The GST Council has officially unveiled three new GST return forms, named GST RET-1 (Normal Form), GST RET-2 (Sahaj Form) and GST RET-3 (Sugam Form). The new GST return has been filing on a trial basis since 1st July 2019 and the final version will go live from October 2020 as per the recommendation by GST council members. It will replace the existing forms including GSTR 1, 2, 3, 3B, etc.

Sugam (GST RET-3) is a quarterly GST return form which will be filed by registered taxpayers whose annual turnover is up to INR 5 crore and who are engaged in B2B & B2C supplies. The RET-3 form is required to be filed on a quarterly basis.

Filing Procedure of GST Sugam Return (RET-3) Form

The GST RET-3 Sugam Return form has the following parts:

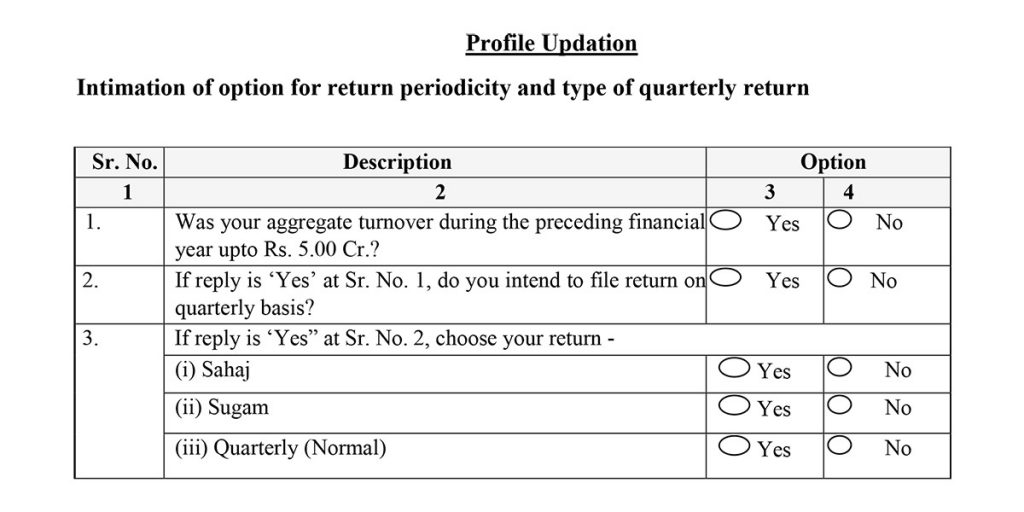

Profile Updation

Profile Option – Intimation of option for return periodicity and type of quarterly return

This field is to be used by a taxpayer for selecting his/her option for the filing of monthly/quarterly returns. They can select whether they want to file returns on a monthly or a quarterly basis. Then, they can choose the form/s – Normal/Sahaj/Sugam – they wish to file. Once the options are locked, the taxpayer will have to file their GST returns accordingly.

Form GST RET-3 (Sugam) Questionnaire Information GST ANX-1 Form

This form is comprised of Annexure 1 & 2 (for outward and inward supplies), RET-3 quarterly form (the actual return form), and Annexure-1A & RET-3A (amendment forms). The detailed filing process and formats are given below.

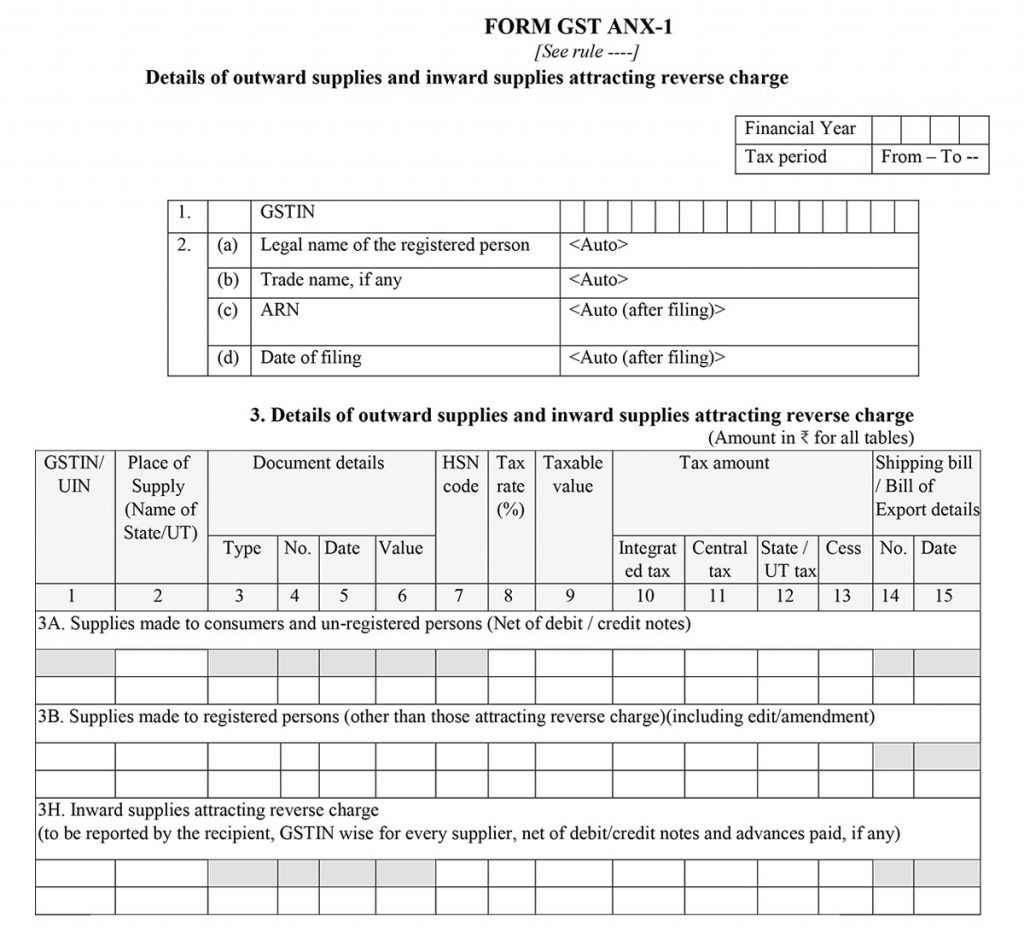

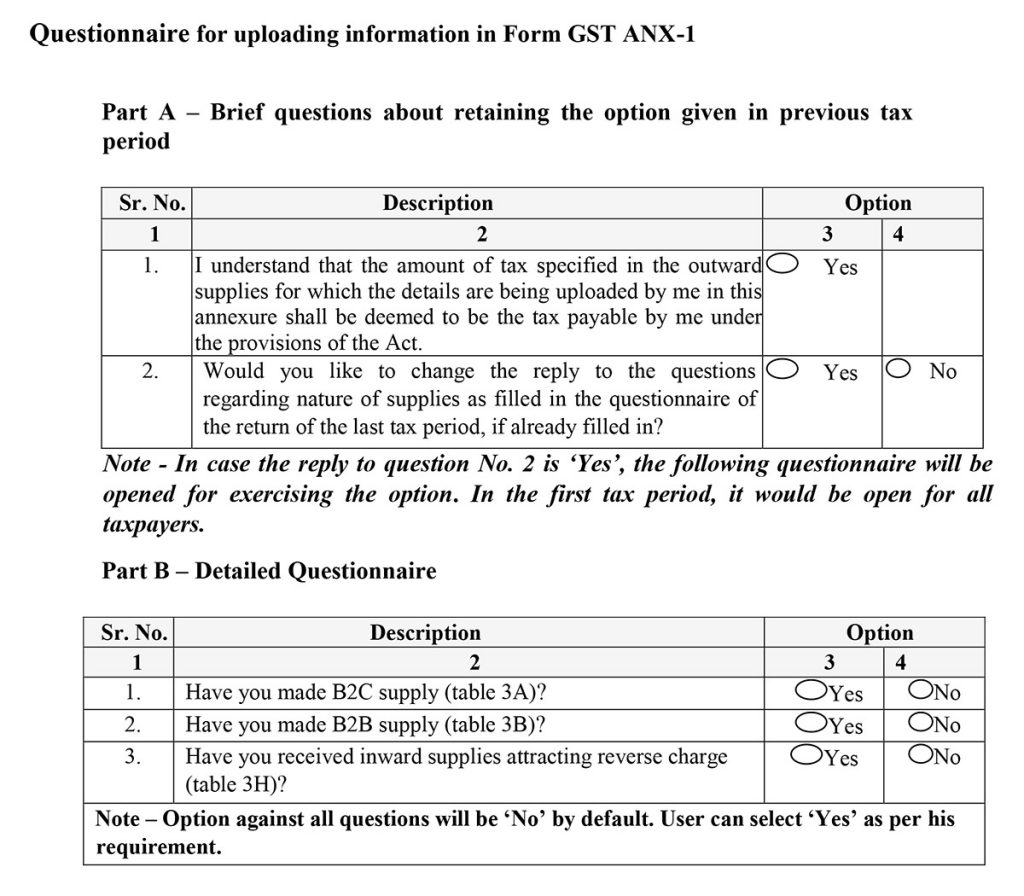

Questionnaire for uploading information in Form GST ANX-1

Before filing information in the GST ANX-1, the taxpayer has to answer the following questions about ‘retaining the option given in the previous tax period’ and supply details.

GST ANX-1 Form for Inward and Outward Supplies

This is the Annexure of outward supplies and inward supplies attracting a reverse charge. The taxpayer is required to upload here details of the supplies made by them during the particular tax period.

The form will contain details such as GSTIN of the taxpayer, name, business name, ARN, date of filing, details of outward supplies and inward supplies (attractive reverse charge), including supplies made to unregistered persons, supplies made to registered persons, and input supplies attractive reverse charge. The taxpayer (supplier) is required to upload the supply documents in ANX-1 Form.

Make sure to read the instructions below before filing this form.

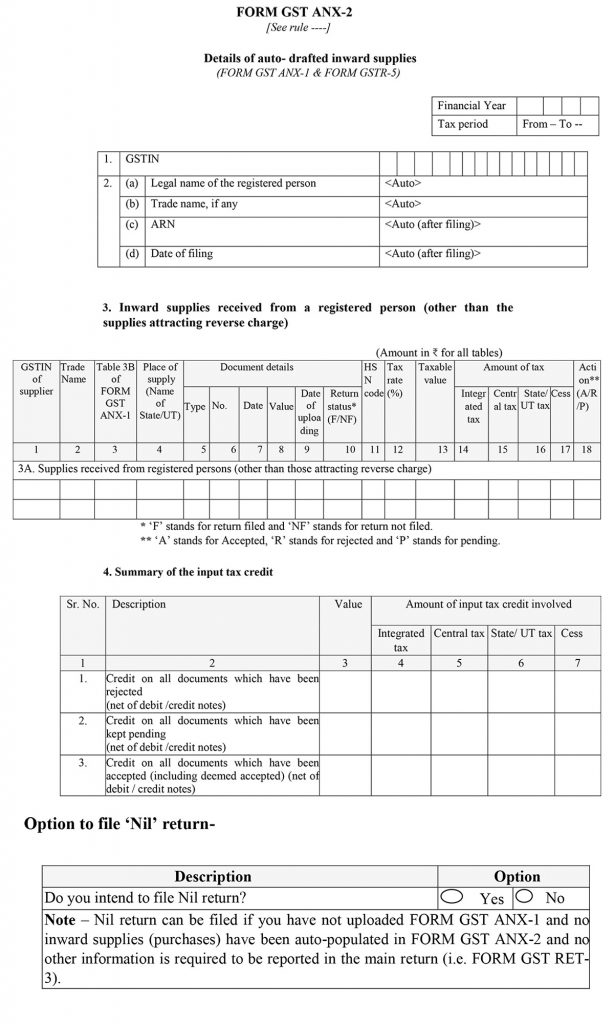

GST ANX-2 Auto-Drafted Inward Supplies

Annexure of inward supplies – this will contain ‘Details of auto-drafted inward supplies’ (FORM GST ANX-1 & FORM GSTR-5)

The information of inward supplies received from a registered person (other than the supplies attracting reverse charge) will be furnished here, along with the summary of the input tax credit (ITC). The form will auto-fetch information from the supply documents uploaded by the corresponding supplier(s) in their ANX-1 form. The recipient is only required to check, verify and accept/reject the details in this form.

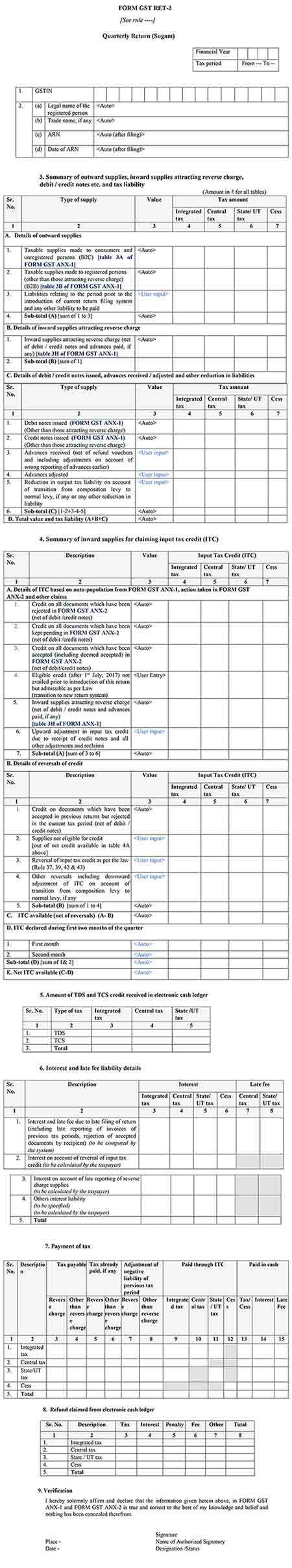

GST Sugam RET-3 Quarterly Return Form

This is the actual ‘Quarterly return’ which will contain the details of supplies (both inward and outward) declared through Form GST ANX-1 and GST ANX-2 above. This is the main return form which will auto-fetch the information of supplies from the first two annexure forms. The supplier (taxpayer) needs to complete the remaining details and calculate their tax liability.

The GST Sugam RET-3 Form will contain details such as summary of outward supplies, inward supplies attracting reverse charge, debit/credit notes, advanced received, total tax liability, summary of inward supplies for claiming ITC, Net ITC available, amount of TDS/TCS credit received, interest and late fee (if any) and the final payable tax, along with details of tax payment and details of refund claimed from the ledger.

Read the instructions carefully.

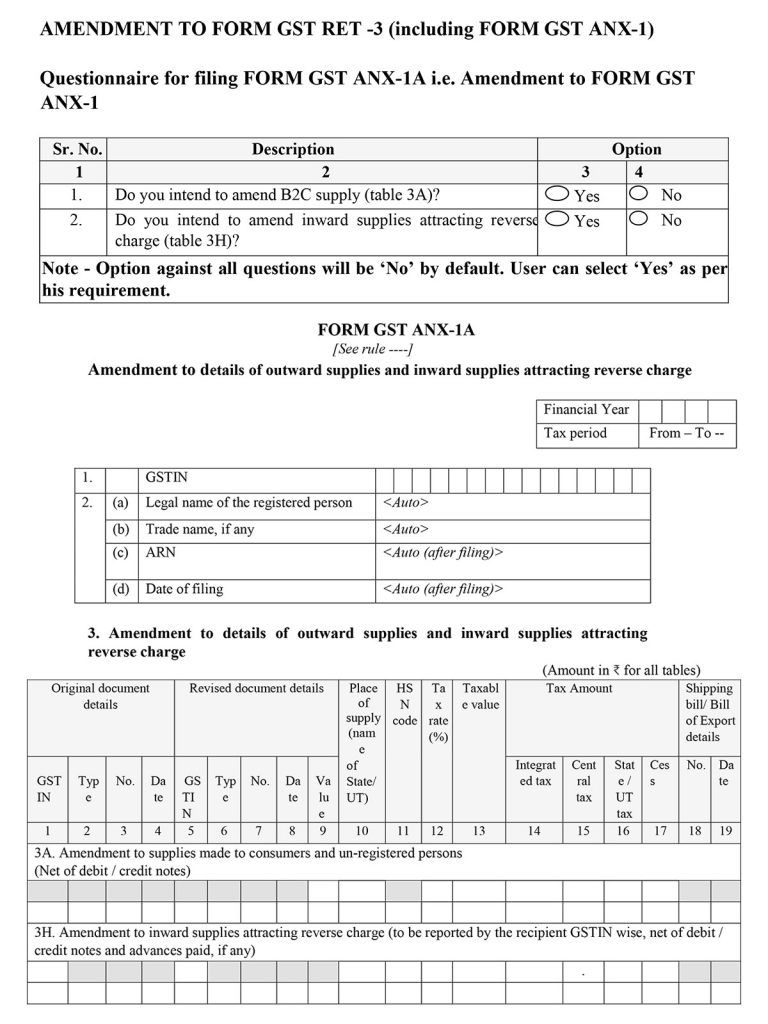

Sugam GST ANX-1A Amendment Form

This is the form to be used for making ‘Amendment to details of outward supplies and inward supplies attracting reverse charge’ (uploaded in FORM GST ANX-1). Make sure to answer the questionnaire before you start filing this form.

The GST ANX-1A Amendment form can only be filed before the due date for September month return filing or before the actual date of annual return filing for the corresponding year, whichever is earlier.

The form will contain details of outward supplies and inward supplies attracting a reverse charge.

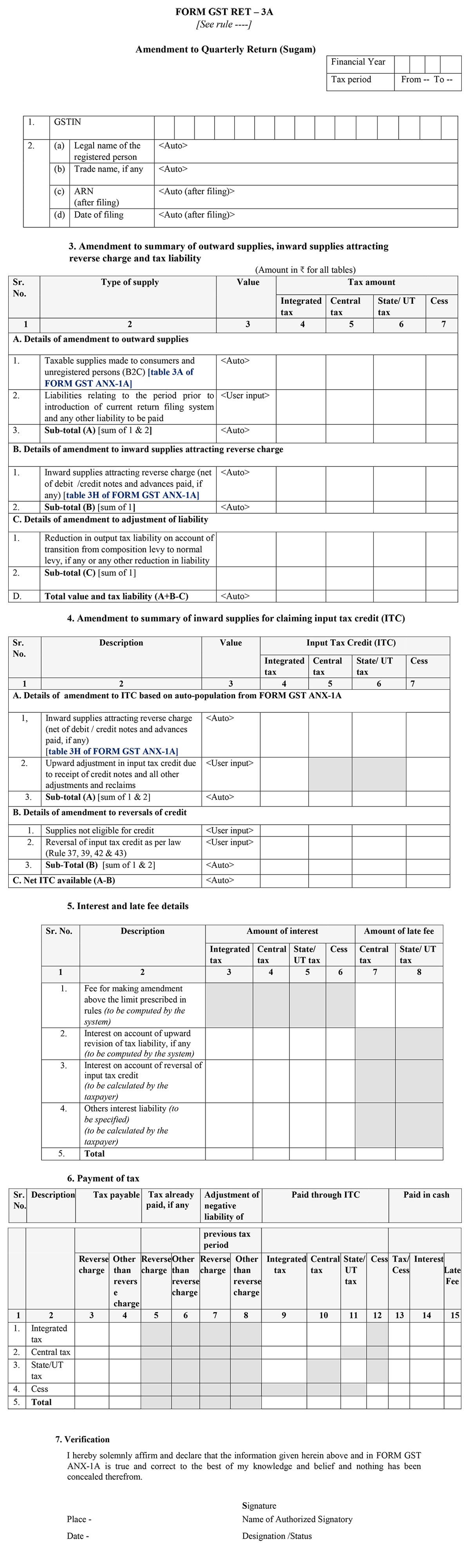

GST Sugam Amendment to Quarterly Return RET-3A

This form is to be used for making the Amendment to Quarterly Return (Sugam). The filing process for the RET-3A form is similar to the filing of original return form RET-3. It has the same fields as the original form. While filing this form, the taxpayer needs to provide the correct details or the details to be amended in the original return.

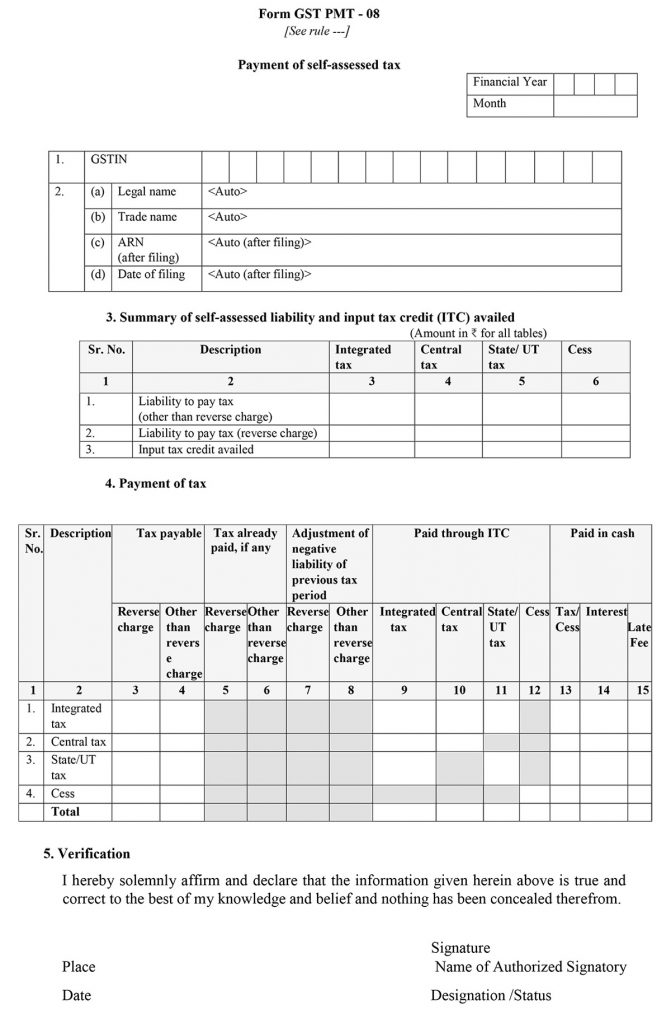

Form GST PMT-08 Payment of Self-Assessed Tax

This form is to be filed for ‘Payment of self-assessed tax’ based on the liabilities calculated through the GST Sugam RET-3 Form. It contains details of Summary of self-assessed liability and input tax credit (ITC) availed and the Payment of tax.

Good