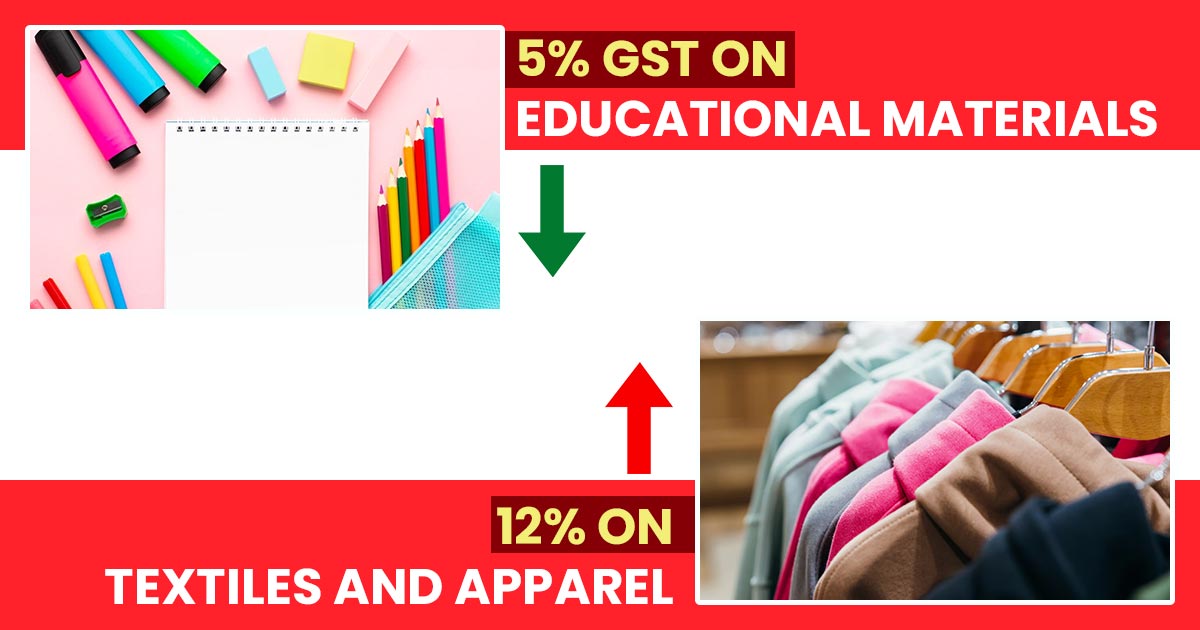

As the end of the financial year approaches, it is essential for businesses to ensure that they are complying with their Goods and Services Tax (GST) obligations. The GST system can be complex, with various rules and regulations that need to be followed, which is why having a checklist can be incredibly helpful. In this […]