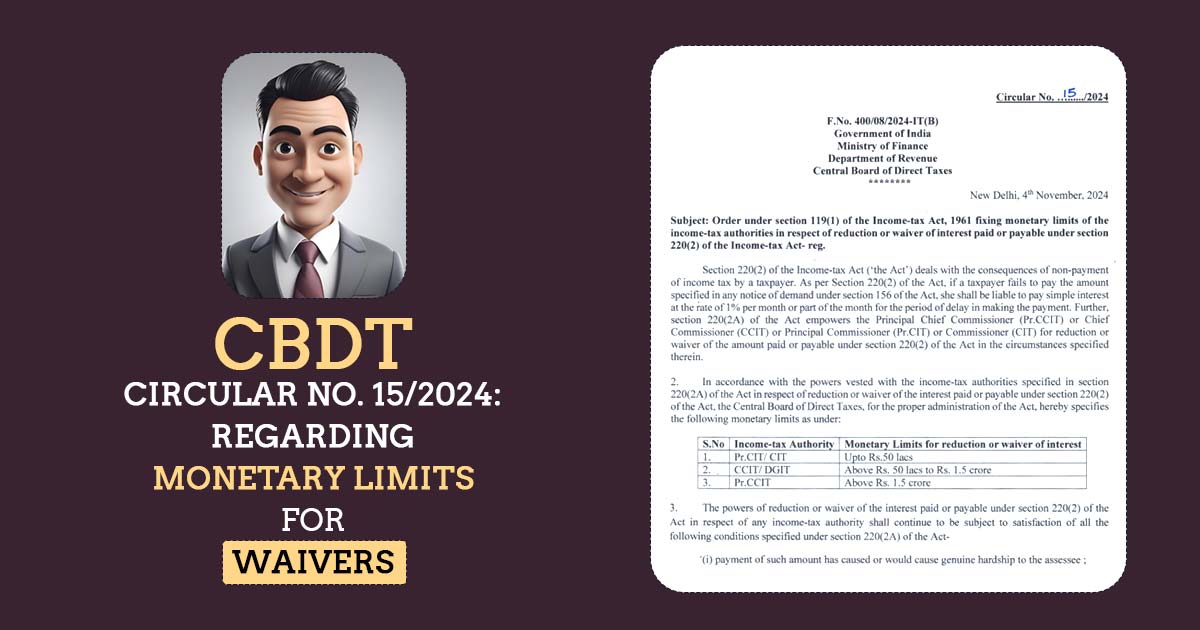

Under the direct tax dispute resolution scheme ‘Vivad Se Vishwas’ the entities furnishing the declaration can be amended till the tax council provides the certificate which displays the information of the tax arrear and the amount payable said the income tax department. The Central Board of Direct Taxes (CBDT) providing the FAQs on ‘Vivad Se […]