Refunds of many importers have got cemented due to the fact that refunds are not subject to the self-assessment of the transactions, as explained by the income tax department while declining the reimbursement.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

Refunds of many importers have got cemented due to the fact that refunds are not subject to the self-assessment of the transactions, as explained by the income tax department while declining the reimbursement.

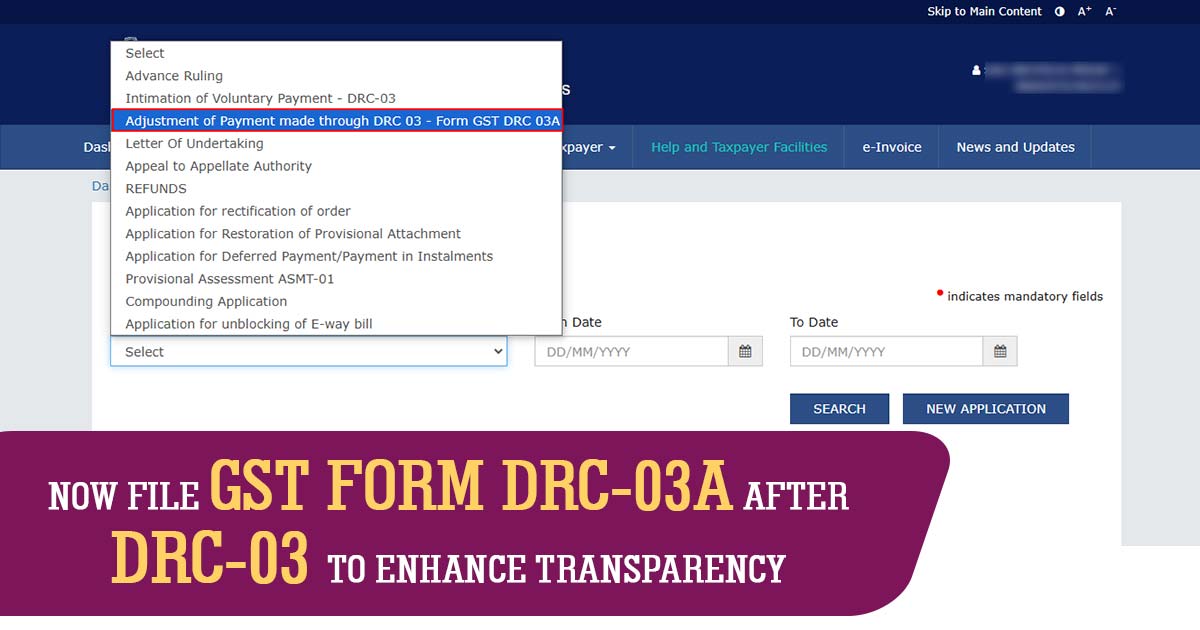

The goods and services tax (GST) is a value-added tax charged on most goods and services sold for domestic consumption, introduced by the Constitution Act in 2016.

GST Council has from always been an Institution known not just for ensuring the better implementation of GST in the country but also had stood strong on the anti-evasion measures.

Is GST actually stimulating or discouraging cashless economy? The same can be understood with this case study of a restaurant in Mumbai. This restaurant is a dinner point for well-breads family and a choice of high-class society.

The general elections of India will most probably be held between April and May 2019 to form the 17th Lok Sabha. So before the general election of 2019, the Finance Minister Arun Jaitley will announce the first budget of this government on 1 February 2019.

The First income tax rate in nascent India after Independence was fixed as high as 97.75 per cent with 11 tax slabs. There was a huge challenge in front of the Country to lower the pace of this sky-high tax rate. The Country had witnessed the tax rates from a high of 97.75 per cent […]

People are demanding to rationalise the tax at a certain level in all the sectors. Considering the point of people, the Minister of State for Finance Shiv Pratap Shukla is planning review the tax in the educational sector as ‘Education is the most powerful weapon which one can use to change the world’.

As we know, in the GST Regime, businesses whose turnover exceeds Rs. 20 lakhs is required to register as a normal taxable person.

A reduction of 12% GST on ‘housing’ to a toll to 5% without any extension in the benefit of the input tax credit (ITC) to developers, would definitely increase the price of the Apartments and would largely affect the Low and the Middle-income Group.