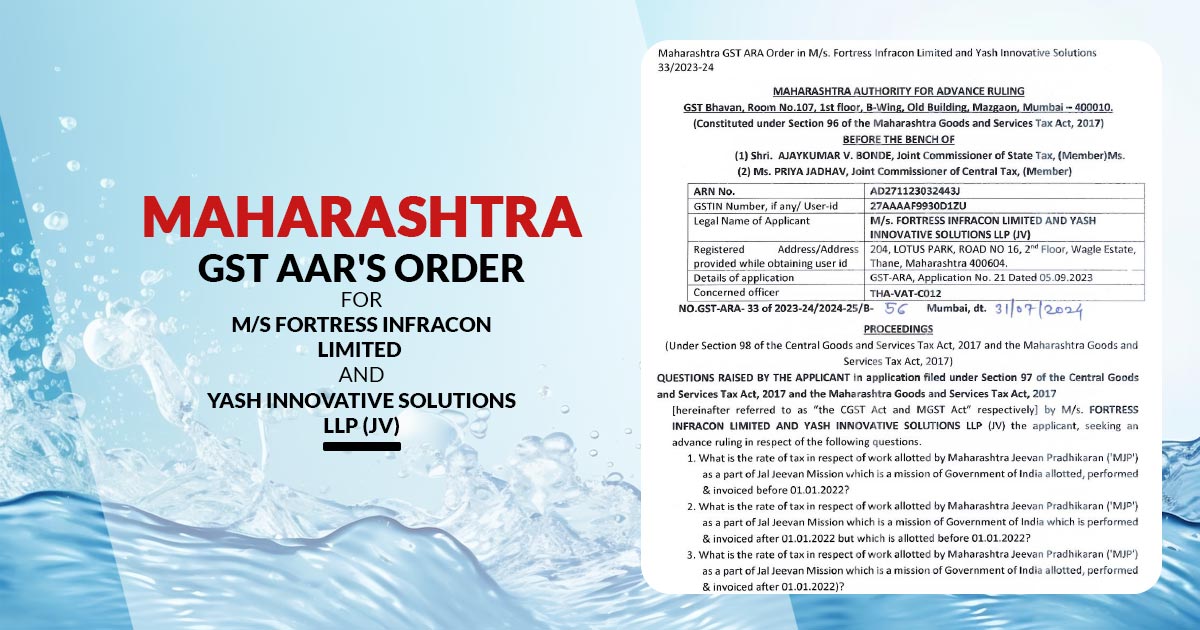

M/s Fortress Infracon Limited and Yash Innovative Solutions LLP (JV), have filed an application which is a partnership firm engaged in the business of providing technical consultancy to various Governments, Semi-Government, Government Corporations & Quasi-Government Institutions.

Under the operations allotted on the Government machinery by the Constitution of India, State Governments and Panchayat Raj Institutions are mandated to establish effective facilities for sewage and used water disposal for villages, towns, and cities.

Read Also: UP AAR: GST Applies to Sale of Residential Units, Classified as Services Not Immovable Property

Planning, engineering, and designing are needed for the implementation of such schemes, and for that, the consultants like applicants are hired by the Government.

The Maharashtra Jeevan Authority Act, 1976 (MJA Act) authorizes the Government to initiate and implement supply/drainage/sanitation/stormwater schemes using consolidated funds under the allocations of budget from the Government.

An amendment to the MJA Act was notified under Notification No.16/2021 – Central Tax (Rate) dated 18.11.2021 where the words “or a Governmental Authority or a Government Entity” came to be missed from Sr. 3 and 4 of GST notification 12/2017 – Central Tax (Rate) dated 28.06.2017.

Through this amendment, there emerges a confusion that if the activity of the applicant is not waived from the GST however now leviable at 18%, subsequently effectuated under the absence of constancy in the tax application.

The existing application asked for clarification on the applicable tax rate to pure services like the project management consultancy provided to Central/State Governments/Local Authority/ Government Authority/Entity” before 01.01.2022 and after 01.01.2022.

It was marked that the petitioner was eligible as a Governmental Authority for exemption under GST notification No.16/2021 – Central Tax (Rate) and for the Services rendered by the Applicant towards the MJP before 31.12.2021.

AAR renders the decision after considering that “Technical Consultancy for Project Development and Management support services” furnished via the applicant to MJP as part of the Jal Jeevan Mission by the Government of India qualifies as “pure services” for the period before 01.01.2022.

The authority Bench after observing ruled that No tax shall be subjected to be paid via the applicant for the work allotted via MJP as part of Jal Jeevan mission and performed and invoiced before 01.01.2022; alternatively, an 18% GST rate is to be applied on any undergone work and invoiced after 01.01.2022 being covered by Entry at Sr. No 21 Heading 9983, (ii) of the Notification No. 11/2017 – Central Tax (Rate) dated 28.06.2017.

| Case Title | M/s Fortress Infracon Limited and Yash Innovative Solutions LLP (JV) |

| GSTIN Number | 27AAAAF9930D1ZU |

| Date | 31.07.2024 |

| Order Number | GST-ARA-33 of 2023-24/2024-25/B-56 |

| Maharashtra AAR | Read Order |